Featured Article

-

1.0KOil & Gas News

1.0KOil & Gas NewsOil Market Faces Production Capacity Issue in 2024, Goldman’s Currie Says

(Bloomberg) — Oil will rise back above $100 a barrel this year and may face a serious supply problem in 2024 as...

-

958Oil & Gas News

958Oil & Gas NewsChina To Cut Oil Exports Amid Strong Domestic Demand

By: S&P Global – China’s refineries will cut clean oil product exports in February as domestic demand in January was better than...

-

1.1KOil & Gas News

1.1KOil & Gas NewsElk Range Closes Acquisition of Tower Rock’s Permian Royalty Interests

Hart Energy – Staff Story. Elk Range Royalties LP closed its acquisition of Permian Basin mineral and royalty interests from Tower Rock...

-

2.1KOil & Gas News

2.1KOil & Gas NewsOil Steady As Russian Oil Products Ban Looms

By: Reuters – Oil prices were steady on Thursday as looming sanctions on Russian oil products added uncertainty over supply but the...

-

911Oil & Gas News

911Oil & Gas NewsThe Day Crude Oil Futures Ran Out of Fuel: 5 Lessons to Learn

FROM ZACKS Investment Research. An Unprecedented Commodity Event. A little more than two years ago the commodity market shocked the world. In...

-

1.1KOil & Gas News

1.1KOil & Gas NewsAlliance Resources’ Permian Royalty Acquisitions Set to Total More Than $150 Million

STORY BY Darren Barbee, Oil and Gas Investor. Coal company Alliance Resource Partners LP is upping its oil and gas mineral acreage...

-

1.0KOil & Gas News

1.0KOil & Gas NewsTexas Trade Group Calls Bull Case For Oil & Gas

By: S&P Global – Amid declining forecasts for US oil and natural gas consumption, a different story is being told in the...

-

910Oil & Gas News

910Oil & Gas NewsDenver oilfield giant says profits, healthy fracking market are here to stay

By Greg Avery – Senior Reporter, Denver Business Journal. Fracking company Liberty Energy doesn’t expect a possible recession this year to derail demand for...

-

1.2KOil & Gas News

1.2KOil & Gas NewsHow Long Until ‘Peak Oil’?

By: YahooNews – Oil giant BP released a report Monday predicting that the world would sharply reduce its reliance on the company’s...

-

1.4KExploration

1.4KExplorationWindfall Taxes Sweep Through The Global Energy Sector

OilPrice.com. Over the past two years, global energy companies have enjoyed record profits amid high commodity prices, with the International Energy Agency...

Snippets

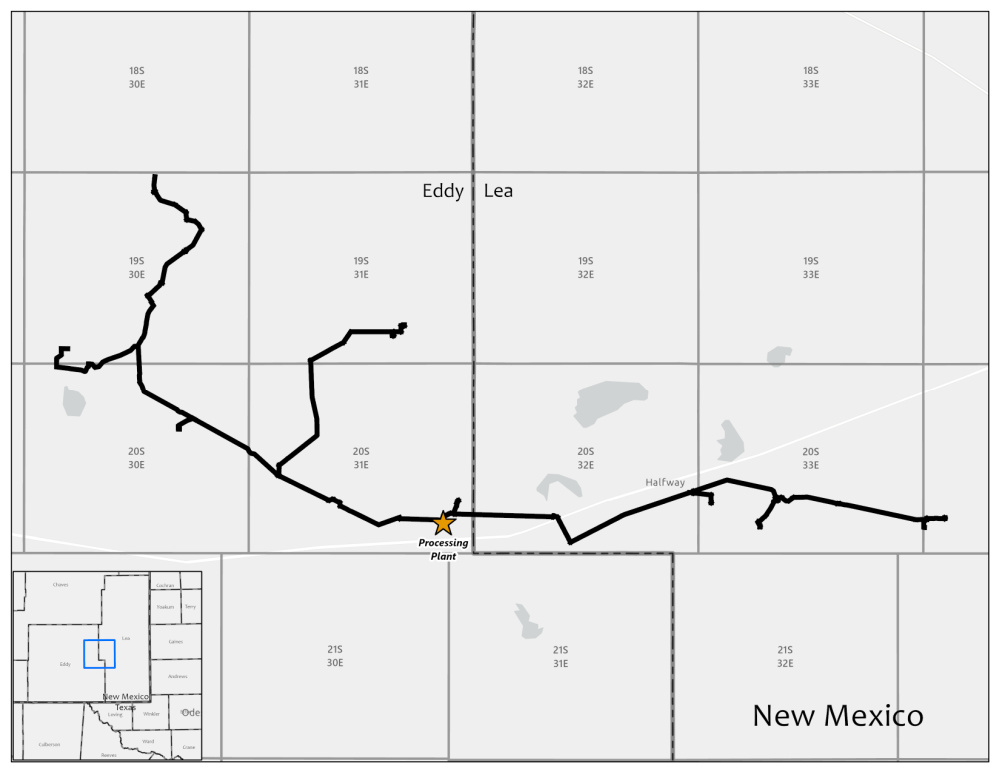

- Matador Resources to Acquire Permian Midstream Assets from Summit for $75 MillionMatador Resources Co. agreed to acquire a gathering and processing system in New Mexico’s Eddy and...Matador Resources Co. agreed to acquire a gathering and processing system in New Mexico’s Eddy and Lea counties from Summit Midstream Partners LP for $75 million, adding to Matador’s midstream portfolio in the Permian Basin.Read More

- What else is brewing this Friday morning...Read More

- US auto safety regulators are expanding their investigation of Tesla’s Autopilot system after a series of new crashes involving first-responder vehicles.

- President Biden wants to turn one of the country’s largest underwater canyons, 100 miles off of the New York coastline, into a national marine sanctuary.

- A heat wave is going to bake the Southwest this weekend.

- Stitch Fix is laying off 15% of salaried positions to save money in these tumultuous times.

- The Grammys announced new awards, including “Songwriter of the Year” and “Best Score Soundtrack for Video Games and Other Interactive Media.”

- Mortgage demand is at its lowest point in 22 yearsOver the last week, mortgage applications fell 7%, and ...Over the last week, mortgage applications fell 7%, and they're down 21% since last June.Read More

A traditional 30-year fixed mortgage saw average interest rates rise to 5.4% last week, compared to rates in the low 3% range around this time last year.

The cost to buy a home has risen dramatically in 2022, which has resulted in a drop-off in demand.

Or, more simply: there's been "a meltdown." - Closing Oil and Gas Prices for ThursdayBenchmark U.S. crude oil for July delivery fell 60 cents to $121.51 a barrel Thursday. Brent crude for...Benchmark U.S. crude oil for July delivery fell 60 cents to $121.51 a barrel Thursday. Brent crude for August delivery fell 51 cents to $123.07 a barrel.Read More

Wholesale gasoline for July delivery rose 6 cents to $4.28 a gallon. July heating oil rose 9 cents to $4.40 a gallon. July natural gas rose 26 cents to $8.96 per 1,000 cubic feet. - US natural gas storage rises 97 Bcf to 1.999 Tcf as NYMEX futures reboundThe US Energy Information Administration on June 9 reported a 97 Bcf injection to US inventories for...The US Energy Information Administration on June 9 reported a 97 Bcf injection to US inventories for the week ended June 3. The addition to stocks was closely aligned with S&P Global Commodity Insights' storage survey result, which called for an injection of 96 Bcf. The weekly build was also much closer to historical averages, just barely undershooting the year-ago injection of 98 Bcf and the five-year average of 100 Bcf in the corresponding week, data from the EIA showed.Read More

As a result, the US working gas inventories climbed to 1.999 Tcf, while the shortfall to 2021 widened to 398 Bcf, leaving stocks about 17% below the year-ago level of 2.397 Tcf. The inventory deficit to the prior five-year average also expanded to its widest yet this season, pushing stocks to 340 Bcf, or almost 15%, below the historical average of 2.339 Tcf.

Immediately following the EIA storage report's release, the Henry Hub July contract jumped about 25 cents to $8.45/MMBtu, followed by continued price gains throughout the morning and early afternoon that left the prompt-month contract just shy of $9/MMBtu at settlement, data from CME Group showed.

MOST POPULAR

-

520Oil & Gas News

520Oil & Gas NewsN.M. Braces for Revenue Losses From Royalty Rate Cuts

Ian M. Stevenson | EENews.net | Falling royalty rates for oil and gas production...

-

482Acquisitions

482Acquisitions$550MM Canvas Acquisition Expands Diversified Energy’s Oklahoma Footprint

Diversified Energy Company Plc has announced a $550 million acquisition of Canvas Energy, a...

-

380Oil & Gas News

380Oil & Gas NewsU.S. Oil Producers Slash 2025 Spending as Prices Slide and Consolidation Mounts

The U.S. oil and gas industry is entering a period of retrenchment, marked by...

-

371Energy

371EnergyNatural Gas and Batteries Anchor Data Center Growth

Data centers across the United States are increasingly grappling with one of the most...

-

331Oil & Gas News

331Oil & Gas NewsShale Expected to Weather ‘Lower for Longer’ Oil Prices

By Mella McEwen,Oil Editor | MRT | Crude prices have spent much of the year...

-

325Oil & Gas News

325Oil & Gas NewsViking Minerals Closes $40M Fund VI, Doubling Down on Strategic Growth Amid Industry Headwinds

Oklahoma City, OK – September 16, 2025 — In a market where many mineral...

-

307Natural Gas

307Natural GasPowering the US Data Center Boom With Wasted Natural Gas

[energyintel.com] A data center boom in the US is straining the grid and pushing...

-

301Oklahoma

301OklahomaOklahoma Drive In Pauses Operations During New Energy Project

The temporary closure of the Chief Drive In Theatre in Ninnekah has sparked local...

-

255Oil & Gas News

255Oil & Gas NewsFaster Decline Rates Challenge Energy Security Worldwide

The International Energy Agency (IEA) has issued a stark warning that the world’s oil...

-

236Oil & Gas News

236Oil & Gas NewsFermi America Reveals Ambitious Texas Energy Megaproject

Fermi America, a Texas-based company co-founded by former U.S. Energy Secretary and former Texas...

-

226International

226InternationalCanada Bets Big on LNG Export Capacity Growth

Canada’s ambitions to become a global energy powerhouse gained momentum just two months after...

-

108Oil & Gas News

108Oil & Gas NewsIs the Market Sleepwalking Into a Global Oil Shortage?

Managed money speculators hit record bearish positions on WTI even as the IEA forecasts...