Featured Article

-

3.5KRig Count

3.5KRig CountRig Count – January 1, 2017

Out With The Old, In With The New – Rig Count Climbs Again A Look Back At 2016 Things were ominous for...

-

6.9KProduction

6.9KProductionNew Record Well For Continental Resources

Over-pressured Meramec wells in STACK are delivering some of the highest returns across the play. Continental Resources (NYSE: CLR) announced a new...

-

4.4KProduction

4.4KProductionOff-Unit Commencement of Operations

Most modern oil and gas leases provide that a lease will not terminate if the lessee “commences operations for the drilling of...

-

9.7KProduction

9.7KProductionBefore Accepting That Offer: Use A Map

Last month’s article was focused on the value of GIS (Geographic Information Systems) or “smart” maps to mineral owners. I focused on...

-

6.1KProduction

6.1KProductionAn Elephant in The Desert

INTRO Only time will tell whether OPEC will effectively implement its recent decision to curb oil supplies and reverse a price slump...

-

6.4KScoop & Stack

6.4KScoop & StackThe Farmout: What You Need To Know

In many areas now designated as the SCOOP and STACK, there are oil and gas leases that have been held-by-production for decades....

-

21.1KProduction

21.1KProductionA Look Back at One of The Biggest Oil and Gas Fields

THE BEGINNING Oklahoma and oil and gas have been synonymous since the late 1800’s. Oklahoma is in the heart of the Mid-Continent...

-

6.5KExploration

6.5KExplorationOklahoma Indian Mineral Curative

Since the Homestead Act of 1862 and the Dawes Act of 1887, property in Oklahoma owned by individual Native Americans and Tribes...

-

3.2KRig Count

3.2KRig CountRig Count – November 20, 2016

US Rig Count Surges +20 November 20, 2016 ~ Energy Update Global oil production is still too high relative to demand. Oil prices remain...

-

3.9KExploration

3.9KExplorationThe value of “Smart” Maps to Mineral Owners

In last month’s article, I discussed the geographic (spatial) nature of oil and gas data and the importance and prevalence of “Where?”...

Snippets

- Home prices in top U.S. cities at new all-time high: Case-ShillerThe numbers: Home prices in the 20 biggest U.S. metros...The numbers: Home prices in the 20 biggest U.S. metros inched up to a new record high, as home-buying demand continued to outpace the availability of properties for sale.Read More

The S&P CoreLogic Case-Shiller 20-city house price index rose 0.6% in February compared to the previous month. The 20-city and the national index are at an all-time high. The national index also rose at the fastest annual pace since November 2022.

Home prices in the 20 major U.S. metro markets were up 7.3% in the 12 months ending in February. San Diego posted the biggest year-over-year home-price gains in February. Prices were up 11.4%.

A broader measure of home prices, the national index, rose 0.4% in February and also was up 6.4% over the past year. All numbers are seasonally adjusted. - Truce Talks Inch AlongUS Secretary of State Antony...US Secretary of State Antony Blinken urged Hamas yesterday to accept Israel's latest proposal for a temporary cease-fire in exchange for the release of some hostages. The proposal reportedly involves a two-part plan, with Israel seeking the initial release of 33 of the roughly 130 hostages remaining in Hamas' captivity (down from an original demand of 40).Read More

Blinken's comments came on his visit to Saudi Arabia—the first stop on his latest Middle East trip over truce talks—as a Hamas delegation met with Egyptian mediators in Cairo. Hamas previously said it seeks a full end to the war with Israel and the removal of Israeli troops from Gaza in exchange for the release of all hostages. - Diamondback Stockholders All in for $26B Endeavor DealDiamondback Energy’s shareholders have spoken, approving the $26 billion...Diamondback Energy’s shareholders have spoken, approving the $26 billion merger with Endeavor Energy Resources LP that will add 344,000 net Midland Basin acres and about 2,300 core drilling locations.Read More

Pro forma, Diamondback’s oil production will grow to an average 468,000 bbl/d (816,000 boe/d) from 273,000 bbl/d (463,000 boe/d). Analysts at Stifel have said the combined company will have a market value of more than $50 billion.

Diamondback said its stockholders approved the issuance of shares of Diamondback common stock in connection with the Endeavor merger, according to an April 26 press release. - ☕️What Else is Brewing Tuesday MorningColumbia suspends student protesters against the war in Gaza. Protesters...Columbia suspends student protesters against the war in Gaza. Protesters defied an afternoon deadline set by Columbia yesterday to break up their encampment and agree to follow school rules through the end of the semester, so the school said it began suspending students involved. However, the school did not call in police to clear the area, as the university’s leaders appeared to be trying not to repeat the escalation that occurred after protesters were arrested previously. Protests also continued at several other schools inspired by Columbia, including Cornell, which also suspended some participants, and the University of Texas at Austin, where police arrested demonstrators.Read More

Three officers on a US Marshals Task Force were fatally shot and five other officers were wounded in North Carolina while trying to serve a warrant to a felon for possessing a firearm.

US regulators are investigating Ford’s hands-free BlueCruise system after fatal crashes.

Grocery delivery service Getir is exiting the US and EU markets (both literal and figurative), where it struggled to gain traction, and is focusing on Turkey.

Peacock will raise its prices by $2/month before the Olympics.

The Supreme Court refused to hear an appeal from Elon Musk, leaving in place a settlement with the SEC that requires him to get approval before blasting out tweets about Tesla.

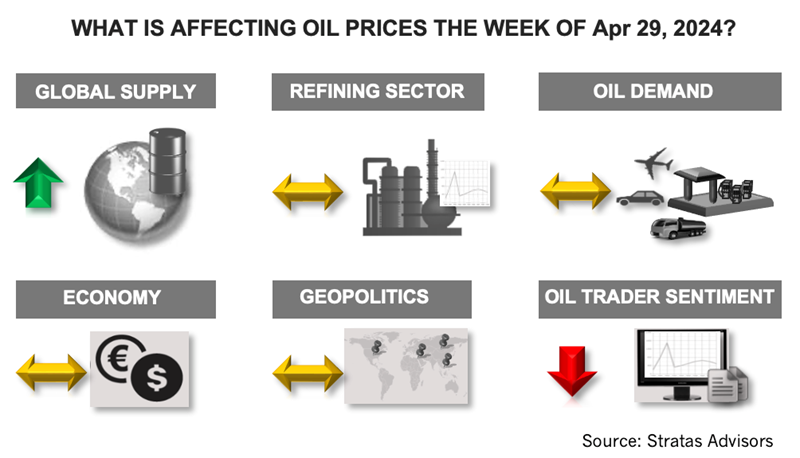

Taylor Swift just keeps breaking records: Her songs are now in the top 14 of Billboard’s Hot 100, and with The Tortured Poets Department debuting at the top of Billboard’s chart, Swift is now tied with Jay-Z for the second-most No. 1 albums, behind only the Beatles. - What's Affecting Oil Prices This Week? (April 29, 2024)The price of Brent crude ended last week at $88.06 after closing the...The price of Brent crude ended last week at $88.06 after closing the previous week at $87.39. The price of WTI ended the week at $83.68 after closing the previous week at $83.24. The price of DME Oman crude ended the week at $89.99 after closing the previous week at $88.02.Read More

As we expected, the aftermath of the limited attack on Iran by Israel has resulted in reducing geopolitical tensions with Iran not responding with a counterattack. Also, the economic news of last week did not provide any additional support for oil prices. READ MORE

MOST POPULAR

-

408Exploration

408ExplorationU.S. Gulf Remains a Centerpiece of Growth for Oil Majors

By Andrew Kelly | Energy Intelligence | The US Gulf of Mexico holds a...

-

343Exploration

343ExplorationTotalEnergies Secures New Offshore Exploration Permit in Congo

By Michael Kern for Oilprice.com | TotalEnergies, along with its partners QatarEnergy and the national...

-

343Production

343ProductionTen Counties in the Permian Basin Account for 93% of U.S. Oil Production Growth Since 2020

Source: EIA | Between 2020 and 2024, total crude oil and lease condensate production...

-

243Oil & Gas News

243Oil & Gas NewsEnbridge Backs Northeast Supply and Gulf LNG Demand

Canadian midstream operator Enbridge has approved final investment decisions on two new gas transmission...

-

235Renewables

235RenewablesThe Battery Storage Market Is Set to Grow Ninefold by 2040

By Felicity Bradstock for Oilprice.com | Following the massive growth in global renewable energy...

-

230Midstream

230MidstreamTarga Advances Forza Pipeline Linking Delaware to Waha

Targa Resources Corp. has launched a non-binding open season for its proposed Forza Pipeline...

-

224Oil & Gas News

224Oil & Gas NewsN.M. Braces for Revenue Losses From Royalty Rate Cuts

Ian M. Stevenson | EENews.net | Falling royalty rates for oil and gas production...

-

171Acquisitions

171Acquisitions$550MM Canvas Acquisition Expands Diversified Energy’s Oklahoma Footprint

Diversified Energy Company Plc has announced a $550 million acquisition of Canvas Energy, a...

-

140National

140NationalU.S. Gas Power Capacity Set for Big Jump as Renewables Growth Slows

Reporting by Gavin Maguire | (Reuters) – U.S. power developers are planning to sharply...

-

139Downstream

139DownstreamCalifornia Puts Oil Price-Gouging Rule on Hold to Keep Pumps Supplied

Authored by Jill McLaughlin via The Epoch Times, | California regulators fearing a dramatic...

-

82Oil & Gas News

82Oil & Gas NewsU.S. Oil Producers Slash 2025 Spending as Prices Slide and Consolidation Mounts

The U.S. oil and gas industry is entering a period of retrenchment, marked by...

-

56Energy

56EnergyNatural Gas and Batteries Anchor Data Center Growth

Data centers across the United States are increasingly grappling with one of the most...