Featured Article

-

901Oil & Gas News

901Oil & Gas NewsCrude, Gas, Lithium, EV’s: 4 Charts To Watch This Week

Credit: S&P Global 1. Asian refiners expect limited OPEC+ cut impact on H2 term crude supply What’s happening? Saudi Arabia, Iraq, the...

-

854Oil & Gas News

854Oil & Gas NewsGerman Cabinet OKs Oil & Gas Heating Phase-Out

On Wednesday, the German cabinet approved a bill prohibiting most new oil and gas heating systems from 2024, aimed at reducing greenhouse...

-

1.3KAcquisitions

1.3KAcquisitionsPermian in Spotlight as Energy Dealmaking Gathers Steam

Mrinalika Roy – [Reuters] Companies with a focus on the oil-rich Permian Basin are likely to be at the center of the...

-

1.1KOil & Gas News

1.1KOil & Gas NewsU.S. LNG Boom In Jeopardy Due To Costs and Rivalry

Intense competition among developers and rising costs are creating challenges for new liquefied natural gas (LNG) projects in the United States, even...

-

891World Events

891World EventsBaghdad, KRG take step towards resuming Iraq northern oil exports

April 17 (Reuters) – Iraq’s federal government and the Kurdistan Regional Government (KRG) have ironed out technical issues essential to resuming northern...

-

833Oil & Gas News

833Oil & Gas NewsOil Falls As Recession Fears Loom

Oil prices experienced a downturn on Monday as investors weighed the potential impact of a May interest rate hike by the U.S....

-

1.5KMineral Owners

1.5KMineral OwnersPart 3 of Understanding Mineral Rights: A Three-Part Series for New Mineral Owners

In Part 1 of our 3-Part series, we discussed the different types of mineral ownership, in Part 2 of our series we...

-

1.5KMineral Owners

1.5KMineral OwnersPart 2 of Understanding Mineral Rights: A Three-Part Series for New Mineral Owners

In Part 1 of our 3-Part series, we discussed the different types of mineral ownership. Today we will be discussing royalties, how...

-

1.9KOil & Gas News

1.9KOil & Gas News🤖What We Know ChatGPT Can Do for the Petroleum Industry, So Far

ChatGPT. Story Credit, Habib Ouadi et al.: Journal of Petroleum Technology. The complex and dynamic nature of the oil industry calls for...

-

1.8KMineral Owners

1.8KMineral OwnersUnderstanding Mineral Rights: Part One of A Three-Part Series for New Mineral Owners

Importance of understanding mineral rights As a mineral owner, it is crucial to understand the concept of mineral rights and their role...

Snippets

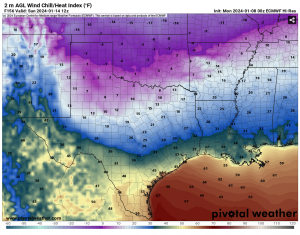

- 🌨️Cold Weather Forecast for OklahomaA real taste of winter is hitting most of the state this week, sending oil and gas crews to wear extra...A real taste of winter is hitting most of the state this week, sending oil and gas crews to wear extra clothing to fight the extreme wind chills. Oklahoma Climatologist Gary McManus says we’ll see wind chills down “into the single digits and teens” Tuesday morning.Read More

“Then, around Friday, we’re going to get a blast of true Arctic air, and then we could see a February 2021-lite version of winter where we stay below freezing for several days. A bit far out to say for sure, but get ready for winter-for-real.”

He said another storm system will likely hit the state on Friday and early next week with a strong chance of snow for many areas of Oklahoma—“just depends on the storm track of those systems. [Source: OK Energy Today} - DOE earmarks $70M to secure energy infrastructureThe Department of Energy is allocating up to $70 million to guard the nation's infrastructure from cyberattacks...The Department of Energy is allocating up to $70 million to guard the nation's infrastructure from cyberattacks and other cyber threats. The DOE is accepting applications for funding for its All-Hazards Energy Resilience project that will center on zero-trust architectures for electrical, gas, or oil settings.Read More

- Closing Oil & Gas PriceBenchmark U.S. crude oil for February delivery...Benchmark U.S. crude oil for February delivery rose $1.47 to $72.24 per barrel Tuesday. Brent crude for March delivery rose $1.47 to $77.59 per barrel.Read More

Wholesale gasoline for February delivery rose 5 cents to $2.08 a gallon. February heating oil rose 7 cents to $2.65 a gallon. February natural gas rose 21 cents to $3.19 per 1,000 cubic feet.

- Energy Sector CommentaryThe energy sector is off to a...Read More

The energy sector is off to a higher start, rebounding from yesterday's steep slide on the backs of strength in the underlying commodities. Major equity futures meanwhile steadied this morning as rates ticked higher and investors await a pair of key inflation readings later this week to gain clarity into the path forward for rate cuts from the Fed. The benchmark 10-year Treasury note yield rose more than 4 basis points this morning and is now trading above 4%.

WTI and Brent crude oil futures are up by over 2.5% in early trading, recovering from yesterday’s 4% drop on rising concerns that tensions in the Middle East will spread and ongoing supply outages in Libya. Weak economic data out of Germany, lingering demand worries, and speculation of rising OPEC supply after Saudi Arabia cut its OSP yesterday, are keeping a cap on gains. The Israeli military has said its fight against Hamas will continue through 2024, worrying markets that the conflict could grow into a regional crisis that could disrupt Middle Eastern oil supplies. German industrial production unexpectedly fell in November according to the Federal Statistics Office, marking a sixth consecutive monthly decline.

Natural gas futures resumed their trend higher, backed by cooler weather forecast in key consuming regions that should stir demand ahead of another winter storm.

- Canada, Mexico projects seen squeezing US Gulf heavy crude supplyThe upcoming startup of the 590,000-barrel-per-day Trans Mountain Expansion oil pipeline in Canada and...The upcoming startup of the 590,000-barrel-per-day Trans Mountain Expansion oil pipeline in Canada and the 340,000-bpd Olmeca refinery in Mexico is expected to reduce the availability of heavy sour crude oil barrels on the US Gulf Coast. Crude imports from Venezuela could help fill a potential gap, but uncertainty surrounding US sanctions clouds that prospect.Read More

MOST POPULAR

-

424International

424InternationalOPEC+ 8 Decide to Implement Output Adjustment

Story By Andreas Exarheas | RigZone.com | A statement posted on OPEC’s website on...

-

396Oil & Gas News

396Oil & Gas NewsTexas Refinery Hub Faces Historic Water Crisis

One of the busiest refining and petrochemical clusters on the Gulf Coast is now...

-

370Energy

370EnergyData Centers Ignite Next Texas Energy Expansion

The once unstoppable Texas shale boom is showing clear signs of fatigue, but a...

-

304Oil & Gas News

304Oil & Gas NewsBP’s AI Breakthrough Redefines Global Oil Exploration

BP is redefining how artificial intelligence is used in energy exploration, marking a turning...

-

291Oil & Gas News

291Oil & Gas NewsShale Giants Slash Thousands of Jobs as Lower Prices Bite

By Tsvetana Paraskova for Oilprice.com | U.S. oil and gas producers seek efficiencies and...

-

241Oil & Gas News

241Oil & Gas NewsCoterra Energy at a Crossroads: Activist Investor Kimmeridge Calls for Strategic Overhaul

[Oklahoma City, November 5, 2025] — In an oil and gas landscape increasingly shaped...

-

209International

209InternationalU.S. Sanctions Force Lukoil to Divest Global Holdings

By Tsvetana Paraskova for Oilprice.com | Lukoil has agreed to sell its international business to...

-

64Investing

64InvestingEnergy Transition Shapes HSBC’s New Financing Plan

HSBC is reshaping its approach to energy financing as the global transition toward cleaner...

-

54Oil & Gas News

54Oil & Gas NewsEnergy Jobs Anchor Permian Basin Employment Stability

Job cuts are sweeping across the United States at a rate not seen in...

-

44Oil & Gas News

44Oil & Gas NewsU.S. Shale Firms Still in Growth Mode Despite Lower Prices

“At current price levels, US producers are still incentivized to grow,” Walt Chancellor, a...