Featured Article

-

1.9KOil & Gas News

1.9KOil & Gas NewsApache resumes drilling in Alpine High play

Apache Corp. generated national – and even international – headlines in the fall of 2016 when it announced what it believed was...

-

1.4KOil & Gas News

1.4KOil & Gas News2 oil companies quietly spent $10 million to exit Arctic Refuge leases

When the federal government auctioned off oil leases in the Arctic National Wildlife Refuge last year, no major firms bid, in a...

-

1.4KOil & Gas News

1.4KOil & Gas NewsSaudi Arabia’s oil dominance to last

The world’s two biggest oil and natural gas reservoirs are in the Permian Basin and Saudi Arabia with estimated remaining reserves of...

-

1.3KOil & Gas News

1.3KOil & Gas NewsEnbridge to build pipelines to service new LNG facility

By: Bloomberg – Energy transportation giant Enbridge Inc. will be going ahead with two pipeline projects to service a new liquefied natural...

-

1.1KOil & Gas News

1.1KOil & Gas NewsMorgan Stanley’s Shareholders Vote Against Proposal on Fossil Fuels

(Reuters) Morgan Stanley CEO James Gorman told shareholders during the bank’s annual general meeting on May 26 that he does not plan...

-

1.4KOil & Gas News

1.4KOil & Gas NewsNatural gas prices are heating up

By: CNBC – Natural gas surged above $9 per million British thermal units, or MMBtu, on Wednesday, hitting the highest level in more...

-

1.3KOil & Gas News

1.3KOil & Gas NewsHedge fund Elliott chases oil and gas deals, bucking Wall Street

By: David French – Reuters – Energy bankers and hedge fund managers who lost one client after another when poor returns pushed...

-

1.5KOil & Gas News

1.5KOil & Gas NewsPower Grid Problems: A Hot, Deadly Summer Is Coming With Frequent Blackouts

(Bloomberg) — Global power grids are about to face their biggest test in decades with electricity generation strangled in the world’s largest...

-

1.0KOil & Gas News

1.0KOil & Gas NewsNatural Gas Market Is Hurtling Toward Historic Winter Shortages

(Bloomberg) — The liquefied natural gas market is hurtling toward a potentially historic shortage this winter as the world rushes to secure...

-

1.4KOil & Gas News

1.4KOil & Gas NewsHart Energy: Popularity for Longer Laterals Grows in Permian Basin

FORT WORTH, Texas—In the Permian Basin, the popularity of longer laterals is slowly but steadily rising, according to Rystad Energy’s upstream research...

Snippets

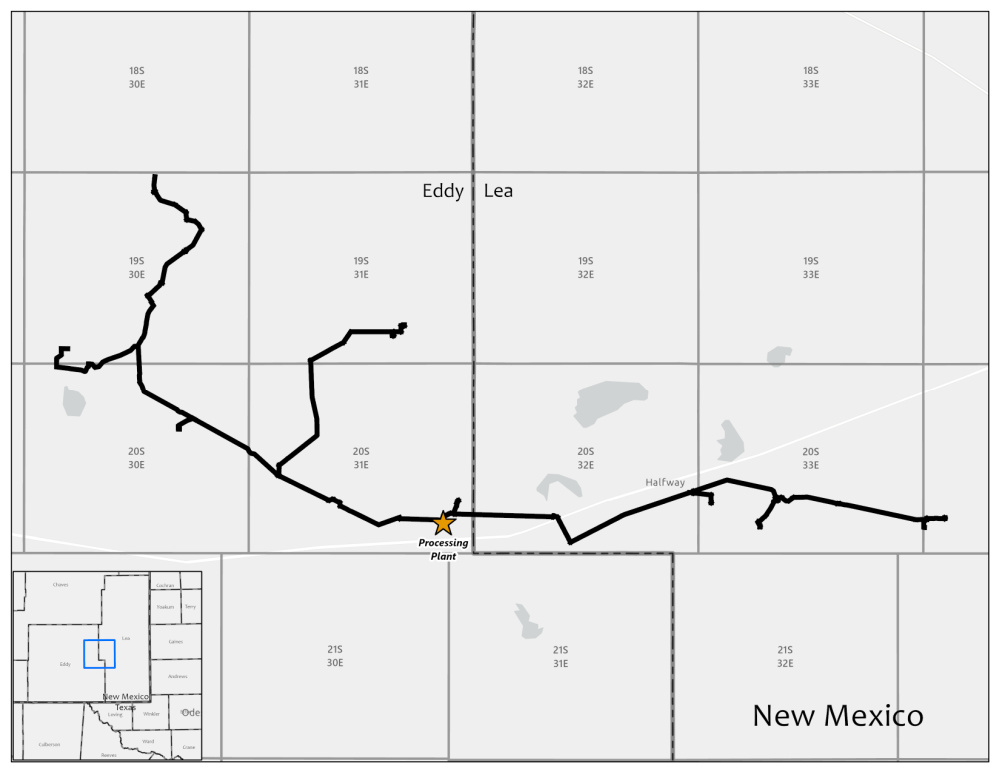

- Matador Resources to Acquire Permian Midstream Assets from Summit for $75 MillionMatador Resources Co. agreed to acquire a gathering and processing system in New Mexico’s Eddy and...Matador Resources Co. agreed to acquire a gathering and processing system in New Mexico’s Eddy and Lea counties from Summit Midstream Partners LP for $75 million, adding to Matador’s midstream portfolio in the Permian Basin.Read More

- What else is brewing this Friday morning...Read More

- US auto safety regulators are expanding their investigation of Tesla’s Autopilot system after a series of new crashes involving first-responder vehicles.

- President Biden wants to turn one of the country’s largest underwater canyons, 100 miles off of the New York coastline, into a national marine sanctuary.

- A heat wave is going to bake the Southwest this weekend.

- Stitch Fix is laying off 15% of salaried positions to save money in these tumultuous times.

- The Grammys announced new awards, including “Songwriter of the Year” and “Best Score Soundtrack for Video Games and Other Interactive Media.”

- Mortgage demand is at its lowest point in 22 yearsOver the last week, mortgage applications fell 7%, and ...Over the last week, mortgage applications fell 7%, and they're down 21% since last June.Read More

A traditional 30-year fixed mortgage saw average interest rates rise to 5.4% last week, compared to rates in the low 3% range around this time last year.

The cost to buy a home has risen dramatically in 2022, which has resulted in a drop-off in demand.

Or, more simply: there's been "a meltdown." - Closing Oil and Gas Prices for ThursdayBenchmark U.S. crude oil for July delivery fell 60 cents to $121.51 a barrel Thursday. Brent crude for...Benchmark U.S. crude oil for July delivery fell 60 cents to $121.51 a barrel Thursday. Brent crude for August delivery fell 51 cents to $123.07 a barrel.Read More

Wholesale gasoline for July delivery rose 6 cents to $4.28 a gallon. July heating oil rose 9 cents to $4.40 a gallon. July natural gas rose 26 cents to $8.96 per 1,000 cubic feet. - US natural gas storage rises 97 Bcf to 1.999 Tcf as NYMEX futures reboundThe US Energy Information Administration on June 9 reported a 97 Bcf injection to US inventories for...The US Energy Information Administration on June 9 reported a 97 Bcf injection to US inventories for the week ended June 3. The addition to stocks was closely aligned with S&P Global Commodity Insights' storage survey result, which called for an injection of 96 Bcf. The weekly build was also much closer to historical averages, just barely undershooting the year-ago injection of 98 Bcf and the five-year average of 100 Bcf in the corresponding week, data from the EIA showed.Read More

As a result, the US working gas inventories climbed to 1.999 Tcf, while the shortfall to 2021 widened to 398 Bcf, leaving stocks about 17% below the year-ago level of 2.397 Tcf. The inventory deficit to the prior five-year average also expanded to its widest yet this season, pushing stocks to 340 Bcf, or almost 15%, below the historical average of 2.339 Tcf.

Immediately following the EIA storage report's release, the Henry Hub July contract jumped about 25 cents to $8.45/MMBtu, followed by continued price gains throughout the morning and early afternoon that left the prompt-month contract just shy of $9/MMBtu at settlement, data from CME Group showed.

MOST POPULAR

-

521Oil & Gas News

521Oil & Gas NewsN.M. Braces for Revenue Losses From Royalty Rate Cuts

Ian M. Stevenson | EENews.net | Falling royalty rates for oil and gas production...

-

484Acquisitions

484Acquisitions$550MM Canvas Acquisition Expands Diversified Energy’s Oklahoma Footprint

Diversified Energy Company Plc has announced a $550 million acquisition of Canvas Energy, a...

-

371Energy

371EnergyNatural Gas and Batteries Anchor Data Center Growth

Data centers across the United States are increasingly grappling with one of the most...

-

332Oil & Gas News

332Oil & Gas NewsShale Expected to Weather ‘Lower for Longer’ Oil Prices

By Mella McEwen,Oil Editor | MRT | Crude prices have spent much of the year...

-

326Oil & Gas News

326Oil & Gas NewsViking Minerals Closes $40M Fund VI, Doubling Down on Strategic Growth Amid Industry Headwinds

Oklahoma City, OK – September 16, 2025 — In a market where many mineral...

-

307Natural Gas

307Natural GasPowering the US Data Center Boom With Wasted Natural Gas

[energyintel.com] A data center boom in the US is straining the grid and pushing...

-

305Oklahoma

305OklahomaOklahoma Drive In Pauses Operations During New Energy Project

The temporary closure of the Chief Drive In Theatre in Ninnekah has sparked local...

-

255Oil & Gas News

255Oil & Gas NewsFaster Decline Rates Challenge Energy Security Worldwide

The International Energy Agency (IEA) has issued a stark warning that the world’s oil...

-

239Oil & Gas News

239Oil & Gas NewsFermi America Reveals Ambitious Texas Energy Megaproject

Fermi America, a Texas-based company co-founded by former U.S. Energy Secretary and former Texas...

-

228International

228InternationalCanada Bets Big on LNG Export Capacity Growth

Canada’s ambitions to become a global energy powerhouse gained momentum just two months after...

-

108Oil & Gas News

108Oil & Gas NewsIs the Market Sleepwalking Into a Global Oil Shortage?

Managed money speculators hit record bearish positions on WTI even as the IEA forecasts...

-

60International

60InternationalTurkey Plans Energy Deals With USA

by Bloomberg, via RigZone.com | F.Kozok, S.Hacaoglu | Turkey plans to sign new energy deals with...