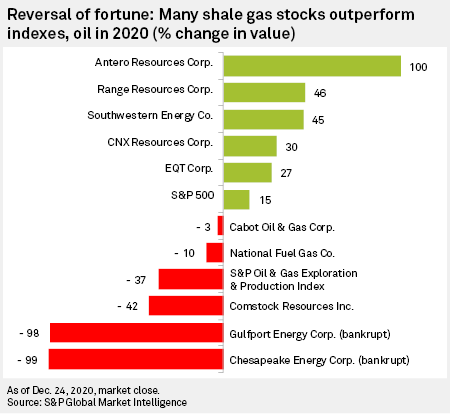

S&P Global – After years of punishment as the shale gas boom imploded, many shale gas stocks outperformed major indexes and their oil and gas peers in 2020 because of increasing investor confidence that natural gas prices will be consistently higher in 2021 and drillers will spend less.

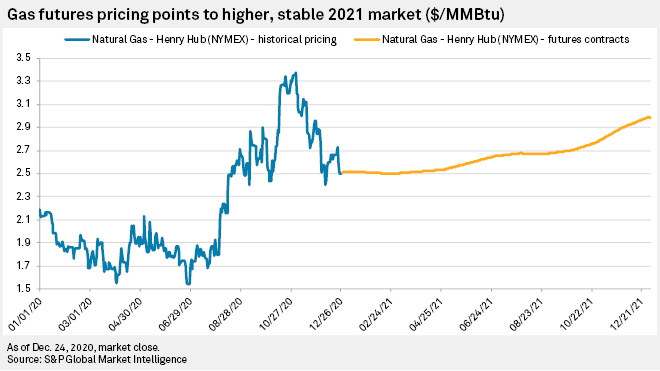

While wilder-than-normal weather in the autumn gutted hopes of a price spike to $4/MMBtu this winter, NYMEX gas futures contracts are signaling an average price of $2.65/MMBtu in 2021, a 31% improvement on 2020’s $2.02/MMBtu average of day-ahead cash prices at the benchmark Henry Hub, according to S&P Global Market Intelligence data Dec. 28.

“While our outlook for a bullish set-up for natural gas in 2021 was bolstered with 3Q20 results given greater apparent discipline from Appalachia producers, this was partly offset by milder November weather,” Goldman Sachs oil and gas analyst Brian Singer said Dec. 15. “We still believe that lower oil/gas drilling activity is likely to shift the natural gas supply-demand picture from bearish to bullish over the next nine months.”

“There are still plenty of chips to fall this winter but even under a weak weather scenario, we think $3/MMBtu for FY’21 is still in play,” analysts at energy investment bank Tudor Pickering Holt & Co. said Dec. 29.

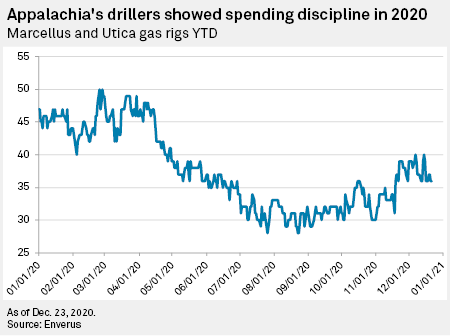

Investors began flocking to shares in shale gas E&Ps, or exploration and production companies, in early spring, as shale oil producers slashed drilling. The drop in oil drilling cut the amount of natural gas coming to market associated with oil wells. Oil producers do not care what price that associated gas fetches, but “free gas” from Texas caps the prices shale gas drillers, primarily in Appalachia, could realize.

Ironically, the biggest 2020 gainers in the shale gas patch are three Appalachian producers with significant NGL production, liquids whose prices are pegged to crude oil’s price. Any rebound in oil prices flows directly to the bottom lines of Antero Resources Corp., Range Resources Corp. and Southwestern Energy Co.Houston’s pain became Pittsburgh’s gain. While COVID-19 concerns slashed oil demand due to reduced driving and flying in the U.S., demand for gas for heating and power stayed relatively constant. Shares in shale gas E&Ps benefited as gas prices stayed low but stable. Appalachia’s gas producers uncharacteristically stuck to their vows to drill less, spend less, and use the savings to pay down debt left over from the shale gas land rush of the previous decade.

“As one of the largest NGL producers with significant gas hedges, upside to near-term cash flows is levered to propane and heavier gas liquids,” energy data firm Enverus analyst Matt Clenchy said of Antero on Dec. 17. “According to the company, the prices for these products recovered to roughly $26 per barrel through October and November, up from $22.50/bbl in Q3.”

Not all shale gas E&Ps survived the pandemic-induced economic recession as their debt outweighed any increase in commodity prices. Shale pioneer Chesapeake Energy Corp. and Oklahoma City neighbor Gulfport Energy Corp. both filed for bankruptcy protection in 2020 as lenders gave up on either E&P paying off debts from the shale gas boom.

The stock performance of two shale gas drillers, New York’s National Fuel Gas Co. and Haynesville shale producer Comstock Resources Inc., suffered when they broke with the pack and told the markets they would spend more drilling to capture higher prices in 2021 and 2022. Investors wanted less spending and punished both stocks.

Comstock’s decline came after its Nov. 5 guidance that it would add a rig to capture higher 2021 prices following a disappointing operational performance in the third quarter. “The violent stock reaction was attributable to the quarterly miss on curtailed volumes and near-term capital efficiency concerns due to Q420 and 2021 implied capital efficiency below expectations,” Stifel Nicolaus & Co. oil and gas analyst Derrick Whitfield said.

Possibly a victim of its own success, Marcellus Shale driller Cabot Oil & Gas Corp. has been generating free cash and distributing it to shareholders for several years. But sentiment that the stock is fully valued kept its performance flat in 2020.

Cabot is “fully-valued so must compete on yield, in our view,” veteran shale gas analyst Subash Chandra with Northland Securities Inc. said after third-quarter earnings were announced in early November. He thinks Cabot will generate $1 billion in free cash in 2021 and have $150 million of additional cash to distribute after paying for its operations, retiring its debt and paying the current 2.3% dividend.

“The [oil and gas] sector, on average, has embraced the message of free cash flow,” Sanford C. Bernstein & Co. LLC oil and gas analyst Bob Brackett said Dec. 21. “While it has not yet arrived meaningfully, it is certainly coming as we emerge from this current downcycle.”