Featured Article

-

820Oil & Gas News

820Oil & Gas NewsPermian Gas Production Set to Rise as Oil Production Declines

By: Carlabad Current-Argus – Two new natural gas processing facilities recently began service in the Permian Basin as companies seek to match...

-

1.2KOil & Gas News

1.2KOil & Gas NewsWest Texas gas operators released tons of excess emissions during June heat wave

As a record-breaking heat wave bore down in June, extreme temperatures triggered a series of failures in West Texas’ gas supply infrastructure...

-

1.2KOil & Gas News

1.2KOil & Gas NewsThe Shale Industry Accelerates Rig Reductions, Signals Shift in Focus

In a recent article by The Wall Street Journal titled “The Shale Industry Is Dropping Drilling Rigs Fast,” the authors Mari Novik...

-

818Oil & Gas News

818Oil & Gas NewsIndia’s reliance on Russian oil may be ‘approaching a limit’

By: CNBC – India’s ability to import more Russian oil may have hit a limit, analysts tell CNBC, citing infrastructural and political...

-

929About

929AboutDeath Valley: A Mesmerizing Attraction in the Midst of a U.S. Heat Wave

In the scorching midst of a nationwide heatwave, Death Valley National Park emerges as a fascinating and alluring destination. MarketWatch highlights the...

-

1.5KOil & Gas News

1.5KOil & Gas NewsEOG Resources’ New Frac Design: A Game-Changer?

EOG Resources is a leading independent oil and gas producer in the United States. The company has been quietly developing a new...

-

892Oil & Gas News

892Oil & Gas NewsChina-US climate progress could hinge on new methane deal

By: Reuters – This week’s visit by U.S. climate envoy John Kerry to China after years of diplomatic disruptions could boost cooperation between the...

-

847Oil & Gas News

847Oil & Gas NewsRussia’s Strategic Move: Significant Reduction in Oil Exports Anticipated in August

Russia, a key player in the oil industry, has recently announced plans to reduce its oil exports from western ports by approximately...

-

1.1KAcquisitions

1.1KAcquisitionsHouston Natural Resources Corp. Acquires Appalachian EP, Set to Rebrand – A Summary

Houston Natural Resources Corp. (HNRC) plans to rebrand after acquiring full ownership of Appalachian Basin E&P Cunningham Energy. Houston Natural Resources acquired...

-

803Oil & Gas News

803Oil & Gas NewsBrent Oil Hovers Above $80 as U.S. Inflation Eases

By: Reuters – Global oil benchmark Brent hovered above $80 a barrel on Thursday after U.S. inflation data implied interest rates in...

Snippets

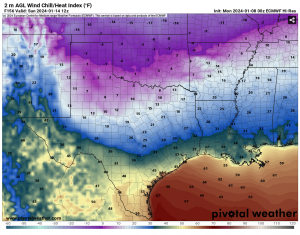

- 🌨️Cold Weather Forecast for OklahomaA real taste of winter is hitting most of the state this week, sending oil and gas crews to wear extra...A real taste of winter is hitting most of the state this week, sending oil and gas crews to wear extra clothing to fight the extreme wind chills. Oklahoma Climatologist Gary McManus says we’ll see wind chills down “into the single digits and teens” Tuesday morning.Read More

“Then, around Friday, we’re going to get a blast of true Arctic air, and then we could see a February 2021-lite version of winter where we stay below freezing for several days. A bit far out to say for sure, but get ready for winter-for-real.”

He said another storm system will likely hit the state on Friday and early next week with a strong chance of snow for many areas of Oklahoma—“just depends on the storm track of those systems. [Source: OK Energy Today} - DOE earmarks $70M to secure energy infrastructureThe Department of Energy is allocating up to $70 million to guard the nation's infrastructure from cyberattacks...The Department of Energy is allocating up to $70 million to guard the nation's infrastructure from cyberattacks and other cyber threats. The DOE is accepting applications for funding for its All-Hazards Energy Resilience project that will center on zero-trust architectures for electrical, gas, or oil settings.Read More

- Closing Oil & Gas PriceBenchmark U.S. crude oil for February delivery...Benchmark U.S. crude oil for February delivery rose $1.47 to $72.24 per barrel Tuesday. Brent crude for March delivery rose $1.47 to $77.59 per barrel.Read More

Wholesale gasoline for February delivery rose 5 cents to $2.08 a gallon. February heating oil rose 7 cents to $2.65 a gallon. February natural gas rose 21 cents to $3.19 per 1,000 cubic feet.

- Energy Sector CommentaryThe energy sector is off to a...Read More

The energy sector is off to a higher start, rebounding from yesterday's steep slide on the backs of strength in the underlying commodities. Major equity futures meanwhile steadied this morning as rates ticked higher and investors await a pair of key inflation readings later this week to gain clarity into the path forward for rate cuts from the Fed. The benchmark 10-year Treasury note yield rose more than 4 basis points this morning and is now trading above 4%.

WTI and Brent crude oil futures are up by over 2.5% in early trading, recovering from yesterday’s 4% drop on rising concerns that tensions in the Middle East will spread and ongoing supply outages in Libya. Weak economic data out of Germany, lingering demand worries, and speculation of rising OPEC supply after Saudi Arabia cut its OSP yesterday, are keeping a cap on gains. The Israeli military has said its fight against Hamas will continue through 2024, worrying markets that the conflict could grow into a regional crisis that could disrupt Middle Eastern oil supplies. German industrial production unexpectedly fell in November according to the Federal Statistics Office, marking a sixth consecutive monthly decline.

Natural gas futures resumed their trend higher, backed by cooler weather forecast in key consuming regions that should stir demand ahead of another winter storm.

- Canada, Mexico projects seen squeezing US Gulf heavy crude supplyThe upcoming startup of the 590,000-barrel-per-day Trans Mountain Expansion oil pipeline in Canada and...The upcoming startup of the 590,000-barrel-per-day Trans Mountain Expansion oil pipeline in Canada and the 340,000-bpd Olmeca refinery in Mexico is expected to reduce the availability of heavy sour crude oil barrels on the US Gulf Coast. Crude imports from Venezuela could help fill a potential gap, but uncertainty surrounding US sanctions clouds that prospect.Read More

MOST POPULAR

-

438International

438InternationalOPEC+ 8 Decide to Implement Output Adjustment

Story By Andreas Exarheas | RigZone.com | A statement posted on OPEC’s website on...

-

399Oil & Gas News

399Oil & Gas NewsTexas Refinery Hub Faces Historic Water Crisis

One of the busiest refining and petrochemical clusters on the Gulf Coast is now...

-

375Energy

375EnergyData Centers Ignite Next Texas Energy Expansion

The once unstoppable Texas shale boom is showing clear signs of fatigue, but a...

-

312Oil & Gas News

312Oil & Gas NewsBP’s AI Breakthrough Redefines Global Oil Exploration

BP is redefining how artificial intelligence is used in energy exploration, marking a turning...

-

295Oil & Gas News

295Oil & Gas NewsShale Giants Slash Thousands of Jobs as Lower Prices Bite

By Tsvetana Paraskova for Oilprice.com | U.S. oil and gas producers seek efficiencies and...

-

254Oil & Gas News

254Oil & Gas NewsCoterra Energy at a Crossroads: Activist Investor Kimmeridge Calls for Strategic Overhaul

[Oklahoma City, November 5, 2025] — In an oil and gas landscape increasingly shaped...

-

211International

211InternationalU.S. Sanctions Force Lukoil to Divest Global Holdings

By Tsvetana Paraskova for Oilprice.com | Lukoil has agreed to sell its international business to...

-

68Investing

68InvestingEnergy Transition Shapes HSBC’s New Financing Plan

HSBC is reshaping its approach to energy financing as the global transition toward cleaner...

-

59Oil & Gas News

59Oil & Gas NewsEnergy Jobs Anchor Permian Basin Employment Stability

Job cuts are sweeping across the United States at a rate not seen in...

-

45Oil & Gas News

45Oil & Gas NewsU.S. Shale Firms Still in Growth Mode Despite Lower Prices

“At current price levels, US producers are still incentivized to grow,” Walt Chancellor, a...