Featured Article

-

659Midstream

659MidstreamDiamondback, Kinetik Commit to EPIC Crude Expansion Plan

Diamondback Energy, Kinetik Holdings, and EPIC Midstream have announced a series of transactions designed to strengthen the growth and financial stability of...

-

549Oil & Gas News

549Oil & Gas NewsCombination of Factors Impacting Natural Gas Market

Story By Andreas Exarheas|Rigzone.com| The natural gas market is impacted by a combination of national, global, fundamental, and weather-related factors. That’s what...

-

858Oil & Gas News

858Oil & Gas NewsQuantum CEO Warns U.S. Shale Boom Is Over

In a recent interview with Bloomberg, Wil Vanloh, CEO of Quantum Energy Partners, shared his candid views on the future of U.S....

-

868Oil & Gas News

868Oil & Gas NewsNew Pipeline Has Oil-Storage Tanks at Key US Hub Running Dry

By Lucia Kassai and Devika Krishna Kumar |Bloomberg)– Oil storage tanks at a key US crude hub in Cushing have drained to near...

-

832Oil & Gas News

832Oil & Gas NewsHistoric Milestone: Spain Integrates Hydrogen Into Gas Supply

A Spanish infrastructure company, Redexis, has reached a significant milestone for Spain’s energy industry. The Madrid-based company announced that it has started...

-

2.9KOil & Gas News

2.9KOil & Gas NewsArkansas Landowners Demand Higher Royalties for Lithium

Landowners in Arkansas are calling on the Arkansas Oil and Gas Commission to reject a joint application filed by five lithium companies...

-

528International

528InternationalWhy the rapid death of North Sea risks leaving taxpayers on the hook for billions

Story By Jonathan Leake | The Telegraph | Analysts have warned that Labour’s tax raid on the UK’s North Sea oil and...

-

616Oil & Gas News

616Oil & Gas NewsCourt Halts Wyoming Drilling Over Groundwater Concerns

A federal judge has hit the pause button on new oil and gas drilling permits in Converse County, Wyoming because of some...

-

2.1KOil & Gas News

2.1KOil & Gas NewsEIA Fuel Update Shows Decreasing Price Trend in Gasoline, Diesel

Story By Andreas Exarheas |Rigzone.com| The U.S. Energy Information Administration’s (EIA) latest gasoline and diesel fuel update, released earlier this week, showed...

-

747International

747InternationalDeepwater Oil Rigs May Fetch $600,000 a Day as Spending Expands

By David Wethe | (Bloomberg) — The price to rent a deepwater drilling rig may climb to near-record levels if demand from oil...

Snippets

- U.S. stocks end lower, but Nasdaq posts longest weekly win streak since FebruaryU.S. stocks closed lower on Friday as investors focused on debt-ceiling...U.S. stocks closed lower on Friday as investors focused on debt-ceiling talks in Washington D.C., which Republican Rep. Garret Graves of Louisiana, a deputy for House Speaker Kevin McCarthy, said were on pause. The Dow Jones Industrial Average DJIA ended about 109 points lower Friday near 33,426 but booked a 0.4% weekly gain. So did the other major U.S. indexes. The S&P 500 index SPX closed 0.2% lower while booking a 1.6% weekly gain. The Nasdaq Composite Index COMP shed 0.2% Friday but gained 3% for the week to advance for a fourth week in a row, its longest weekly stretch of wins since February 3, according to Dow Jones Market Data. Focus on Friday also was on regional banks after CNN reported that Treasury Secretary Janet Yellen said more mergers in the sector might be needed.Read More

- Energy Commentary for Friday MorningThe energy sector is off to a...Read More

The energy sector is off to a higher start, supported by strength in the underlying commodities and in the major equity futures. U.S. stock index futures edged higher on optimism that a deal to avoid a catastrophic U.S. debt default could be reached over the weekend.

WTI and Brent crude oil futures are trading higher as investors turned cautiously optimistic over the fading risk of a U.S. debt default. Sentiment has remained mixed as investors weigh optimism over the avoidance of a U.S. debt default against inflation data that could portend more interest rate hikes from global central banks. However, Middle East crude prices in Asia fell to their lowest level in months, despite OPEC+ production cuts, as Asian refiners held back spot purchases and China and India binged on cheap Russian oil.

Natural gas futures are extending gains for the second-straight session on a smaller-than-expected U.S. storage build and as wildfires kept gas exports from Canada near a 25-month low.

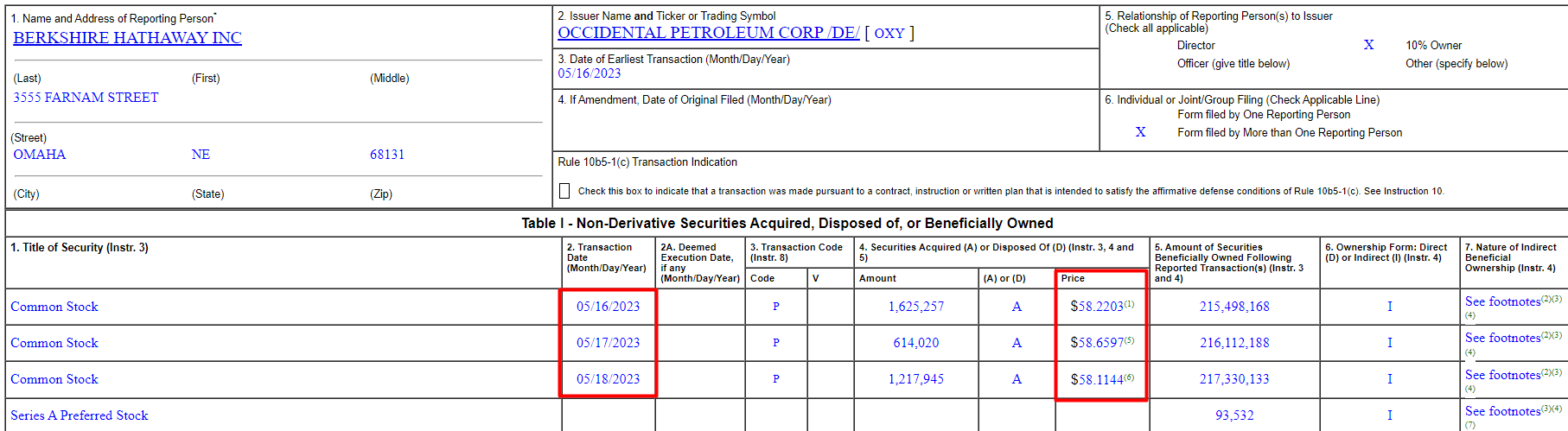

- Occidental Petroleum: Warren Buffett Buys AgainJust a few hours ago, ...Just a few hours ago, it was revealed that Warren Buffett purchased an additional $200 million [or ~ 3.46 million shares] in OXY stock from May 16-18, 2023, according to the recent SEC filing.Read More

In total, Berkshire now owns more than 217.3 million shares of Occidental Petroleum, valued at approximately $12.7 billion. Additionally, Berkshire holds around $9.5 billion worth of Occidental preferred stock, which carries an 8% annual dividend, and has warrants to purchase $5 billion worth of Occidental common shares for $59.62 per share.

- ChatGPT gets its own appOpenAI released an ...OpenAI released an app of its chatbot for the iPhone in the US and said a version for green texters is on the way. The ChatGPT app functions similarly to the existing browser design (free, no ads), but OpenAI hopes that by making ChatGPT easily accessible on your phone, you’ll use it more—and Google Search less. In other AI news, Meta, for the first time, revealed the extensive infrastructure it’s been building to support its artificial intelligence ambitions, including a “family” of chips.Read More

- Friday Sports ClipsKentucky Derby winner Mage...Kentucky Derby winner Mage will look to win the second leg of Triple Crown at tomorrow's 148th Preakness Stakes (More) | Rafael Nadal to miss French Open with injury, expects 2024 to be his final season (More)Read More

MOST POPULAR

-

437Oil & Gas News

437Oil & Gas NewsN.M. Braces for Revenue Losses From Royalty Rate Cuts

Ian M. Stevenson | EENews.net | Falling royalty rates for oil and gas production...

-

403Acquisitions

403Acquisitions$550MM Canvas Acquisition Expands Diversified Energy’s Oklahoma Footprint

Diversified Energy Company Plc has announced a $550 million acquisition of Canvas Energy, a...

-

381National

381NationalU.S. Gas Power Capacity Set for Big Jump as Renewables Growth Slows

Reporting by Gavin Maguire | (Reuters) – U.S. power developers are planning to sharply...

-

293Downstream

293DownstreamCalifornia Puts Oil Price-Gouging Rule on Hold to Keep Pumps Supplied

Authored by Jill McLaughlin via The Epoch Times, | California regulators fearing a dramatic...

-

291Oil & Gas News

291Oil & Gas NewsU.S. Oil Producers Slash 2025 Spending as Prices Slide and Consolidation Mounts

The U.S. oil and gas industry is entering a period of retrenchment, marked by...

-

286Energy

286EnergyNatural Gas and Batteries Anchor Data Center Growth

Data centers across the United States are increasingly grappling with one of the most...

-

242Natural Gas

242Natural GasPowering the US Data Center Boom With Wasted Natural Gas

[energyintel.com] A data center boom in the US is straining the grid and pushing...

-

227Oil & Gas News

227Oil & Gas NewsShale Expected to Weather ‘Lower for Longer’ Oil Prices

By Mella McEwen,Oil Editor | MRT | Crude prices have spent much of the year...

-

205Oil & Gas News

205Oil & Gas NewsViking Minerals Closes $40M Fund VI, Doubling Down on Strategic Growth Amid Industry Headwinds

Oklahoma City, OK – September 16, 2025 — In a market where many mineral...

-

160Oil & Gas News

160Oil & Gas NewsFaster Decline Rates Challenge Energy Security Worldwide

The International Energy Agency (IEA) has issued a stark warning that the world’s oil...

-

144International

144InternationalCanada Bets Big on LNG Export Capacity Growth

Canada’s ambitions to become a global energy powerhouse gained momentum just two months after...

-

65Oklahoma

65OklahomaOklahoma Drive In Pauses Operations During New Energy Project

The temporary closure of the Chief Drive In Theatre in Ninnekah has sparked local...