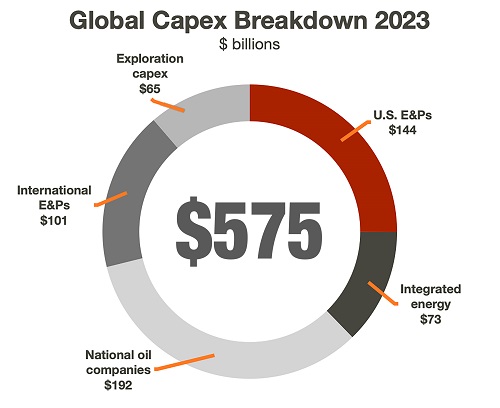

STORY BY Joseph Markman| Hart Energy. U.S. upstream CAPEX will increase to about $144 billion in 2023, AllianceBernstein said in a Jan. 13 report. That represents a 15% rise over 2022. U.S. onshore CAPEX is projected to go up by 16%.

Overall E&Ps are still being stingy — spending is roughly on par with outlays from more than a decade ago, which should provide support for oil prices in the $75 to $80 range, according to the report.

Globally, CAPEX will increase to about $575 billion in 2023, Bernstein said, but that figure is well below what is needed to meet long-term oil and gas demand. The amount includes $65 billion for exploration, while the analysts estimate that an incremental $75 billion is needed, even in a rapid energy transition. That adds up to an underinvestment of about $500 billion in exploration from 2016 through 2023.

“Adjusted for inflation, the upstream sector is investing in supply at ’05-’09 levels and real CAPEX per flowing barrel is near a 20-year low,” the analysts said in the report.

Bernstein’s estimate was more optimistic than S&P Global, which predicts an increase of about 10%, based on both lower oil prices and inflation compared to 2022 levels. Moody’s Investors Service expects a 10% to 15% increase in CAPEX, according to its Jan. 5 forecast.

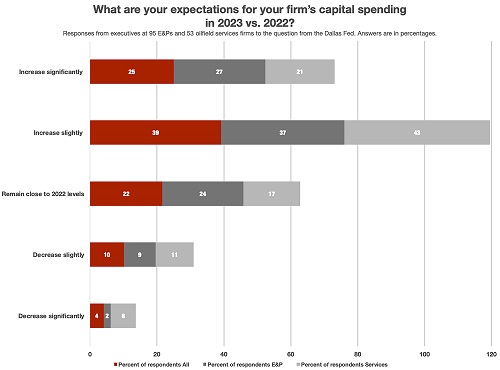

The Dallas Fed’s survey of oil and gas executives found that 63% expected capital spending to increase either significantly or slightly in 2023. Only 4% of those responding expected a significant decrease in capex.

Capital discipline

In reviewing prior forecasts, Bernstein said it overestimated global development CAPEX by about $100 billion a year, based on assumptions of how the industry would respond as crude oil prices rise. The sector reinvested just over 30% of cash flow into supply in 2021-2022, compared to 55% in 2017-2019. Meeting global demand in 2022 required tapping oil inventories to compensate for underinvestment in supply.

In Bernstein’s model, a $5 move in the Brent price drives $20 billion to $25 billion in development CAPEX, while a 1% move in the national oil company reinvestment rate drives $5 billion to $10 billion of spend.

For investors, continuing that spending model could be a plus. As Bernstein noted, “capital discipline and underinvestment are structurally supportive to price and free cash flow.”

“We believe that left unaddressed, underinvestment in supply should continue to provide positive support to crude price at the $75-80 level,” the analysts wrote. “Longer-term, either capital discipline breaks (we fail to see where geographically or at an asset level) or price breaks (upward).

“We continue to believe the upstream sector can offer attractive returns for investors and operators willing to put capital to work,” they added.

CREDIT: Joseph Markman, senior editor for Hart Energy, covers markets and provides data analysis for all Hart Energy editorial products.

READ NEXT: Big Oil, Good Times Set To Roll On