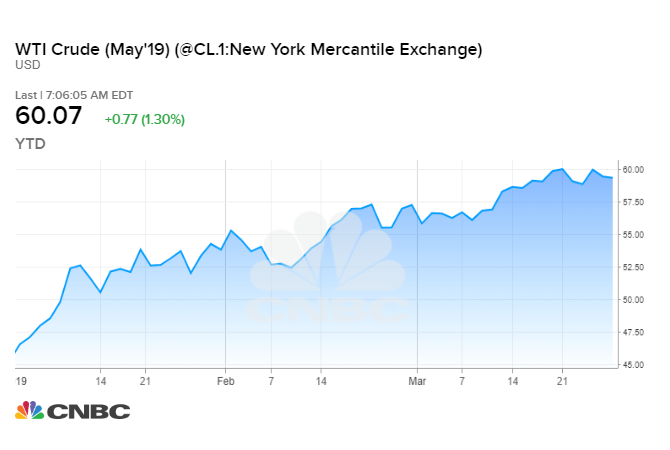

- U.S. crude rose 30 percent in the first three months of the year.

- Oil prices draw support in 2019 from efforts by OPEC and allies like Russia to withhold around 1.2 million barrels per of supply.

- U.S. sanctions on oil exporters Iran and Venezuela also underpin the surge in the cost of crude.

Nick Oxford | Reuters A worker walks through an oil production facility owned by Parsley Energy in the Permian Basin near Midland, Texas, August 23, 2018.

CNBC –Oil prices rose on Friday, on track for their biggest quarterly rise in a decade, as U.S. sanctions against Iran and Venezuela, as well as OPEC-led supply cuts, overshadowed concerns over a slowing global economy.

The rebound comes after a swift and punishing collapse in oil prices during the final quarter of 2018.

U.S. West Texas Intermediate crude futures settled 84 cents higher at $60.14 per barrel, up 1.4 percent on the day. WTI earlier touched $60.73, its highest level since Nov. 12.

WTI futures rose for a fourth straight week and surged 32 percent in the first three months of the year.

The May Brent crude futures contract, which expires Friday, gained 57 cents to $68.39 a barrel, gaining 27 percent in the first quarter. The more-active June contract was up 57 cents to $67.67 a barrel around 2:30 p.m. EDT (1830 GMT).

For both futures contracts, the first quarter 2019 is the best performing quarter since the second quarter of 2009 when both gained about 40 percent.

U.S. sanctions on Iran and Venezuela have boosted oil prices this year, as the sanctions have restricted crude exports out of the countries.

The United States is keen to see that Malaysia, Singapore and others are fully aware of illicit Iranian oil shipments and the tactics Iran uses to evade sanctions, a top U.S. sanctions official said on Friday.

Sigal Mandelker, under-secretary of the Treasury for Terrorism and Financial Intelligence, told reporters in Singapore that the United States had placed additional “intense pressure” on Iran this week.

“It seems that the Trump administration may be more serious about imposing sanctions on Iranian oil this time around,” said John Kilduff, a partner at Again Capital in New York.

Oil falls after Trump tweet, but energy expert Tom Kloza sees higher prices in Q2 3:21 PM ET Thu, 28 March 2019 | 02:23

Oil falls after Trump tweet, but energy expert Tom Kloza sees higher prices in Q2 3:21 PM ET Thu, 28 March 2019 | 02:23

Meanwhile, the United States has instructed oil trading houses and refiners around the world to further cut dealings with Venezuela or face sanctions themselves, even if the trades are not prohibited by published U.S. sanctions, three sources familiar with the matter said.

Also lifting prices this year has been a deal between OPEC and allies such as Russia to cut output by around 1.2 million barrels per day, which officially started in January.

OPEC and its allies are scheduled to meet in June to set policy, but some cracks in the union are emerging.

OPEC’s de facto leader Saudi Arabia is struggling to convince Russia to stay much longer in the pact, and Moscow may agree only to a three-month extension, three sources familiar with the matter said.

The market has also been supported by slower output growth in the U.S., the world’s top crude producer, where record production has steadied at a record over 12 million bpd since mid-February.

In its latest monthly report on Friday, the government said U.S. crude production edged lower in January to 11.87 million bpd.

Saudi government expenditure has been rising steadily: Oil expert 17 Hours Ago | 02:59

Saudi government expenditure has been rising steadily: Oil expert 17 Hours Ago | 02:59

U.S. energy firms this week reduced the number of oil rigs operating to their lowest in nearly a year, cutting the most rigs in a quarter in three years, General Electric Co’s GE.N Baker Hughes energy services firm said.

Futures gains have been capped this quarter by concerns about a slowing global economy that could hit crude demand.

U.S. consumer spending rebounded less than expected in January and incomes rose modestly in February, suggesting the economy was fast losing momentum after growth slowed in the fourth quarter.

Elsewhere, three of China’s top state-controlled bank posted their weakest quarterly profit growth in more than two years.

Still, Barclays bank forecast oil prices “are likely to move still higher in Q2 and average $73 per barrel ($65 WTI), and $70 for the year.”

A monthly Reuters survey of economists and analysts forecast Brent would average $67.12 a barrel in 2019, about 1 percent higher than the previous poll’s $66.44.

— CNBC’s Tom DiChristopher contributed to this report.