From Hart Energy: PDC Energy Inc. recently announced the completion of its $1.3 billion cash-and-stock acquisition of privately held Great Western Petroleum LLC in the Denver-Julesburg (D-J) Basin.

“We are excited to close the Great Western acquisition, which is accretive to our operating, ESG and financial metrics. We look forward to providing the market with updated guidance by early next month as we work to integrate Great Western’s operations,” Bart Brookman, president and CEO of PDC, commented in a May 6 company release.

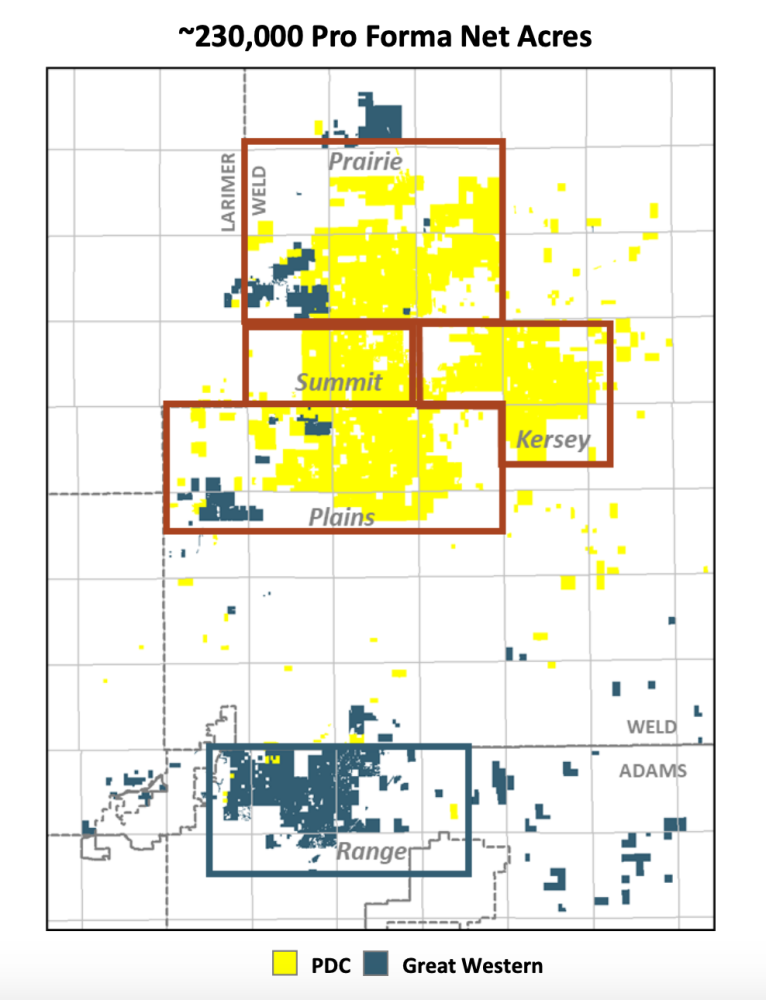

The acquisition of Great Western boosts PDC Energy’s D-J Basin position to roughly 230,000 net acres. PDC also holds some 25,000 net acres in the Delaware Basin in the Permian. Great Western’s D-J Basin acreage stretches across Adams, Larimer and Weld counties in Colorado.

Analysts with Tudor, Pickering, Holt & Co. (TPH) said the Great Western acquisition adds much-needed inventory in the Wattenberg Field to PDC Energy’s D-J Basin portfolio, according to a note by the firm when the deal was first announced in February.

“On the equity, a deal was not all that surprising to us given concerns on the inventory side (and good to see the company not transact in expensive M&A) and will help remove some of the M&A overhang on the stock, but basin and county exposure (outside of Weld) is a bit surprising,” the TPH analysts wrote in a research note on Feb. 28.

Consideration paid for the Great Western acquisition, valued at roughly $1.3 billion when it was announced, comprised of $543 million (less $50 million previously placed into escrow) and approximately 4 million shares of PDC common stock. PDC Energy planned to finance the acquisition with cash on hand and borrowings under the company’s credit facility.

In addition, PDC said on May 6 that it paid off the Great Western secured credit facility totaling $235 million and $312 million in principal amount of Great Western’s 12% senior secured notes due 2025.

“I want to thank the Great Western team for their strong focus and commitment to responsible Colorado development,” Brookman added in the May 6 release. “PDC shares this commitment, and we will continue to lead the way in community-focused, environmentally-sound, and efficient operations as we move forward.”

Previously, PDC Energy said it planned to run three rigs and 1.5 crews in the second half of 2022 on the combined D-J asset with pro-forma CAPEX of about $900 million and $1 billion. Pro-forma production for the second half of the year is expected to be roughly 250,000 to 260,000 boe/d and 82,000 to 87,000 bbl/d of oil.

Related Story: PDC Energy planning multi-well drilling program in Colorado

PJT Partners is the exclusive financial adviser to PDC, and Davis, Graham and Stubbs LLP is PDC’s legal counsel. Citi is the exclusive financial adviser to Great Western, and Latham & Watkins LLP is Great Western’s legal counsel.

LEASING OR SELLING OIL & GAS MINERAL RIGHTS?

If you or your family members are considering leasing to an oil company or selling your mineral rights in Oklahoma or Texas, go visit redriverhub.com, the premier oil, and gas mineral rights platform where mineral owners can lease or sell their mineral rights. Red River Hub is a site built by mineral owners for mineral owners.