By Chris Matthews, Hart Energy: Following a record year of dealmaking for oil and gas minerals and royalties in 2022, experts say public consolidators are still searching for scale and more M&A.

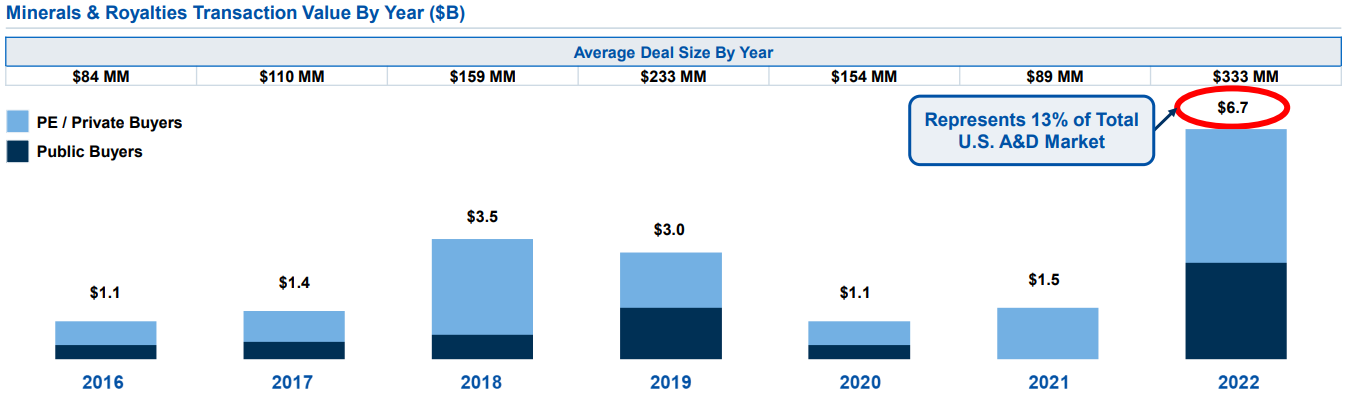

U.S. mineral and royalty transactions reached a record $6.8 billion in 2022, according to data from RBC Richardson Barr. That is nearly double the previous record of $3.5 billion in 2018.

2022 was a record year for U.S. oil and gas mineral and royalty transactions. (Source: RBC Capital Markets; RBC Richardson Barr)

The spike in deal activity followed two relatively paltry years for mineral and royalty A&D in 2020 and 2021, RBC Richardson Barr Managing Director Rusty Shepherd said at the World Oilman’s Mineral & Royalty Conference in early April.

“If you want to get exposure to a commodity without taking the cyclical performance risk, you’re going to focus on the high-margin opportunities that minerals and royalties provide,” Shepherd said.

Publics, Permian steal spotlight

A large volume of the mineral and royalty deals completed last year involved private operators, private equity-backed companies or hybrid, debt-and-equity investment vehicles.

When it comes to the ability to bring cash to the table, these hybrids became “game changers” in the mineral and royalty sector last year, Shepherd said.

But many of the largest deals in 2022 still involved publicly traded companies. One of the biggest deals was Sitio Royalties’ $4.8 billion merger with Brigham Minerals, which expanded Sitio’s footprint in the Permian Basin and other plays in the Lower 48.

And, after a year of massive growth, Sitio is not done growing. The company continues to evaluate opportunities to add scale through M&A this year, CEO Chris Conoscenti during the conference.

RELATED: Sell Your Mineral Rights

APA Corp., the parent company of Apache Corp., sold a mineral package in the Permian’s Delaware Basin to an undisclosed buyer for $805 million last spring.

Kimbell Royalty Partners acquired 889 net royalty acres in the Delaware and Midland basins in a deal valued at approximately $270.7 million late last year. Earlier this month, Kimbell announced plans to acquire about 806 net royalty acres in the Northern Midland Basin for $143.1 million.

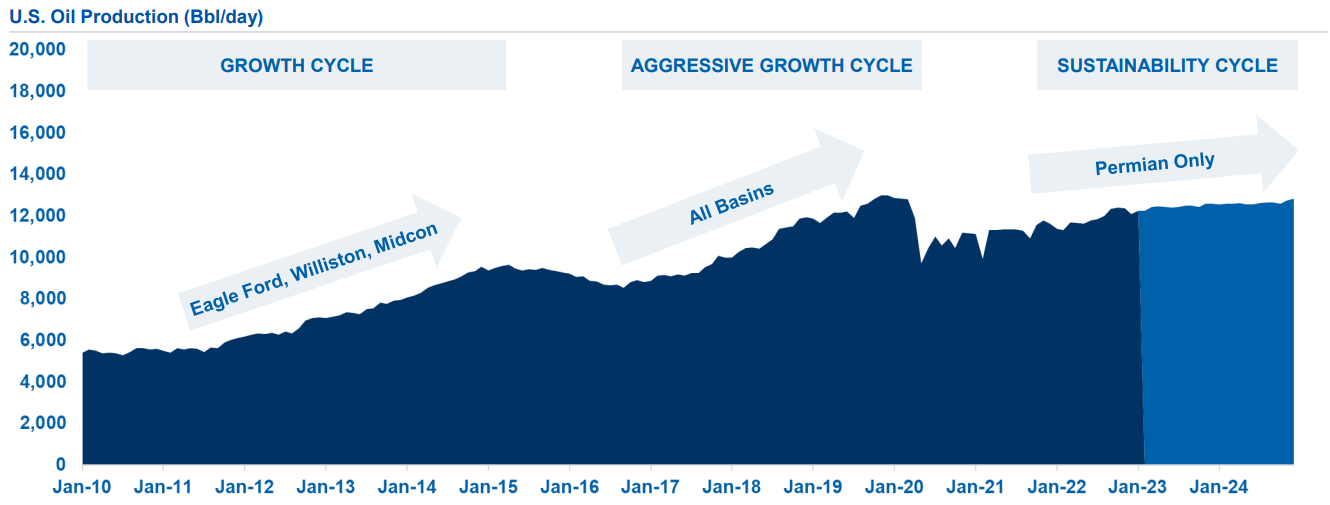

As companies search to scoop up oil-rich inventory, the Permian – the Lower 48’s top oil-producing basin – has proven a competitive market for deals.

From 2010 through about 2015, there was runway in oil basins like the Eagle Ford, the Willison and the Mid-Continent, Shepherd said. But the Permian has emerged as the only growth-oriented oil basin in the Lower 48 today, he said.

While the company will consider deals in other basins, Sitio’s primary target area for acquisitions this year is still the Permian, Conoscenti said.

Even in the Permian, operators are finding it more difficult to locate and acquire top-tier, core inventory.

“It’s hard to find scaled assets today that fit an aggressive growth profile,” Shepherd said.

The Permian Basin has emerged as the Lower 48’s only real growth basin for oil production, said RBC Richardson Barr Managing Director Rusty Shepherd. (Source: RBC Capital Markets; RBC Richardson Barr)

RELATED: Oklahoma Mineral Rights

Despite a more competitive environment for core positions, the trend of public consolidation in the mineral and royalty space is expected to continue in 2023 and beyond.

Public mineral and royalty players are coveting greater investment from generalist institutional investors, but those investors are typically looking for companies with market capitalizations of $5 billion and above, Shepherd said.

Today, the average market cap for U.S. public mineral consolidators is around $3 billion. Sitio is close to $4 billion.

“We think that public companies will continue to be inquisitive to try to fulfill their goals of getting to that $5 billion market cap,” Shepherd said.