Featured Article

-

901Oil & Gas News

901Oil & Gas NewsShell Considers Mega-Merger With BP Amid Industry Shake-Up

According to sources cited by Bloomberg, Shell is quietly exploring a potential takeover of rival BP, a merger that could reshape both...

-

302International

302InternationalSaudi Push Into Indian Refining Is Stalling Over Crude Supply

Bloomberg Wire | Gulf News | Saudi Arabia’s progress in securing investment in two oil refineries in India is being held back...

-

850Oil & Gas News

850Oil & Gas NewsTexas Fuel Supplier Sues Tesla Over Unpaid Bill

A Houston-based fuel company says Tesla still hasn’t paid for millions of dollars’ worth of fuel it delivered to the electric carmaker’s...

-

517Oil & Gas News

517Oil & Gas NewsU.S. LNG Exports Surge to New Highs on Strong Buying by Europe

Gavin Maguire| LITTLETON, Colorado-(Reuters) | U.S. exports of LNG so far this year have surged by over 20% from the same period...

-

387International

387InternationalTrump and Ukraine Finalize Mineral Deal as War Presses On

After months of tough negotiations and political tension, the United States and Ukraine have reached a new economic agreement designed to secure...

-

2.2KOil & Gas News

2.2KOil & Gas NewsUtah Family Busted in Cartel Oil Smuggling Probe

It sounds like something out of a Netflix crime drama, but this one’s all too real. A well-off Utah family is facing...

-

490Oil & Gas News

490Oil & Gas NewsU.S. Oil Companies Spent Less on Interest Over the Last Decade Despite Higher Rates

Source: EIA | Higher oil prices, increased drilling efficiency, and structurally lower debt needs have contributed to lower interest expenses for some...

-

478Oil & Gas News

478Oil & Gas NewsConocoPhillips Bows Out Amid Malaysia Oil Sector Turmoil

In a move that is raising eyebrows across the global oil industry, ConocoPhillips has quietly exited a massive deepwater oil project off...

-

320Oil & Gas News

320Oil & Gas NewsEnergy Secretary Aims to Reassure Oil Bosses Amid Trade War

by Bloomberg|David Wethe, Alix Steel | Energy Secretary Chris Wright sought to reassure US oil companies during a visit to Oklahoma, saying...

-

412Oil & Gas News

412Oil & Gas NewsRussia and Iran Deepen Energy Alliance With Gas and Nuclear Agreements

Russia and Iran have cemented a preliminary energy pact that could dramatically reshape regional energy flows and geopolitical alignments. The agreement includes...

Snippets

- Oil prices finish higher after Trump's threat to buyers of crude from VenezuelaOil futures settled higher on Monday after President...Read More

Oil futures settled higher on Monday after President Donald Trump said in a Truth Social post that countries that purchase oil from Venezuela will face a 25% tariff on all of their imports to the U.S. starting April 2. He also imposed new tariffs on Venezuela, according to the Associated Press.

The decision to impose tariffs on buyers of crude from Venezuela is "based on the alleged arrival of tens of thousands of Venezuelan migrants with violent backgrounds, which has been presented as a threat to U.S. national security," said Antonio Di Giacomo, a financial markets analyst at XS.

He said the impact on the energy market was immediate. Prices climbed Monday, with the May contract for West Texas Intermediate crude up 83 cents, or 1.2%, to settle at $69.11 a barrel on the New York Mercantile Exchange. May Brent crude settled at $73 on ICE Futures Europe, up 84 cents, or 1.2%.

- U.S. stocks end sharply higher Stocks jumped Monday on optimism that President Donald...Read More

Stocks jumped Monday on optimism that President Donald Trump may hold back from implementing some of his wide-ranging tariff plans and so the U.S. could skirt an economic slowdown from a protracted trade war.

The Dow Jones Industrial Average jumped 597.97 points, or 1.42%, to end at 42,583.32. The S&P 500 added 1.76% and closed at 5,767.57, while the tech-heavy Nasdaq Composite gained 2.27% to settle at 18,188.59.

Shares of Tesla which have fallen nine straight weeks, were up nearly 12%, adding to their Friday gains. Meta Platforms and Nvidia each climbed more than 3%.

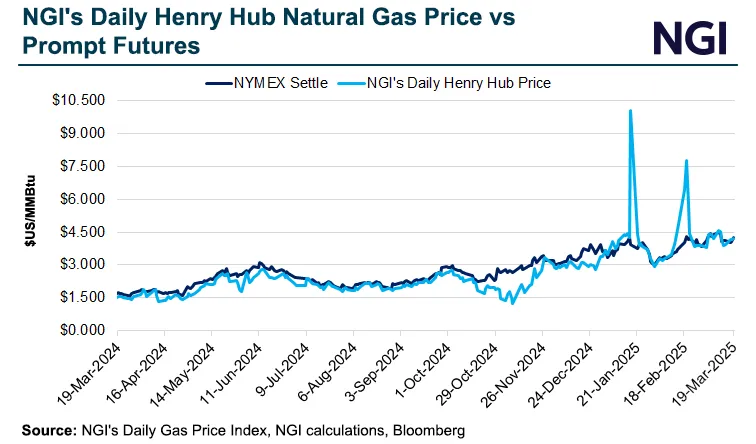

- As Stock Market Swoons Amid Tariff Fallout, Natural Gas Futures Prove Safe HavenDespite spring weather and rapidly fading heating demand, natural gas futures hold strong at winter price...Despite spring weather and rapidly fading heating demand, natural gas futures hold strong at winter price levels.Read More

To be sure, seasonally soft supply in storage and record levels of export demand are key drivers. However, traders said a stock market slump has proved to be another bullish factor for natural gas prices over the past month.

- Phillips 66's Lake Charles refinery may get $99M upgradePhillips 66 is pursuing a $99 million expansion of its 264,000-barrel-per-day...Phillips 66 is pursuing a $99 million expansion of its 264,000-barrel-per-day Lake Charles refinery in Louisiana, with proposed upgrades ranging from a steam turbine power generator to a naphtha fractionator. The project, under review for state tax incentives, could be finalized in late 2027.Read More

- Mesa Minerals IV Launches New Acquisition InitiativeMesa Minerals IV has officially...Read More

Mesa Minerals IV has officially launched to acquire mineral and royalty interests in the Haynesville Shale, Permian Basin, and other plays, as announced by CEO Darin Zanovich at Hart Energy's 2025 DUG Gas Conference & Expo in Shreveport.

NGP's latest royalty fund financially backs the new venture and follows the success of Mesa Minerals III, which built a substantial portfolio including approximately 6,000 net royalty acres in the Permian Basin and 16,000 net royalty acres in the Haynesville.

While Mesa III has been temporarily sidelined with plans for NGP to market its portfolio in the future, the company is expanding its focus beyond the Permian Basin due to high asking prices for oil-weighted assets there.

This continues the Mesa franchise's established presence in the Haynesville play, where both Mesa I and II previously built and successfully sold mineral positions to Franco-Nevada Corp.

MOST POPULAR

-

406Exploration

406ExplorationU.S. Gulf Remains a Centerpiece of Growth for Oil Majors

By Andrew Kelly | Energy Intelligence | The US Gulf of Mexico holds a...

-

342Production

342ProductionTen Counties in the Permian Basin Account for 93% of U.S. Oil Production Growth Since 2020

Source: EIA | Between 2020 and 2024, total crude oil and lease condensate production...

-

341Exploration

341ExplorationTotalEnergies Secures New Offshore Exploration Permit in Congo

By Michael Kern for Oilprice.com | TotalEnergies, along with its partners QatarEnergy and the national...

-

241Oil & Gas News

241Oil & Gas NewsEnbridge Backs Northeast Supply and Gulf LNG Demand

Canadian midstream operator Enbridge has approved final investment decisions on two new gas transmission...

-

233Renewables

233RenewablesThe Battery Storage Market Is Set to Grow Ninefold by 2040

By Felicity Bradstock for Oilprice.com | Following the massive growth in global renewable energy...

-

227Midstream

227MidstreamTarga Advances Forza Pipeline Linking Delaware to Waha

Targa Resources Corp. has launched a non-binding open season for its proposed Forza Pipeline...

-

220Oil & Gas News

220Oil & Gas NewsN.M. Braces for Revenue Losses From Royalty Rate Cuts

Ian M. Stevenson | EENews.net | Falling royalty rates for oil and gas production...

-

166Acquisitions

166Acquisitions$550MM Canvas Acquisition Expands Diversified Energy’s Oklahoma Footprint

Diversified Energy Company Plc has announced a $550 million acquisition of Canvas Energy, a...

-

138National

138NationalU.S. Gas Power Capacity Set for Big Jump as Renewables Growth Slows

Reporting by Gavin Maguire | (Reuters) – U.S. power developers are planning to sharply...

-

136Downstream

136DownstreamCalifornia Puts Oil Price-Gouging Rule on Hold to Keep Pumps Supplied

Authored by Jill McLaughlin via The Epoch Times, | California regulators fearing a dramatic...

-

79Oil & Gas News

79Oil & Gas NewsU.S. Oil Producers Slash 2025 Spending as Prices Slide and Consolidation Mounts

The U.S. oil and gas industry is entering a period of retrenchment, marked by...

-

48Energy

48EnergyNatural Gas and Batteries Anchor Data Center Growth

Data centers across the United States are increasingly grappling with one of the most...