Featured Article

-

1.2KOil & Gas News

1.2KOil & Gas NewsWhy Texas, a clean energy powerhouse, is about to hit the brakes

Story by Anna Phillips, The Washington Post. Already No. 1 in wind power, and home to a fast-growing solar industry, Texas is...

-

860Oil & Gas News

860Oil & Gas NewsOil’s Slide Surprised Markets, But Some Traders See A Bottom

By: CNBC – The recent slide in oil prices is starting to bottom out, according to analysts who predict that a more...

-

1.7KOil & Gas News

1.7KOil & Gas NewsEOG May DUC Eagle Ford’s Dorado Gas Wells After June

Story By Nissa Darbonne | Oil and Gas Investor | EOG Resources Inc. is looking at delaying completions in its behemoth Dorado...

-

838Oil & Gas News

838Oil & Gas NewsCallon Petroleum Exits Eagle Ford, Acquires Permian Assets for $475MM

Callon Petroleum Company has announced two definitive agreements that will consolidate and refocus its operations, speed up the attainment of its debt...

-

845Oil & Gas News

845Oil & Gas NewsShell Beats Expectations with $9.6B In Q1 Profits

By: CNBC – British oil giant Shell on Thursday posted a stronger-than-anticipated first-quarter profit, extending a record run of bumper results after...

-

992Oil & Gas News

992Oil & Gas NewsIncreased oilfield activity is expected in Oklahoma

Story by Jerry Bohnen, OK Energy Today. Despite losses in Oklahoma’s oilfield activity in the past few weeks as reported by Baker...

-

946Oil & Gas News

946Oil & Gas NewsEnergy Policy Lands Interior Secretary Haaland Under Fire

By: Idaho Capital Sun – Members of the U.S. Senate Energy and Natural Resources Committee used a Tuesday hearing on the Interior...

-

795Oil & Gas News

795Oil & Gas NewsIran seizes second oil tanker in a week in Gulf -U.S. Navy

DUBAI, May 3 (Reuters) – Iran seized a second oil tanker in a week on Wednesday in Gulf waters, the U.S. Navy...

-

855Oil & Gas News

855Oil & Gas NewsOklahoma Legislature Moves to Exempt NatGas Industry From Price Gouging Law

By: KOSU – Rep. Mark McBride, R-Moore, authored House Bill 2561, which exempts the natural gas industry from the rule. He said...

-

756Oil & Gas News

756Oil & Gas NewsPredictions Of An Oil And Gas Decline Are Overblown

Story By Irina Slav for Oilprice.com. The end of oil and gas is nigh. In a decade or so, demand will begin...

Snippets

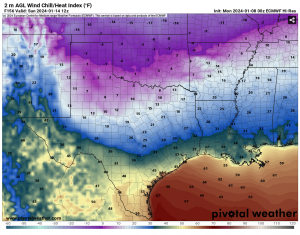

- 🌨️Cold Weather Forecast for OklahomaA real taste of winter is hitting most of the state this week, sending oil and gas crews to wear extra...A real taste of winter is hitting most of the state this week, sending oil and gas crews to wear extra clothing to fight the extreme wind chills. Oklahoma Climatologist Gary McManus says we’ll see wind chills down “into the single digits and teens” Tuesday morning.Read More

“Then, around Friday, we’re going to get a blast of true Arctic air, and then we could see a February 2021-lite version of winter where we stay below freezing for several days. A bit far out to say for sure, but get ready for winter-for-real.”

He said another storm system will likely hit the state on Friday and early next week with a strong chance of snow for many areas of Oklahoma—“just depends on the storm track of those systems. [Source: OK Energy Today} - DOE earmarks $70M to secure energy infrastructureThe Department of Energy is allocating up to $70 million to guard the nation's infrastructure from cyberattacks...The Department of Energy is allocating up to $70 million to guard the nation's infrastructure from cyberattacks and other cyber threats. The DOE is accepting applications for funding for its All-Hazards Energy Resilience project that will center on zero-trust architectures for electrical, gas, or oil settings.Read More

- Closing Oil & Gas PriceBenchmark U.S. crude oil for February delivery...Benchmark U.S. crude oil for February delivery rose $1.47 to $72.24 per barrel Tuesday. Brent crude for March delivery rose $1.47 to $77.59 per barrel.Read More

Wholesale gasoline for February delivery rose 5 cents to $2.08 a gallon. February heating oil rose 7 cents to $2.65 a gallon. February natural gas rose 21 cents to $3.19 per 1,000 cubic feet.

- Energy Sector CommentaryThe energy sector is off to a...Read More

The energy sector is off to a higher start, rebounding from yesterday's steep slide on the backs of strength in the underlying commodities. Major equity futures meanwhile steadied this morning as rates ticked higher and investors await a pair of key inflation readings later this week to gain clarity into the path forward for rate cuts from the Fed. The benchmark 10-year Treasury note yield rose more than 4 basis points this morning and is now trading above 4%.

WTI and Brent crude oil futures are up by over 2.5% in early trading, recovering from yesterday’s 4% drop on rising concerns that tensions in the Middle East will spread and ongoing supply outages in Libya. Weak economic data out of Germany, lingering demand worries, and speculation of rising OPEC supply after Saudi Arabia cut its OSP yesterday, are keeping a cap on gains. The Israeli military has said its fight against Hamas will continue through 2024, worrying markets that the conflict could grow into a regional crisis that could disrupt Middle Eastern oil supplies. German industrial production unexpectedly fell in November according to the Federal Statistics Office, marking a sixth consecutive monthly decline.

Natural gas futures resumed their trend higher, backed by cooler weather forecast in key consuming regions that should stir demand ahead of another winter storm.

- Canada, Mexico projects seen squeezing US Gulf heavy crude supplyThe upcoming startup of the 590,000-barrel-per-day Trans Mountain Expansion oil pipeline in Canada and...The upcoming startup of the 590,000-barrel-per-day Trans Mountain Expansion oil pipeline in Canada and the 340,000-bpd Olmeca refinery in Mexico is expected to reduce the availability of heavy sour crude oil barrels on the US Gulf Coast. Crude imports from Venezuela could help fill a potential gap, but uncertainty surrounding US sanctions clouds that prospect.Read More

MOST POPULAR

-

735Oil & Gas News

735Oil & Gas NewsFermi America Reveals Ambitious Texas Energy Megaproject

Fermi America, a Texas-based company co-founded by former U.S. Energy Secretary and former Texas...

-

565Oklahoma

565OklahomaOklahoma Drive In Pauses Operations During New Energy Project

The temporary closure of the Chief Drive In Theatre in Ninnekah has sparked local...

-

443National

443NationalEIA: U.S. Natural Gas Use to Hit Record in 2025

Natural gas remains the leading source of electricity generation in the United States, but...

-

436International

436InternationalTurkey Plans Energy Deals With USA

by Bloomberg, via RigZone.com | F.Kozok, S.Hacaoglu | Turkey plans to sign new energy deals with...

-

409Oil & Gas News

409Oil & Gas NewsTrump Calls Out Europe on Russian Energy Purchases

President Donald Trump used his address at the United Nations General Assembly this week...

-

373Mineral Owners

373Mineral OwnersTiny Decimals, Big Consequences: Mineral Rights Fragmentation in the U.S.

Mineral rights fragmentation is not a temporary crisis but an inherent, perpetual friction in...

-

336Oil & Gas News

336Oil & Gas NewsInfrastructure Gaps Threaten Permian’s AI Energy Future

West Texas holds a treasure trove of natural gas that could become a critical...

-

265Oil & Gas News

265Oil & Gas NewsIs the Market Sleepwalking Into a Global Oil Shortage?

Managed money speculators hit record bearish positions on WTI even as the IEA forecasts...

-

211Acquisitions

211AcquisitionsContinental and TotalEnergies Ink Major Anadarko Basin Agreement

TotalEnergies has signed an agreement with Continental Resources to acquire a 49% interest in...

-

200Oil & Gas News

200Oil & Gas NewsOil Posts Biggest Weekly Gain Since July

by Bloomberg [via RigZone.com] |Veena Ali-Khan, Mia Gindis| Oil notched its biggest weekly gain...

-

130Oil & Gas News

130Oil & Gas NewsDouble Eagle Founders Still Love Their Work

By Mella McEwen,| Midland Reporter Telegram | John Sellers and Cody Campbell, co-chief executive officers...

-

123International

123InternationalU.S. Energy Giant Exxon Mobil Fires 2,000 as Job Losses Rip Through Economy

By DANIEL JONES, US CONSUMER EDITOR | Daily Mail | and REUTERS | Exxon Mobil...