Featured Article

-

972Oil & Gas News

972Oil & Gas NewsIran Allocates Half of Oil Revenue to Military Spending

Iran’s upcoming budget plan reveals a significant shift in its allocation of oil and gas export revenues, with more than half directed...

-

734Oil & Gas News

734Oil & Gas NewsUSA EIA Slashes WTI Oil Price Forecast

Story by Andreas Exarheas| RigZone.com | In its latest short term energy outlook (STEO), which was released earlier this month, the U.S. Energy...

-

709LNG

709LNGA ‘Tidal Wave’ of Natural Gas Supply — The Biggest Yet — Will Reshape Global Markets, Says RBC Capital

Story by Lee Ying Shan |CNBC.com| The biggest influx of liquified natural gas (LNG) supply is coming online and it will transform...

-

728Oil & Gas News

728Oil & Gas NewsIraq Seeks U.S. Investment to Reduce Flaring

Iraq’s Deputy Petroleum Minister, Hamid Younes al-Zobai, recently visited Washington in an effort to secure additional funding from the United States. The...

-

421International

421InternationalLabour Campaigner’s Oil Company Joins North Sea Exodus Amid Tax Raid

Matt Oliver | The Telegraph | A Labour campaigner’s oil and gas company will sell its North Sea assets after concluding Britain...

-

643Oil & Gas News

643Oil & Gas NewsSynthica Energy Breaks Ground on Renewable Natural Gas Facility

Cincinnati-based Synthica Energy has officially broken ground on a new Renewable Natural Gas (RNG) facility in Rome, Georgia, just outside Atlanta. Named...

-

853Oil & Gas News

853Oil & Gas NewsAtlas Energy’s $400M Dune Express Conveyor System Nears Operation

Story By By Mella McEwen, Oil Editor| Midland Telegram Reporter | Construction of the 42-mile electrified conveyor system carrying sand from Atlas Energy...

-

535Oil & Gas News

535Oil & Gas NewsU.S. Driller to Buy Competitor in $360 Million Transaction

Story By Robert Stewart | UpStreamOnline.com | New York-listed driller Nabors Industries will acquire competitor Parker Wellbore for nearly $360 million, the...

-

455Exploration

455ExplorationOil’s Recent Spike Kicked Off Rush of Hedging by Producers

By Devika Krishna Kumar and Alex Longley | (Bloomberg) — US oil producers pounced on a chance to lock in prices, known as...

-

1.1KOil & Gas News

1.1KOil & Gas NewsExxon Mobil Plans Bakken Divestment to Refocus Strategy

Exxon Mobil Corp, the leading oil producer in the U.S., is planning to sell part of its assets in North Dakota’s Bakken...

Snippets

- Iran Expects Confiscated Oil Cargo to Be Returned in FullIran expects an oil cargo confiscated by the U.S. off the coast of Greece to be returned in full,...Iran expects an oil cargo confiscated by the U.S. off the coast of Greece to be returned in full, Tehran's ambassador to Athens said on June 9, following a Greek court ruling quashing the original decision to confiscate it.Read More

The case arose when Greece in April impounded the Iranian-flagged Lana, formerly Pegas, with 19 Russian crew members on board, near the island of Evia due to EU sanctions.

The ship was released due to complications over its ownership. The U.S. in May confiscated part of the Iranian oil cargo onboard, transferring it to another ship, following the initial Greek court ruling.

The Greek court's decision to overturn that ruling has not yet been made public. - US Agrees $500 Million Loan Guarantee for Utah Hydrogen Storage ProjectThe U.S. Department of Energy said on June 8 it has finalized a $504.4 million loan guarantee to...The U.S. Department of Energy said on June 8 it has finalized a $504.4 million loan guarantee to help finance the world's largest storage facility for hydrogen, a gas that can be produced with renewable power and used to generate electricity.Read More

Hydrogen can be burned as a fuel in power plants to reduce dependence on fuels like natural gas that emit large amounts of greenhouse gases when burned.

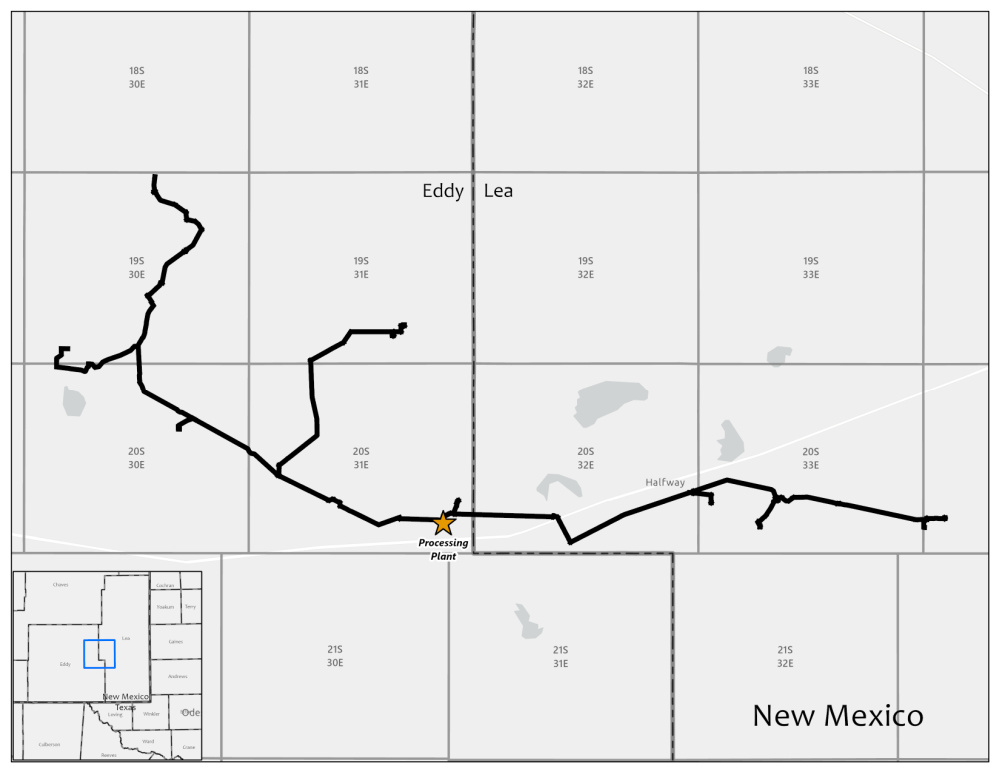

The Advanced Clean Energy Storage project in Delta, Utah, is set to store green hydrogen and then burn it as a fuel for the Intermountain Power Agency's Renewed Project, a hydrogen-capable gas turbine, the combined cycle power plant intends to be fueled by 100% clean hydrogen by 2045. - Matador Resources to Acquire Permian Midstream Assets from Summit for $75 MillionMatador Resources Co. agreed to acquire a gathering and processing system in New Mexico’s Eddy and...Matador Resources Co. agreed to acquire a gathering and processing system in New Mexico’s Eddy and Lea counties from Summit Midstream Partners LP for $75 million, adding to Matador’s midstream portfolio in the Permian Basin.Read More

- What else is brewing this Friday morning...Read More

- US auto safety regulators are expanding their investigation of Tesla’s Autopilot system after a series of new crashes involving first-responder vehicles.

- President Biden wants to turn one of the country’s largest underwater canyons, 100 miles off of the New York coastline, into a national marine sanctuary.

- A heat wave is going to bake the Southwest this weekend.

- Stitch Fix is laying off 15% of salaried positions to save money in these tumultuous times.

- The Grammys announced new awards, including “Songwriter of the Year” and “Best Score Soundtrack for Video Games and Other Interactive Media.”

- Mortgage demand is at its lowest point in 22 yearsOver the last week, mortgage applications fell 7%, and ...Over the last week, mortgage applications fell 7%, and they're down 21% since last June.Read More

A traditional 30-year fixed mortgage saw average interest rates rise to 5.4% last week, compared to rates in the low 3% range around this time last year.

The cost to buy a home has risen dramatically in 2022, which has resulted in a drop-off in demand.

Or, more simply: there's been "a meltdown."

MOST POPULAR

-

517Oil & Gas News

517Oil & Gas NewsN.M. Braces for Revenue Losses From Royalty Rate Cuts

Ian M. Stevenson | EENews.net | Falling royalty rates for oil and gas production...

-

480Acquisitions

480Acquisitions$550MM Canvas Acquisition Expands Diversified Energy’s Oklahoma Footprint

Diversified Energy Company Plc has announced a $550 million acquisition of Canvas Energy, a...

-

379Oil & Gas News

379Oil & Gas NewsU.S. Oil Producers Slash 2025 Spending as Prices Slide and Consolidation Mounts

The U.S. oil and gas industry is entering a period of retrenchment, marked by...

-

366Energy

366EnergyNatural Gas and Batteries Anchor Data Center Growth

Data centers across the United States are increasingly grappling with one of the most...

-

352Downstream

352DownstreamCalifornia Puts Oil Price-Gouging Rule on Hold to Keep Pumps Supplied

Authored by Jill McLaughlin via The Epoch Times, | California regulators fearing a dramatic...

-

325Oil & Gas News

325Oil & Gas NewsShale Expected to Weather ‘Lower for Longer’ Oil Prices

By Mella McEwen,Oil Editor | MRT | Crude prices have spent much of the year...

-

323Oil & Gas News

323Oil & Gas NewsViking Minerals Closes $40M Fund VI, Doubling Down on Strategic Growth Amid Industry Headwinds

Oklahoma City, OK – September 16, 2025 — In a market where many mineral...

-

305Natural Gas

305Natural GasPowering the US Data Center Boom With Wasted Natural Gas

[energyintel.com] A data center boom in the US is straining the grid and pushing...

-

293Oklahoma

293OklahomaOklahoma Drive In Pauses Operations During New Energy Project

The temporary closure of the Chief Drive In Theatre in Ninnekah has sparked local...

-

250Oil & Gas News

250Oil & Gas NewsFaster Decline Rates Challenge Energy Security Worldwide

The International Energy Agency (IEA) has issued a stark warning that the world’s oil...

-

226Oil & Gas News

226Oil & Gas NewsFermi America Reveals Ambitious Texas Energy Megaproject

Fermi America, a Texas-based company co-founded by former U.S. Energy Secretary and former Texas...

-

223International

223InternationalCanada Bets Big on LNG Export Capacity Growth

Canada’s ambitions to become a global energy powerhouse gained momentum just two months after...