Featured Article

-

964Oil & Gas News

964Oil & Gas NewsOil Billionaire Is Said to Eye $3 Billion Franklin Mountain Sale

Story By David Carnevali and Kevin Crowley – (Bloomberg) — Refining billionaire Paul Foster is seeking to sell Franklin Mountain Energy, one of...

-

559Finance

559FinanceDevon Surpasses Expectations with Record Q2 Earnings

Riding the momentum of last month’s $5 billion North Dakota asset acquisition, Oklahoma City-based Devon Energy announced record oil production and net...

-

48.9KOil & Gas News

48.9KOil & Gas NewsHellfighters – The Red Adair Story

It has been 20 years since Red Adair died on August 7, 2004, at the age of 89. His company was credited...

-

629Oil & Gas News

629Oil & Gas NewsPennsylvania Fracking Issue Central in Harris-Trump Clash

Facing the need to secure battleground Pennsylvania, Vice President Kamala Harris is distancing herself from any previous statements opposing fracking. However, Republican...

-

562International

562InternationalIran Expected to Retaliate Against Israel by Tomorrow

Story by Andreas Exarheas| RigZone.com | In its latest Maritime Security Threat Advisory (MSTA), which was released on August 5, Dryad Global warned...

-

611Oil & Gas News

611Oil & Gas NewsOil Prices Threatened by Potential Recession

The recent sharp declines in major stock indexes have raised concerns of a recession among investors and analysts alike. The Dow Jones...

-

537Oil & Gas News

537Oil & Gas NewsEfficiencies Help US E&Ps Navigate Dismal Gas Market

Story By Caroline Evans, Houston, and Everett Wheeler |Energy Intelligence Group| Independent US gas producers pinched by continually low commodity prices are looking...

-

862Oil & Gas News

862Oil & Gas NewsChevron Relocates Headquarters from California to Texas

Chevron Corporation has announced its decision to relocate its headquarters from San Ramon, California, to Houston, Texas, marking the end of an...

-

579Opinion

579OpinionKamala Harris’s silent fracking flip-flop

As Joe Biden’s vice president, she strongly supported every anti-energy order from the White House, 👀 and saying “There’s no question I’m in favor...

-

859Oil & Gas News

859Oil & Gas NewsShale Costs Forecast to Fall 10% This Year, Wood Mackenzie Says

By David White (Bloomberg) — The cost to drill and frack new wells in US shale basins is expected to drop about...

Snippets

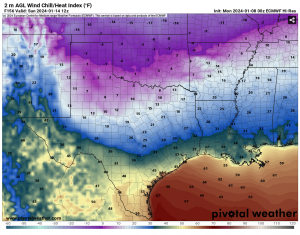

- 🌨️Cold Weather Forecast for OklahomaA real taste of winter is hitting most of the state this week, sending oil and gas crews to wear extra...A real taste of winter is hitting most of the state this week, sending oil and gas crews to wear extra clothing to fight the extreme wind chills. Oklahoma Climatologist Gary McManus says we’ll see wind chills down “into the single digits and teens” Tuesday morning.Read More

“Then, around Friday, we’re going to get a blast of true Arctic air, and then we could see a February 2021-lite version of winter where we stay below freezing for several days. A bit far out to say for sure, but get ready for winter-for-real.”

He said another storm system will likely hit the state on Friday and early next week with a strong chance of snow for many areas of Oklahoma—“just depends on the storm track of those systems. [Source: OK Energy Today} - DOE earmarks $70M to secure energy infrastructureThe Department of Energy is allocating up to $70 million to guard the nation's infrastructure from cyberattacks...The Department of Energy is allocating up to $70 million to guard the nation's infrastructure from cyberattacks and other cyber threats. The DOE is accepting applications for funding for its All-Hazards Energy Resilience project that will center on zero-trust architectures for electrical, gas, or oil settings.Read More

- Closing Oil & Gas PriceBenchmark U.S. crude oil for February delivery...Benchmark U.S. crude oil for February delivery rose $1.47 to $72.24 per barrel Tuesday. Brent crude for March delivery rose $1.47 to $77.59 per barrel.Read More

Wholesale gasoline for February delivery rose 5 cents to $2.08 a gallon. February heating oil rose 7 cents to $2.65 a gallon. February natural gas rose 21 cents to $3.19 per 1,000 cubic feet.

- Energy Sector CommentaryThe energy sector is off to a...Read More

The energy sector is off to a higher start, rebounding from yesterday's steep slide on the backs of strength in the underlying commodities. Major equity futures meanwhile steadied this morning as rates ticked higher and investors await a pair of key inflation readings later this week to gain clarity into the path forward for rate cuts from the Fed. The benchmark 10-year Treasury note yield rose more than 4 basis points this morning and is now trading above 4%.

WTI and Brent crude oil futures are up by over 2.5% in early trading, recovering from yesterday’s 4% drop on rising concerns that tensions in the Middle East will spread and ongoing supply outages in Libya. Weak economic data out of Germany, lingering demand worries, and speculation of rising OPEC supply after Saudi Arabia cut its OSP yesterday, are keeping a cap on gains. The Israeli military has said its fight against Hamas will continue through 2024, worrying markets that the conflict could grow into a regional crisis that could disrupt Middle Eastern oil supplies. German industrial production unexpectedly fell in November according to the Federal Statistics Office, marking a sixth consecutive monthly decline.

Natural gas futures resumed their trend higher, backed by cooler weather forecast in key consuming regions that should stir demand ahead of another winter storm.

- Canada, Mexico projects seen squeezing US Gulf heavy crude supplyThe upcoming startup of the 590,000-barrel-per-day Trans Mountain Expansion oil pipeline in Canada and...The upcoming startup of the 590,000-barrel-per-day Trans Mountain Expansion oil pipeline in Canada and the 340,000-bpd Olmeca refinery in Mexico is expected to reduce the availability of heavy sour crude oil barrels on the US Gulf Coast. Crude imports from Venezuela could help fill a potential gap, but uncertainty surrounding US sanctions clouds that prospect.Read More

MOST POPULAR

-

741Oil & Gas News

741Oil & Gas NewsFermi America Reveals Ambitious Texas Energy Megaproject

Fermi America, a Texas-based company co-founded by former U.S. Energy Secretary and former Texas...

-

568Oklahoma

568OklahomaOklahoma Drive In Pauses Operations During New Energy Project

The temporary closure of the Chief Drive In Theatre in Ninnekah has sparked local...

-

450National

450NationalEIA: U.S. Natural Gas Use to Hit Record in 2025

Natural gas remains the leading source of electricity generation in the United States, but...

-

438International

438InternationalTurkey Plans Energy Deals With USA

by Bloomberg, via RigZone.com | F.Kozok, S.Hacaoglu | Turkey plans to sign new energy deals with...

-

413Oil & Gas News

413Oil & Gas NewsTrump Calls Out Europe on Russian Energy Purchases

President Donald Trump used his address at the United Nations General Assembly this week...

-

405Mineral Owners

405Mineral OwnersTiny Decimals, Big Consequences: Mineral Rights Fragmentation in the U.S.

Mineral rights fragmentation is not a temporary crisis but an inherent, perpetual friction in...

-

338Oil & Gas News

338Oil & Gas NewsInfrastructure Gaps Threaten Permian’s AI Energy Future

West Texas holds a treasure trove of natural gas that could become a critical...

-

267Oil & Gas News

267Oil & Gas NewsIs the Market Sleepwalking Into a Global Oil Shortage?

Managed money speculators hit record bearish positions on WTI even as the IEA forecasts...

-

214Acquisitions

214AcquisitionsContinental and TotalEnergies Ink Major Anadarko Basin Agreement

TotalEnergies has signed an agreement with Continental Resources to acquire a 49% interest in...

-

205Oil & Gas News

205Oil & Gas NewsOil Posts Biggest Weekly Gain Since July

by Bloomberg [via RigZone.com] |Veena Ali-Khan, Mia Gindis| Oil notched its biggest weekly gain...

-

132Oil & Gas News

132Oil & Gas NewsDouble Eagle Founders Still Love Their Work

By Mella McEwen,| Midland Reporter Telegram | John Sellers and Cody Campbell, co-chief executive officers...

-

126International

126InternationalU.S. Energy Giant Exxon Mobil Fires 2,000 as Job Losses Rip Through Economy

By DANIEL JONES, US CONSUMER EDITOR | Daily Mail | and REUTERS | Exxon Mobil...