By Salman Ghouri and Farris Ahmad|OilPrice.com, via Yahoo News|The oil industry is quite familiar with the concept of a “Peak Oil Supply,” but many find it hard to believe that there is another side of the coin: “Peak Oil Demand.” The idea of declining oil demand may seem confusing, especially in the context of global economic and population growth. This article will examine why the concept of peak oil supply failed to materialize and why one should believe the concept of peak oil demand will materialize.

The question that arises is, why didn’t peak oil supply materialize in the first place? Simply put, the theory was based on static assumptions. In contrast, the oil and gas industry is dynamic, influenced by changing economic conditions and continuous technological advancements and expertise.

Contrary to predictions that Peak Oil could have occurred as early as the 1950s, the world is better off today. Global oil reserves increased from 682 billion barrels in 1980 to 1732 billion in 2022. Likewise, global oil production increased from 32 million barrels daily (MMBD) in 1965 to over 94 MMBD in 2022; as such, the life expectancy of oil reserves is still hovering around 53 years!

Rapid technological innovations in 3D seismic imaging, horizontal drilling, fracking, and multi-completion techniques have challenged the concept of Peak Oil. Since the middle of 2014, oil prices have been falling and reached $30 in January 2016, and are now hovering around $80/bbl. One significant reason for this fluctuation is the US shale oil and shale gas boom that was initially catalyzed by high oil prices, though with several years lag, and continued its steady rise over time. (Figure-1). Furthermore, innovations in technology over time have greatly reduced the breakeven costs of shale oil, unlocking vast reserves previously trapped under shale basins due to low permeability worldwide. The unlocking of these massive shale oil and gas basins, along with conventional discoveries in new frontier basins was possible due to technological advancements such as horizontal drilling and fracking techniques. As a result, U.S. domestic oil production increased from 6.78 million barrels daily (MMBD) in 2008 to 17.77 MMBD in 2022 (Figure-1). Consequently, the debate has shifted from the timing of Peak Oil Supply to when Peak Oil Demand will occur.

Related: Oil Reaches New 2023 High

Figure-1: BP Statistical Energy Review – June 2023.

Peak Oil Demand Theory

Contrary to peak oil supply theories, peak oil demand relies on assumptions of ongoing technological improvements, not just in the oil and gas sector but also in competing energy sources like renewables. Additionally, significant structural changes are occurring in the auto industry, which historically boosted oil demand. Any alterations in the auto industry will inevitably affect global oil consumption, given that 60% of oil is used in transportation. The same industry that spearheaded the oil industry in the early 1900s, when Henry Ford invented the internal combustion engine, is now rapidly challenging the oil sector. These changes will undoubtedly hamper global oil demand.

From 2010 on, Electric Vehicles (EVs) began to make their mark on the automobile industry. Initially, their slow uptake did not overtly concern the oil industry, as they were not looking to challenge the oil sector directly. However, by 2022, the global fleet of 26 million EVs, though only 1.76% of the total cars, signaled a shift in transportation trends.

Technological advancements, battery cost reductions, environmental concerns, and attractive government policies have spurred traditional car manufacturers to pivot towards eco-friendly transport. Concurrently, the evolution of EV charging infrastructure and fuel-efficient vehicles, and higher oil prices have motivated consumers to consider transitioning from internal combustion engine vehicles.

In August 2023, an article titled “EV Adoption Could Spell Trouble For Oil Exporters” was published in OilPrice. We are using the same fuel savings forecast to ascertain as to when the possible peak oil demand will occur. The forecast of EVs and possible fuel savings under an alternative scenario is highlighted in Figure-2 & 3. Under reference cases, total EVs sales are expected to grow at an annual average rate of 20%, rising from 26.2 million in 2022 to 582 million in 2040. Consequently, fuel savings by 2040 are expected to be 21.42 MMBD compared to the 100 MMBD global oil demand in 2022. The reference case is bounded by low and high case to account for the element of uncertainty. Under the high case, the EVs are expected to grow by annual average rate of 23.4% reaching 937 million in 2040. Consequently, fuel savings by 2040 are expected to be 34.46 MMBD. While, under the low case, EVs will grow by an annual average growth rate of 14.34% to 254 million in 2040, with possible fuel savings of 9.36 MMBD.

Figure-2: EVs trends to 2040 under alternative scenarios.

Figure-3: EVs trends in fuel savings (MMBD) to 2040 under alternative scenarios.

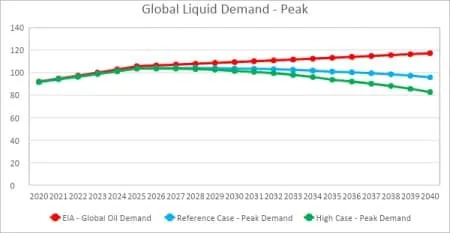

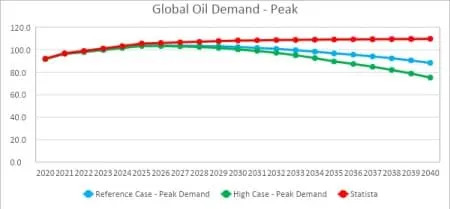

Figure-4 depicts the global oil demand forecast through 2040 by the Energy Information Administration (EIA) from their International Energy Outlook, October 6, 2021. Based on their assessment, they seem to be quite conservative regarding the penetration of EVs into the automotive sector. EIA reference forecast predicts that global liquid demand is expected to continue to grow at an annual average rate of 1% reaching 117.2 MMBD by 2040, and 125.9 MMBD by 2050. However, I anticipate that the EIA will revise their forecasts downward in their forthcoming October 2023 report.

Taking EIA reference liquid demand forecast and deducting our expected fuel savings resulting from penetration of EVs highlighted in Figure-4. Based on the reference case peak oil demand is expected to take place in 2027 and for the high case scenario, it will slip one year earlier to 2026.

Figure-4: Energy Information Administration Forecast Table A5. World liquids consumption by region, Reference case

Based on the Statista oil demand outlook, a reference peak is expected between 2025-2028, while under high case it is expected to happen in 2025 (Figure-5).

e-Figure-5: Global oil products demand outlook 2045 | Statista

According to a report by the International Monetary Fund (IMF), global oil demand is expected to peak around 2040 or “much sooner” 1. However, the International Energy Agency (IEA) has projected that global oil demand will peak in the next few years, with annual growth expected to slow to just 0.4% by 2028. The Organization of the Petroleum Exporting Countries (OPEC) has estimated that global oil product demand will reach 109.8 million barrels per day by 2045, with transportation fuels such as gasoline and diesel expected to remain the most consumed products 3. McKinsey after more than 30 years of stable growth of more than 1 percent per year, oil demand growth slows in the late 2020s and peaks in 2029. Bloomberg in their recent study predicted that peak oil demand will take place in 2027.

Based on our assessment and the speed of EV penetration, oil demand should peak within the current decade. This is again a timely reminder for oil exporting countries that, though oil demand will continue to play a pivotal role in the global primary energy mix and global economic growth, its role will be depleted over time. Major oil exporting countries have already wisely taken appropriate strategies to reduce their high oil revenue dependency by timely diversification. Those who ignore this shift may find it’s too late when they finally wake up to the changing landscape.

By Salman Ghouri and Farris Ahmad