Featured Article

-

2.6KOil & Gas News

2.6KOil & Gas NewsDUC’s growing as Permian Basin pipeline scarcity worsens

Bloomberg – Pipeline bottlenecks in North America’s biggest oil field (Permian Basin) are so pervasive that drillers are quitting new wells at...

-

2.1KOil & Gas News

2.1KOil & Gas NewsBNSF Oil Spill In Iowa

DOON, Iowa (AP) — An estimated 230,000 gallons (870,619 liters) of crude oil spilled into floodwaters in the northwestern corner of Iowa...

-

2.4KRig Count

2.4KRig CountRig Count Update: June 22, 2018

Houston oilfield services company Baker Hughes reported Friday its weekly rig count report. Closing Oil Prices – Friday, June 22, 2018 WTI...

-

5.0KOil & Gas News

5.0KOil & Gas NewsSand – Holder of History, Shaper of Futures

Have you ever thought much about sand? Maybe you played in it as a kid. Or maybe left your...

-

2.4KOil & Gas News

2.4KOil & Gas NewsSandRidge Buyout Gathers Interest

(Reuters) – SandRidge Energy Inc. said on Friday it had been approached by 17 potential bidders for a buyout, including billionaire Carl...

-

2.3KOil & Gas News

2.3KOil & Gas NewsContinental Resources’ Hamm pulls out of OPEC meeting

Continental Resources says CEO and founder Harold Hamm has canceled a scheduled appearance at this week’s OPEC meeting in Vienna, leaving only...

-

3.8KOil & Gas News

3.8KOil & Gas NewsPioneer Natural Resources sells Raton Basin assets for $79 million

Pioneer Natural Resources Co. announced on June 13th, 2018 that it agreed to sell all of its Raton Basin assets in southeastern...

-

2.5KRig Count

2.5KRig CountRig Count Update: June 15, 2018

Houston oilfield services company Baker Hughes reported Friday its weekly rig count report. The overall US Rig count fell while U.S. energy...

-

2.6KOil & Gas News

2.6KOil & Gas NewsOil and Gas Law: 2Q18 Update

The second quarter of the year has seen abundant activity at the intersection of the energy industry and the law. These are...

-

2.5KOil & Gas News

2.5KOil & Gas NewsTexas court sides with Barnett Shale Mineral owners

FORT WORT – A Tarrant County judge has rejected efforts by Chesapeake Exploration and Total E&P USA to dismiss claims in multidistrict...

Snippets

- U.S. stocks end sharply higher Stocks jumped Monday on optimism that President Donald...Read More

Stocks jumped Monday on optimism that President Donald Trump may hold back from implementing some of his wide-ranging tariff plans and so the U.S. could skirt an economic slowdown from a protracted trade war.

The Dow Jones Industrial Average jumped 597.97 points, or 1.42%, to end at 42,583.32. The S&P 500 added 1.76% and closed at 5,767.57, while the tech-heavy Nasdaq Composite gained 2.27% to settle at 18,188.59.

Shares of Tesla which have fallen nine straight weeks, were up nearly 12%, adding to their Friday gains. Meta Platforms and Nvidia each climbed more than 3%.

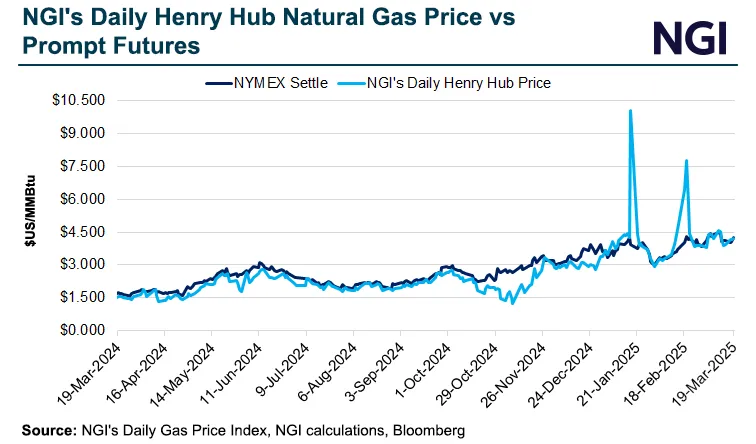

- As Stock Market Swoons Amid Tariff Fallout, Natural Gas Futures Prove Safe HavenDespite spring weather and rapidly fading heating demand, natural gas futures hold strong at winter price...Despite spring weather and rapidly fading heating demand, natural gas futures hold strong at winter price levels.Read More

To be sure, seasonally soft supply in storage and record levels of export demand are key drivers. However, traders said a stock market slump has proved to be another bullish factor for natural gas prices over the past month.

- Phillips 66's Lake Charles refinery may get $99M upgradePhillips 66 is pursuing a $99 million expansion of its 264,000-barrel-per-day...Phillips 66 is pursuing a $99 million expansion of its 264,000-barrel-per-day Lake Charles refinery in Louisiana, with proposed upgrades ranging from a steam turbine power generator to a naphtha fractionator. The project, under review for state tax incentives, could be finalized in late 2027.Read More

- Mesa Minerals IV Launches New Acquisition InitiativeMesa Minerals IV has officially...Read More

Mesa Minerals IV has officially launched to acquire mineral and royalty interests in the Haynesville Shale, Permian Basin, and other plays, as announced by CEO Darin Zanovich at Hart Energy's 2025 DUG Gas Conference & Expo in Shreveport.

NGP's latest royalty fund financially backs the new venture and follows the success of Mesa Minerals III, which built a substantial portfolio including approximately 6,000 net royalty acres in the Permian Basin and 16,000 net royalty acres in the Haynesville.

While Mesa III has been temporarily sidelined with plans for NGP to market its portfolio in the future, the company is expanding its focus beyond the Permian Basin due to high asking prices for oil-weighted assets there.

This continues the Mesa franchise's established presence in the Haynesville play, where both Mesa I and II previously built and successfully sold mineral positions to Franco-Nevada Corp.

- ☕️What Else is Brewing Monday MorningIt’s Opening Day (again, sort of): While last week’s...It’s Opening Day (again, sort of): While last week’s two-game series in Tokyo between the Dodgers and Cubs officially kicked off baseball’s regular season in front of a massive audience, MLB will host a more traditional Opening Day on Thursday, when 28 teams will play in 14 games scheduled throughout the afternoon and evening. They start at 3pm ET, for anyone who wants to plan an early exit from their office.Read More

Segway recalled 220,000 scooters after 20 people were injured.

Columbia University is “on the right track” to get federal funding back, according to Education Secretary Linda McMahon. Separately, the University of Maine said it was in compliance with Title IX and can continue to leverage “essential federal funds.”

Second Lady Usha Vance will visit Greenland this week as part of a US delegation. Greenland’s prime minister criticized the delegation’s visit as an “aggressive” move.

Pope Francis made his first public appearance since being discharged from the hospital.

Sydney Sweeney will star in a movie based on a Reddit post.

MOST POPULAR

-

491Oil & Gas News

491Oil & Gas NewsFermi America Reveals Ambitious Texas Energy Megaproject

Fermi America, a Texas-based company co-founded by former U.S. Energy Secretary and former Texas...

-

460Oil & Gas News

460Oil & Gas NewsViking Minerals Closes $40M Fund VI, Doubling Down on Strategic Growth Amid Industry Headwinds

Oklahoma City, OK – September 16, 2025 — In a market where many mineral...

-

446Oklahoma

446OklahomaOklahoma Drive In Pauses Operations During New Energy Project

The temporary closure of the Chief Drive In Theatre in Ninnekah has sparked local...

-

426Oil & Gas News

426Oil & Gas NewsShale Expected to Weather ‘Lower for Longer’ Oil Prices

By Mella McEwen,Oil Editor | MRT | Crude prices have spent much of the year...

-

350Oil & Gas News

350Oil & Gas NewsFaster Decline Rates Challenge Energy Security Worldwide

The International Energy Agency (IEA) has issued a stark warning that the world’s oil...

-

334International

334InternationalCanada Bets Big on LNG Export Capacity Growth

Canada’s ambitions to become a global energy powerhouse gained momentum just two months after...

-

275International

275InternationalTurkey Plans Energy Deals With USA

by Bloomberg, via RigZone.com | F.Kozok, S.Hacaoglu | Turkey plans to sign new energy deals with...

-

260Oil & Gas News

260Oil & Gas NewsTrump Calls Out Europe on Russian Energy Purchases

President Donald Trump used his address at the United Nations General Assembly this week...

-

259National

259NationalEIA: U.S. Natural Gas Use to Hit Record in 2025

Natural gas remains the leading source of electricity generation in the United States, but...

-

200Oil & Gas News

200Oil & Gas NewsIs the Market Sleepwalking Into a Global Oil Shortage?

Managed money speculators hit record bearish positions on WTI even as the IEA forecasts...

-

149Oil & Gas News

149Oil & Gas NewsInfrastructure Gaps Threaten Permian’s AI Energy Future

West Texas holds a treasure trove of natural gas that could become a critical...

-

75Oil & Gas News

75Oil & Gas NewsOil Posts Biggest Weekly Gain Since July

by Bloomberg [via RigZone.com] |Veena Ali-Khan, Mia Gindis| Oil notched its biggest weekly gain...