Story Credit, Natural Gas Intel. Natural gas futures probed both sides of even in early trading Thursday as traders braced for the latest government inventory data, expected to reveal a near-average springtime injection. Following a 9.3-cent sell-off in the previous session, the May Nymex contract was down 0.9 cents to $2.084/MMBtu this morning.

Expectations appear to be centering around a near-average build in the mid-to upper-20s Bcf for the Energy Information Administration’s (EIA) 10:30 a.m. ET storage report, which covers changes to U.S. inventories during the week ending April 7.

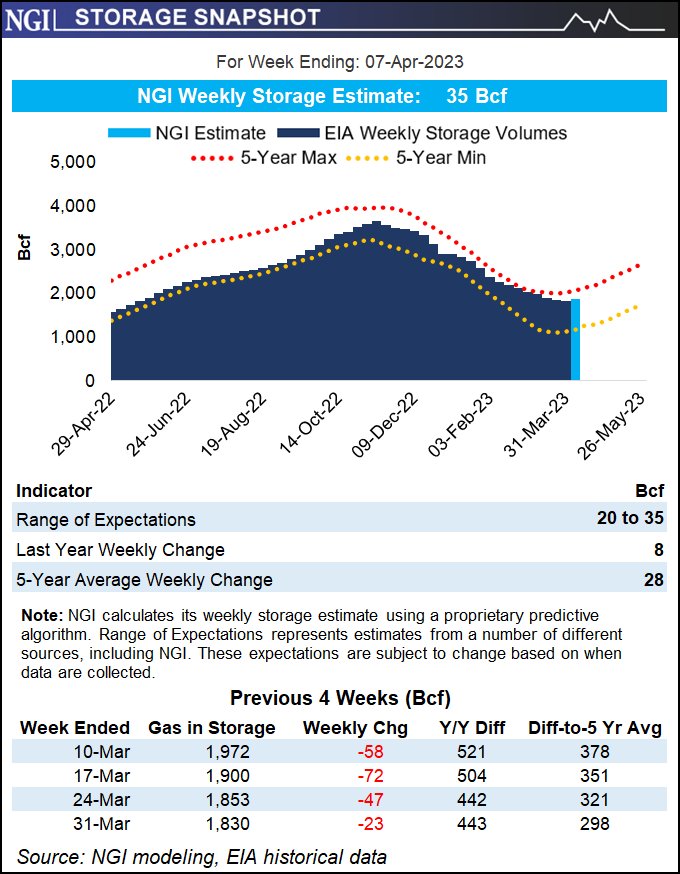

Surveys from Bloomberg and Reuters showed injection estimates ranging from 20 Bcf to 35 Bcf. Bloomberg’s survey of nine analysts produced a median build of 26 Bcf, while the Reuters poll produced a median build of 28 Bcf. A Wall Street Journal poll had a slightly tighter range of estimates but averaged a 28 Bcf injection as well. NGI’s weekly storage estimate is targeting a 35 Bcf build.

EIA recorded an 8 Bcf injection for the year-earlier period, while the five-year average is a build of 28 Bcf.

“It was warmer than normal over the southern and eastern U.S., while cool versus normal over the West and northern Plains,” NatGasWeather said of temperatures during the EIA report period. “We expect a build of 23-24 Bcf.”

In terms of overnight forecast changes, both the American and European models reduced projected heating demand overnight by showing less cooling over the northern United States, according to NatGasWeather.

The next three days are poised to deliver almost historically mild weather in terms of degree day totals, with pleasant temperatures blanketing much of the country, the firm said.

“A slightly cooler than normal weather system will sweep across the northern U.S. Monday to Wednesday with lows of 20s and 30s for a minor bump in national demand,” NatGasWeather added. “Thereafter, demand is still expected to ease to seasonally light levels April 20-27 as much of the U.S. warms into the very nice 60s to 80s besides hotter 90s in the Southwest deserts into Texas.”

Weather aside, production and LNG export trends appeared supportive early Thursday, based on estimates from EBW Analytics Group.

“Low early-cycle nominations in the Permian Basin are providing early-morning support amid continued pipeline maintenance restricting supplies,” EBW analyst Eli Rubin.

As for liquefied natural gas exports, volumes early Thursday were making a “strong” showing at 14.5 Bcf/d, though volumes had been “revised moderately lower in recent days,” the analyst added.

© 2023 Natural Gas Intelligence. All rights reserved.

Read Next: Why U.S. Natural Gas Output Keeps Rising as Pricing Sinks