HART ENERGY, by Emily Patsy. Northern Oil and Gas Inc. expanded its footprint in the Permian Basin during fourth-quarter 2020, the company revealed in a Jan. 7 release.

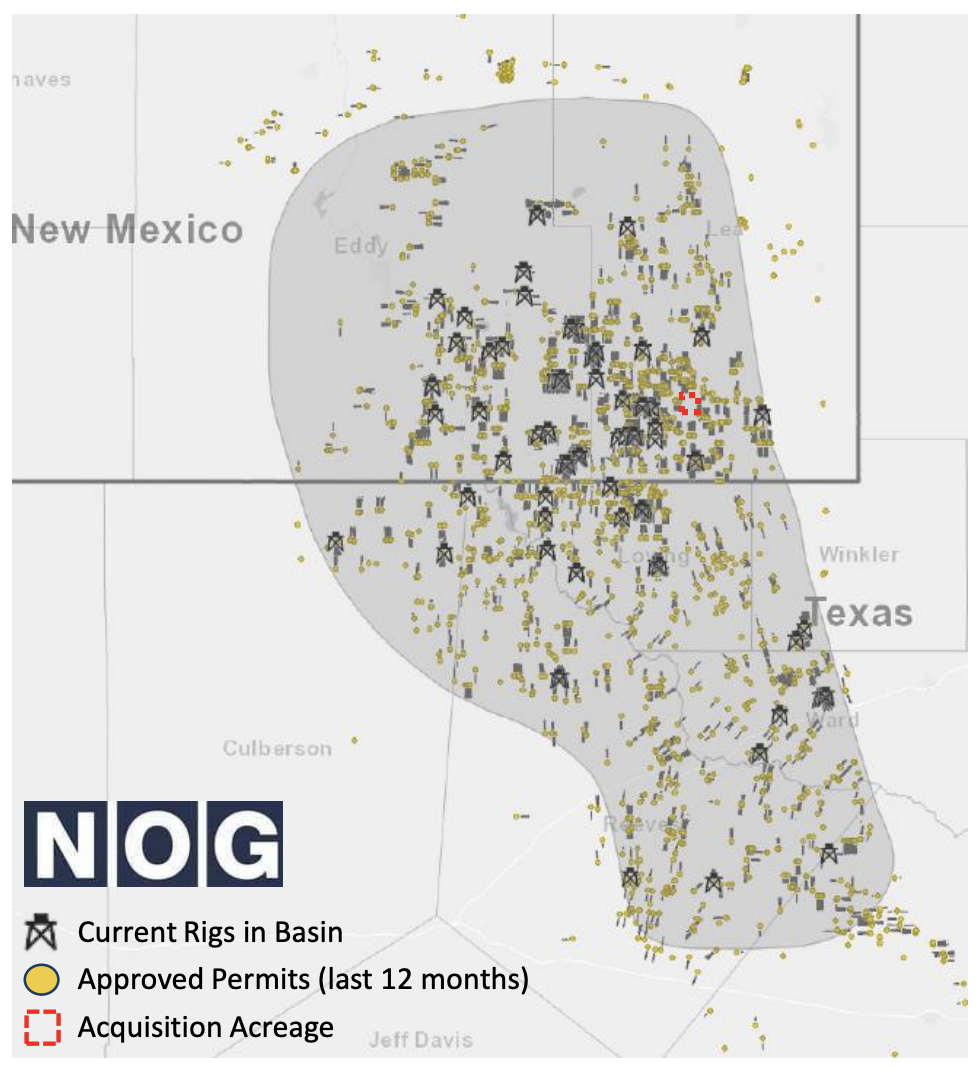

In the release, the company said it had executed 11 transactions totaling $8.4 million in the fourth quarter, inclusive of $1.8 million in equity-based consideration which was previously disclosed. Of the 11 transactions, four targeted the Permian and added about 220 net acres to Northern’s footprint in the basin.

“The Permian transactions are noteworthy as the company looks to expand operations and inventory outside of the Williston following its entrance into the Delaware in September,” Tyler Hoge, senior research associate for Enverus, wrote in a Jan. 7 research note.

Based in Minnetonka, Minn., Northern invests in non-operated minority working and mineral interests in oil and gas properties primarily Williston Basin. In September 2020, the company announced it had acquired non-operated interests within the Delaware Basin from an undisclosed seller, marking its first acquisition outside the Williston Basin where the company touts itself as being the largest nonoperator.

“Our team quietly executed throughout even the most challenging periods of 2020, adding high-quality inventory and development with strong upfront returns and convexity to better pricing, one small deal at a time,” Northern CEO Nick O’Grady said in a statement on Jan. 7. “Our work should pay off in 2021, as the positive trajectory throughout Q4 was encouraging and provides strong momentum. We expect even greater free cash flow, growing volumes, and stellar capital productivity on the horizon.”

As of January, Northern’s backlog of acquisition opportunities exceeds $1 billion in potential deal value. However, the company added that any potential transactions must meet Northern’s “high standards regarding asset quality and total returns.”

In the Jan. 7 release, Northern also reaffirmed a fourth-quarter 2020 production guidance midpoint of 35,000 boe/d and said it had recently retired $65 million of debt.