Story By Chris Matthews |Hart Energy| Baytex Energy Corp. closed its multibillion-dollar acquisition of Ranger Oil Corp., expanding the Canadian E&P’s footprint and scale in the South Texas Eagle Ford Shale.

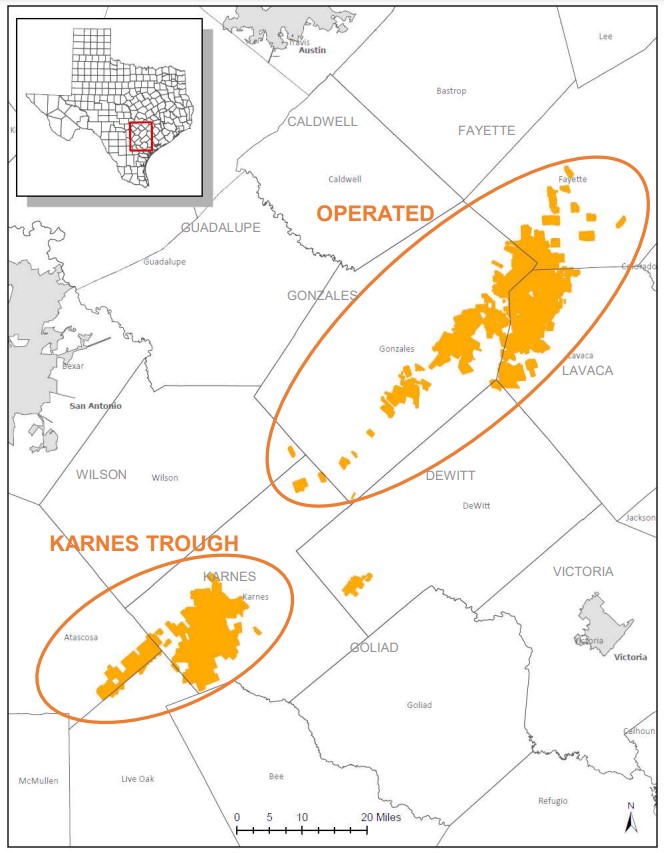

Baytex’s cash-and-stock acquisition of Eagle Ford pure-play Ranger Oil adds 162,000 net acres and 741 undrilled locations in the crude oil window of the Eagle Ford—complementing the company’s existing non-operated position in the Karnes Trough.

The acquisition is expected to contribute to growing overall production from around 88,000 boe/d in the first half of 2023 to between 153,000 and 157,000 boe/d (84% oil and NGL) during the second half of the year, Baytex said in a June 20 news release. The company also provided plans on capex, debt reduction and dividend payments tied to the closing of the deal.

Baytex Energy is adding 162,000 net acres in the Eagle Ford Shale by acquiring Ranger Oil—complementing its existing non-operated position in the Karnes Trough (Source: Baytex Energy investor presentation)

“We are excited to close the Ranger acquisition, which materially increases our scale in the Eagle Ford while building quality operating capability in a premier basin,” said Eric T. Greager, president and CEO at Baytex. “We have emerged from this transaction as a well-capitalized and diversified North American exploration and production company with a portfolio of high-quality oil-weighted assets in Western Canada and the Eagle Ford shale in Texas.”

The total consideration Baytex paid for the acquisition, including the assumption of net debt, was about US$2.2 billion (CA$2.9 billion). Ranger shareholders received 7.49 shares of Baytex stock and $13.31 cash for each owned share of Ranger stock under the terms of the deal.

The deal was valued at approximately US$2.5 billion (CA$3.4 billion) when first announced in late February.

RELATED: Texas upstream oil and gas employment at 3-year high

Capital plans, debt reduction

Baytex plans to spend between $595 million and $635 million on exploration and development activities during the second half of the year after integrating Ranger’s Eagle Ford assets.

In conjunction with closing the deal, Baytex also plans to increase its shareholder returns to at least 50% of its free cash flow through share buybacks and a dividend.

The company said it will also introduce a quarterly dividend of $0.0225 per share ($0.09 per share annualized), which is subject to approval by the Baytex board of directors. If approved, the first dividend is expected to be paid in October 2023.

The company’s share repurchase program was placed on hold at the start of the year due to the planned merger, but Baytex plans to include 25% of the free cash flow it generated from Jan. 1 through June 19 in its 2023 share buyback program.

Baytex aims to boost its shareholder returns framework in the future. In the meantime, the company is focused on reducing debt.

The E&P’s total debt is forecast to be approximately $2.5 billion as of June 30. Baytex’s goal is to reduce its debt load to under $1.5 billion, which would represent a roughly 1x debt to EBITDA ratio at a $50 per barrel WTI price.

After reaching its preferred debt target, Baytex aims to boost shareholder returns to 75% of its free cash flow.