Featured Article

-

1.5KOil & Gas News

1.5KOil & Gas NewsChevron reports highest free cash flow on record

By: Pippa Stevens – CNBC – Chevron said Friday that it generated the highest free cash flow on record during the third quarter...

-

1.3KOil & Gas News

1.3KOil & Gas NewsDwindling Oil Supply at U.S. Hub Is Rippling Into Global Markets

By: Bloomberg News – The culprit behind the latest jump in oil prices isn’t soaring natural gas prices or even OPEC+’s limits...

-

1.8KOil & Gas News

1.8KOil & Gas NewsDanger Ahead: ESG

What is ESG and why should I care? ESG is a back door way of choking capital to the energy sector. Its...

-

1.7KInvesting

1.7KInvestingNatural gas surges as U.S. forecasts stoke winter supply jitters

By: Gerson Freitas Jr. – Pittsburgh Post-Gazette – U.S. natural gas prices soared the most in more than a year, erasing much...

-

1.4KOil & Gas News

1.4KOil & Gas NewsOil prices extend gains to multi-year highs on tight supply

By: Noah Browning – Reuters – Oil prices extended pre-weekend gains on Monday to hit multi-year highs, lifted by tight global supply...

-

1.3KOil & Gas News

1.3KOil & Gas NewsBig Oil CEOs have a personal reason to put more focus on less fossil fuels

By: Bob Woods – CNBC – As energy sector demand roars back and commodities market pundits talk about the return of $100...

-

1.7KInvesting

1.7KInvestingOil Boom 2021: The Time For Artificial Constraint Is Over

By: David Blackmon – Forbes – On April 20, 2020, during the depths of the COVID-19 pandemic, the price for a barrel...

-

1.6KNational

1.6KNationalWhite House asks U.S. oil-and-gas companies to help lower fuel costs -sources

By: Jarrett Renshaw – Reuters – The White House has been speaking with U.S. oil and gas producers in recent days about...

-

3.0KInvesting

3.0KInvestingA Denver oil and gas company with big private equity backers files to go public

A Denver-based oil and gas company that’s backed by a trio of major private equity funds is poised to become publicly traded,...

-

1.1KOil & Gas News

1.1KOil & Gas NewsU.S. shale producer APA ends flaring, captures more gas as prices soar

By: Liz Hampton – Reuters – Shale oil and gas producer APA Corp (APA.O) on Monday said it has ended routine gas flaring...

Snippets

- Industry leaders battle declining appeal of oil, gas jobsUS shale tycoon Harold Hamm has recently donated $50 million to establish the Hamm Institute for American...US shale tycoon Harold Hamm has recently donated $50 million to establish the Hamm Institute for American Energy at Oklahoma State University as part of efforts to counter younger generations' dwindling interest in oil and natural gas careers, while oil giants including ExxonMobil, Chevron and Shell have launched similar initiatives. Undergraduate enrollment in petroleum engineering courses has dropped from 7,046 in 2019 to 3,911 in 2023, heightening concerns about skills shortages in the industry.Read More

- ☕️What Else is Brewing Wednesday MorningThe SEC’s X account got hacked. Everyone is waiting for the SEC’s ...The SEC’s X account got hacked. Everyone is waiting for the SEC’s decision, expected today, about whether it will allow spot bitcoin ETFs that would make buying the cryptocurrency easier and more accessible. But it seems someone wasn’t willing to wait it out: After the SEC’s account posted to X yesterday that the ETFs had been approved, Chair Gary Gensler said on his own account that there had been no approval and the agency’s account was “compromised.” The false post briefly caused a spike in bitcoin prices.Read More

Boeing’s CEO said the company must acknowledge its mistake as it deals with the terrifying Alaska Airlines incident that led to the grounding of its 737 Max 9 planes.

It was a rough one for layoff announcements: BlackRock cut 600 employees, or 3% of its staff, in the face of changes to the industry, Twitch will cut 500 employees, 35% of its workforce, and Rent the Runway let go of 10% of its corporate staff, about 37 people.

Ecuador’s president declared an “internal armed conflict” after gunmen stormed a live TV broadcast and notorious gang leaders escaped from prison.

NASA delayed its plans to put astronauts on the moon until 2026, saying it needed more time to work out technical and safety challenges. - Dow snaps three-day winning streak as market awaits inflation data, earningsU.S. stocks ended mostly lower on Tuesday as investors rethink the chances of an interest-rate cut by...U.S. stocks ended mostly lower on Tuesday as investors rethink the chances of an interest-rate cut by the Federal Reserve in the near term and await new inflation data and earnings results later in the week.Read More

The Dow Jones Industrial Average DJIA fell 157.85 points or 0.4% to end at 37,525.16

The S&P 500 SPX shed 7.04 points or 0.2% to finish at 4,756.50

The Nasdaq Composite COMP gained 13.94 points or 0.1% to close at 14,857.71

On Monday, the Dow Jones Industrial Average rose 217 points, or 0.58%, to 37,683; the S&P 500 increased 66 points, or 1.41%, to 4,764; and the Nasdaq Composite gained 320 points, or 2.2%, to 14,844.

Request a Consultation

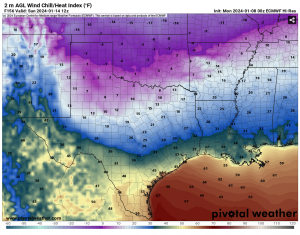

- 🌨️Cold Weather Forecast for OklahomaA real taste of winter is hitting most of the state this week, sending oil and gas crews to wear extra...A real taste of winter is hitting most of the state this week, sending oil and gas crews to wear extra clothing to fight the extreme wind chills. Oklahoma Climatologist Gary McManus says we’ll see wind chills down “into the single digits and teens” Tuesday morning.Read More

“Then, around Friday, we’re going to get a blast of true Arctic air, and then we could see a February 2021-lite version of winter where we stay below freezing for several days. A bit far out to say for sure, but get ready for winter-for-real.”

He said another storm system will likely hit the state on Friday and early next week with a strong chance of snow for many areas of Oklahoma—“just depends on the storm track of those systems. [Source: OK Energy Today} - DOE earmarks $70M to secure energy infrastructureThe Department of Energy is allocating up to $70 million to guard the nation's infrastructure from cyberattacks...The Department of Energy is allocating up to $70 million to guard the nation's infrastructure from cyberattacks and other cyber threats. The DOE is accepting applications for funding for its All-Hazards Energy Resilience project that will center on zero-trust architectures for electrical, gas, or oil settings.Read More

MOST POPULAR

-

734Oil & Gas News

734Oil & Gas NewsFermi America Reveals Ambitious Texas Energy Megaproject

Fermi America, a Texas-based company co-founded by former U.S. Energy Secretary and former Texas...

-

564Oklahoma

564OklahomaOklahoma Drive In Pauses Operations During New Energy Project

The temporary closure of the Chief Drive In Theatre in Ninnekah has sparked local...

-

441National

441NationalEIA: U.S. Natural Gas Use to Hit Record in 2025

Natural gas remains the leading source of electricity generation in the United States, but...

-

435International

435InternationalTurkey Plans Energy Deals With USA

by Bloomberg, via RigZone.com | F.Kozok, S.Hacaoglu | Turkey plans to sign new energy deals with...

-

407Oil & Gas News

407Oil & Gas NewsTrump Calls Out Europe on Russian Energy Purchases

President Donald Trump used his address at the United Nations General Assembly this week...

-

366Mineral Owners

366Mineral OwnersTiny Decimals, Big Consequences: Mineral Rights Fragmentation in the U.S.

Mineral rights fragmentation is not a temporary crisis but an inherent, perpetual friction in...

-

335Oil & Gas News

335Oil & Gas NewsInfrastructure Gaps Threaten Permian’s AI Energy Future

West Texas holds a treasure trove of natural gas that could become a critical...

-

265Oil & Gas News

265Oil & Gas NewsIs the Market Sleepwalking Into a Global Oil Shortage?

Managed money speculators hit record bearish positions on WTI even as the IEA forecasts...

-

209Acquisitions

209AcquisitionsContinental and TotalEnergies Ink Major Anadarko Basin Agreement

TotalEnergies has signed an agreement with Continental Resources to acquire a 49% interest in...

-

200Oil & Gas News

200Oil & Gas NewsOil Posts Biggest Weekly Gain Since July

by Bloomberg [via RigZone.com] |Veena Ali-Khan, Mia Gindis| Oil notched its biggest weekly gain...

-

129Oil & Gas News

129Oil & Gas NewsDouble Eagle Founders Still Love Their Work

By Mella McEwen,| Midland Reporter Telegram | John Sellers and Cody Campbell, co-chief executive officers...

-

123International

123InternationalU.S. Energy Giant Exxon Mobil Fires 2,000 as Job Losses Rip Through Economy

By DANIEL JONES, US CONSUMER EDITOR | Daily Mail | and REUTERS | Exxon Mobil...