Featured Article

-

2.8KRig Count

2.8KRig CountRig Count – February 13, 2017

The Rig Count UP Trend Continues The total number of active oil and gas rigs in the United States is now 741,...

-

3.2KRig Count

3.2KRig CountRig Count – February 4, 2017

Baker Hughes data released Friday shows the U.S. oil rig counts jumped by 17 this week to 583, the highest level since...

-

7.5KInvesting

7.5KInvestingGeographic Information Systems (GIS) Basics

What makes “Smart” maps so smart? By now, I’m hoping many of you are taking advantage of some the great free resources...

-

2.8KScoop & Stack

2.8KScoop & StackCLR Announces 2017 CAPEX

2016 was a come-back year for Continental Resources (NYSE: CLR). The shale driller overcame some missteps, made early in the downturn, to get back...

-

2.9KRig Count

2.9KRig CountRig Count – January 28, 2017

Rig Count On Fire Over Last 90 Days The number of rigs drilling for oil in the United States totaled 566, up...

-

3.7KOil & Gas News

3.7KOil & Gas NewsOil & Gas M&A – Determining the Current Owner

Exxon Mobil Corporation (NYSE:XOM) recently announced it will more than double its Permian Basin resource to 6 billion barrels of oil equivalent through...

-

6.2KInvesting

6.2KInvestingTechnology and the Landman

It is without question that technological innovations have drastically altered the way that geologists and engineers perform their jobs. For the landman,...

-

3.0KRig Count

3.0KRig CountRig Count – January 15, 2017

Oil rigs down, Permian Remains Resilient. In 2016, the oil rig count staged a comeback not seen since the most recent oil...

-

5.2KInvesting

5.2KInvestingDue Diligence from a Mineral Buyer’s Perspective

This month’s article is a continuation of the Due Diligence topic we started in December. You may remember in my previous article...

-

8.9KNational

8.9KNationalThe Rise and Fall of Samson Resources

Oil and Gas Bankruptcy Update: Samson Resources Haynes and Boone has tracked 114 North American oil and gas producers that have filed...

Snippets

- Jet Fuel Took Record Share of ’24 US Refinery Output, EIA SaysA recovering airline industry pushed jet fuel to a record-high share...A recovering airline industry pushed jet fuel to a record-high share of production in U.S. refineries last year, according to a report released by the U.S. Energy Information Administration (EIA) on March 24.Read More

In 2024, U.S. refineries produced a record 659.837 MMbbl of jet fuel, which accounted for about 11% of total refinery yields. According to EIA records dating back to 2005, refineries last set a record for jet fuel production of 659.046 MMbbl in 2018.

“Increased air travel, measured by both TSA passenger volume and flight departures, has increased U.S. jet fuel consumption every year following the steep decline in 2020,” the EIA reported.

Motor gasoline, distillate fuel oil and jet fuel make up more than 85% of U.S. refinery output. Gasoline takes the largest share of the 85%, with distillate fuel oil in second. - ☕️What Else is Brewing Tuesday MorningTrump announces 25% tariff on countries that buy Venezuelan oil...Trump announces 25% tariff on countries that buy Venezuelan oil and gas. As of April 2, a day President Trump has dubbed “Liberation Day” for the economy, countries that buy oil from Venezuela will have to pay an additional 25% tariff on trade with the United States, the president said on Truth Social. Precisely what other tariffs might go into effect that day remains unclear. News outlets reported that the president would not impose blanket tariffs but would focus on more industry-specific ones, and even though reciprocal tariffs are still on the menu, there might be exemptions for some countries. But officials cautioned that the situation could still change. The president also said additional tariffs on cars and pharmaceuticals would be coming soon.Read More

A federal judge refused to lift his order barring the government from deporting anyone under the rarely used Alien Enemies Act, which the Trump administration invoked to deport alleged Venezuelan gang members. An appeals court also held a hearing on the issue during which one judge said “Nazis got better treatment” under the act than the people who were recently deported, since the former got hearings.

Chinese EV-maker BYD made more than $100 billion in sales last year for the first time.

Turkish authorities arrested more than 1,100 people, including journalists, amid protests over the decision to jail a political rival of President Recep Tayyip Erdoğan.

South Korea’s Hyundai plans to invest ~$21 billion in the US, including $5.8 billion towards a steel plant in Louisiana.

Mia Love, the first Black Republican woman elected to Congress, has died of cancer at age 49.

Warren Buffett will pay $1 million to an employee who won his company’s March Madness bracket challenge—which Buffett made easier this year in hopes of having a winner—by correctly calling 31 of the 32 games in the first round of the men’s tournament. - Oil prices finish higher after Trump's threat to buyers of crude from VenezuelaOil futures settled higher on Monday after President...Read More

Oil futures settled higher on Monday after President Donald Trump said in a Truth Social post that countries that purchase oil from Venezuela will face a 25% tariff on all of their imports to the U.S. starting April 2. He also imposed new tariffs on Venezuela, according to the Associated Press.

The decision to impose tariffs on buyers of crude from Venezuela is "based on the alleged arrival of tens of thousands of Venezuelan migrants with violent backgrounds, which has been presented as a threat to U.S. national security," said Antonio Di Giacomo, a financial markets analyst at XS.

He said the impact on the energy market was immediate. Prices climbed Monday, with the May contract for West Texas Intermediate crude up 83 cents, or 1.2%, to settle at $69.11 a barrel on the New York Mercantile Exchange. May Brent crude settled at $73 on ICE Futures Europe, up 84 cents, or 1.2%.

- U.S. stocks end sharply higher Stocks jumped Monday on optimism that President Donald...Read More

Stocks jumped Monday on optimism that President Donald Trump may hold back from implementing some of his wide-ranging tariff plans and so the U.S. could skirt an economic slowdown from a protracted trade war.

The Dow Jones Industrial Average jumped 597.97 points, or 1.42%, to end at 42,583.32. The S&P 500 added 1.76% and closed at 5,767.57, while the tech-heavy Nasdaq Composite gained 2.27% to settle at 18,188.59.

Shares of Tesla which have fallen nine straight weeks, were up nearly 12%, adding to their Friday gains. Meta Platforms and Nvidia each climbed more than 3%.

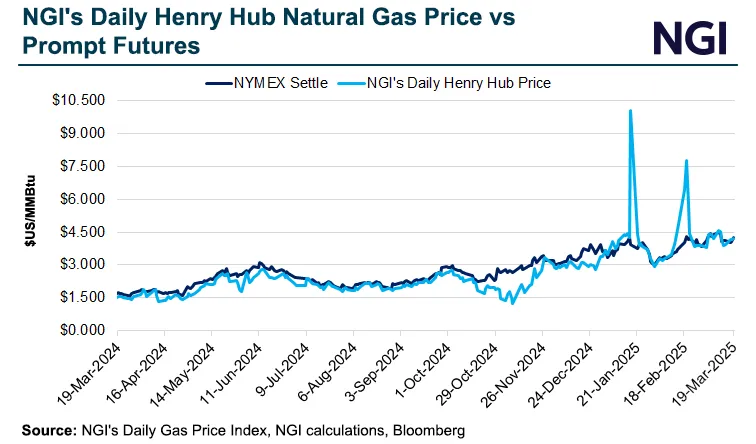

- As Stock Market Swoons Amid Tariff Fallout, Natural Gas Futures Prove Safe HavenDespite spring weather and rapidly fading heating demand, natural gas futures hold strong at winter price...Despite spring weather and rapidly fading heating demand, natural gas futures hold strong at winter price levels.Read More

To be sure, seasonally soft supply in storage and record levels of export demand are key drivers. However, traders said a stock market slump has proved to be another bullish factor for natural gas prices over the past month.

MOST POPULAR

-

407Oil & Gas News

407Oil & Gas NewsHarvest Expands into Uinta, Green River with MPLX Deal

Harvest Midstream, the Houston-based energy company owned by Hilcorp Energy founder Jeff Hildebrand, has...

-

398Exploration

398ExplorationU.S. Gulf Remains a Centerpiece of Growth for Oil Majors

By Andrew Kelly | Energy Intelligence | The US Gulf of Mexico holds a...

-

337Production

337ProductionTen Counties in the Permian Basin Account for 93% of U.S. Oil Production Growth Since 2020

Source: EIA | Between 2020 and 2024, total crude oil and lease condensate production...

-

336Exploration

336ExplorationTotalEnergies Secures New Offshore Exploration Permit in Congo

By Michael Kern for Oilprice.com | TotalEnergies, along with its partners QatarEnergy and the national...

-

234Oil & Gas News

234Oil & Gas NewsEnbridge Backs Northeast Supply and Gulf LNG Demand

Canadian midstream operator Enbridge has approved final investment decisions on two new gas transmission...

-

224Renewables

224RenewablesThe Battery Storage Market Is Set to Grow Ninefold by 2040

By Felicity Bradstock for Oilprice.com | Following the massive growth in global renewable energy...

-

220Midstream

220MidstreamTarga Advances Forza Pipeline Linking Delaware to Waha

Targa Resources Corp. has launched a non-binding open season for its proposed Forza Pipeline...

-

187Oil & Gas News

187Oil & Gas NewsN.M. Braces for Revenue Losses From Royalty Rate Cuts

Ian M. Stevenson | EENews.net | Falling royalty rates for oil and gas production...

-

148Acquisitions

148Acquisitions$550MM Canvas Acquisition Expands Diversified Energy’s Oklahoma Footprint

Diversified Energy Company Plc has announced a $550 million acquisition of Canvas Energy, a...

-

131National

131NationalU.S. Gas Power Capacity Set for Big Jump as Renewables Growth Slows

Reporting by Gavin Maguire | (Reuters) – U.S. power developers are planning to sharply...

-

130Downstream

130DownstreamCalifornia Puts Oil Price-Gouging Rule on Hold to Keep Pumps Supplied

Authored by Jill McLaughlin via The Epoch Times, | California regulators fearing a dramatic...

-

72Oil & Gas News

72Oil & Gas NewsU.S. Oil Producers Slash 2025 Spending as Prices Slide and Consolidation Mounts

The U.S. oil and gas industry is entering a period of retrenchment, marked by...