Bloomberg) — Europe’s natural gas market is showing signs of lingering concern over next winter’s fuel supplies, even as immediate frictions ease.

While near-term contracts have fluctuated as the weather turns warmer, December futures — the most expensive contracts for the rest of the year — have gained about 9% over the past two weeks.

That shows worries over Europe’s second winter without normal flows from former top supplier, Russia, have yet to disappear. High stockpiles and muted demand are keeping a lid on prompt prices for now. But traders are closely watching a potential rebound in rival Asian markets, as well as the possibility of higher fuel usage in power generation and the industrial sector.

To be sure, all of this year’s gas contracts have lost more than 30% since the start of 2023, but declines are more pronounced in near-term prices.

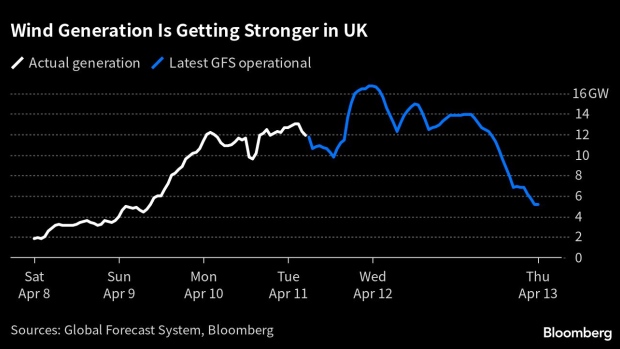

Temperatures in the region are expected to rise in the coming days after April started on a chilly note. Power generation from renewables is also set to gain momentum in parts of Europe, with the UK Met Office issuing wind warnings for this week. While those factors could further reduce demand for gas, French nuclear output remains uncertain amid extended maintenance and strike-related disruptions.

Analysts at Morgan Stanley say that fuel usage in key European economies remains below the average of the past five years, even when adjusting for mild weather. That raises prospects that Europe will rebuild its fuel stockpiles well ahead of the next heating season, they said.

“If demand remains broadly as weak as it has recently been, and liquefied natural gas imports were to continue at the current level, then inventories would reach a 100% fill rate by late August,” according to Morgan Stanley researchers led by Martijn Rats. The continent’s official heating season starts in October.

Read more: Europe May Fill Gas Storage by Late August, Morgan Stanley Says

A meaningful rebound in China’s LNG buying — which has been closely watched since the country lifted its Covid restrictions — has yet to materialize. It even re-exported record-high volumes of LNG in the first quarter, according to vessel tracking data compiled by Bloomberg.

Still, traders remain wary of what will happen with global demand by the end of the year and into 2024.

“The market is torn between the bearish spot fundamentals and the concerns,” analysts at Engie SA’s EnergyScan said in a note.

Dutch front-month gas futures, Europe’s benchmark, swung between gains and losses on Tuesday and traded 0.5% higher at €43.33 a megawatt-hour by 12:06 p.m. in Amsterdam. Month-ahead power prices in Germany and France also fluctuated.. Meanwhile, December gas contracts advanced 2.3% to €57.75.

©2023 Bloomberg L.P. – Original Story HERE

Read Next: Why U.S. Natural Gas Output Keeps Rising as Pricing Sinks