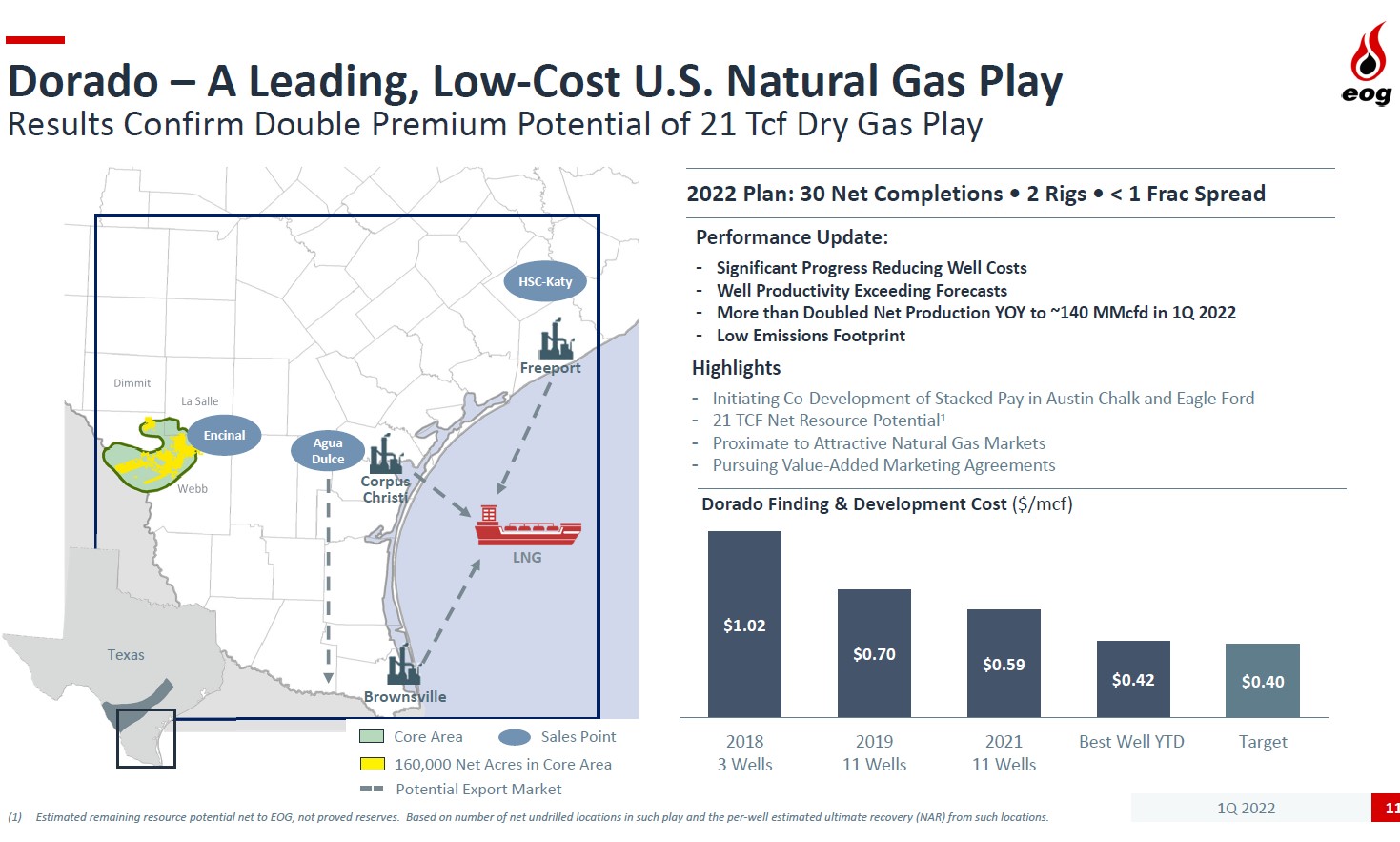

Story By Nissa Darbonne | Oil and Gas Investor | EOG Resources Inc. is looking at delaying completions in its behemoth Dorado gas play in the far southern Eagle Ford window in Webb County, Texas.

“We don’t really feel the need to jump in and complete those wells,” Billy Helms, EOG president and COO, said in an analyst call May 5.

DUCs are a tool producers use to have new oil and gas supply at the ready when prices improve.

Dorado is the supply anchor in EOG’s long-term gas-sales contract with LNG exporter Cheniere Energy Inc.

“In Dorado, it doesn’t take a lot of wells to generate significant volumes out of that place,” said Ken Boedeker, executive vice president, E&P. “I don’t know the exact right [completion] pace, but what we want to do is develop this at the right pace where we don’t outrun our learnings.”

He added, “We’re well ahead of any timing that we would need to add the LNG [gas feedstock] capacity in the future.”

EOG has more gas than just in Dorado, he noted. “We also have the flexibility of moving gas from other operating areas in our multi-basin portfolio to the Gulf Coast. So don’t think of the Dorado as just simply applying itself to the LNG market.

“It’s got the opportunity, but we can get gas from other plays to the Gulf Coast as well through our marketing arrangements.”

During EOG’s May 5 earnings call, Charles Meade, an analyst with Johnson Rice, asked, “Is this about the natural gas price falling [below $2.50]?”

Helms said, “It really is not triggered on a specific gas price, but just the overall softness we see in the current market conditions.”

As for longer-dated gas futures, “We’re still very bullish on the long-term outlook for gas,” he added.

EOG is evaluating holding off on the Eagle Ford completions later this year. “We’re just going to continue to remain disciplined on our investment to make sure we’re maximizing the value to the company over the long term,” Helms said.

EOG is evaluating holding off on the Eagle Ford completions later this year. “We’re just going to continue to remain disciplined on our investment to make sure we’re maximizing the value to the company over the long term,” Helms said.

EOG CEO Ezra Yacob said the company wants to make sure it’s not “outrunning our learnings — that we appropriately invest to be able to keep our costs low, and at the end of the day, to keep our margins wide.”

“We want to put in the correct infrastructure to keep our low operating costs because the margins are always pretty skinny on gas, and the low-cost producer for gas is going to be able to be exposed to the global market here in the U.S. for the long term,” he said.

Helms said Dorado activity continues. “We are increasing activity there, mainly from the drilling side.” That’s providing insight into “how we can continue to lower well costs going forward.”

On completions, “we have some planned activity here in the second quarter, but beyond that we’re looking at ways we can, with the flexibility we have in our program, to delay the completion of any wells beyond the second half.”