Featured Article

-

1.1KOil & Gas News

1.1KOil & Gas NewsOil firms after slide but COVID-19 and supply concerns remain

By: Reuters – Oil edged up towards $69 a barrel on Tuesday as a tight physical market offset some of the COVID-19...

-

1.6KInvesting

1.6KInvestingGoldman Sachs sees ‘upside’ to oil price forcasts after OPEC+ deal

By: Reuters – U.S. investment bank Goldman Sachs said the OPEC+ deal to boost oil supply supports its view on oil prices...

-

1.6KExploration

1.6KExplorationGreenland Ends Unsuccessful 50-Year Bid to Produce Oil

Greenland has ended its 50-year ambition to become an oil-producing nation after announcing on July 16 it would suspend a strategy of...

-

1.2KOil & Gas News

1.2KOil & Gas NewsColorado is a hotbed of oil, gas deals, but what does that mean for the industry’s future?

By: Judith Kohler – The Denver Post – Two of the biggest mergers in the oil and gas industry this year took...

-

2.1KOil & Gas News

2.1KOil & Gas NewsPrivate-equity backed group acquires Hawkwood Energy, LLC

By: Greg Avery – Denver Business Journal – A private equity-backed business has acquired a Denver-based oil and gas company with thousands...

-

1.3KOil & Gas News

1.3KOil & Gas NewsU.S. oil mergers surge as energy, share prices recover from pandemic

By: Reuters Staff – Reuters – U.S. oil and gas mergers surged last quarter with the most $1 billion-plus deals since 2014,...

-

1.9KNational

1.9KNational‘A wake up call’: One of the world’s largest oil pipelines might be in trouble

David Hasemyer, Inside Climate News – The Trans-Alaska Pipeline, one of the world’s largest oil pipelines, could be in danger due to...

-

1.2KOil & Gas News

1.2KOil & Gas NewsNorth Dakota sues fed over canceled leases

By: Laila Kearney – Reuters – North Dakota is suing the U.S. government on claims the Department of the Interior and the...

-

1.5KNational

1.5KNational3 issues to watch with Biden and oil and gasoline prices

A spike in oil and gasoline prices is touching off concerns about inflation and other long-term energy effects — and putting President...

-

1.3KOil & Gas News

1.3KOil & Gas NewsOil and Dollars: Why the UAE Is Risking a Falling-Out With OPEC+

By: Anthony Di Paola – Bloomberg – The OPEC+ oil cartel is facing its biggest crisis since a price war at the...

Snippets

- U.S. oil futures settle lower, but speculation of SPR refills emergeU.S. oil futures settled lower ...U.S. oil futures settled lower on Thursday, down a fifth straight session, but an oil leak that led to a shutdown of the Keystone Pipeline and talk of a potential buyback of oil to refill U.S. reserves helped to limit price losses. The White House said in October that the Biden administration intends to repurchase oil for the Strategic Petroleum Reserve when prices are at or below $67 to $72. U.S. benchmark WTI crude for January delivery CLF23 fell 55 cents, or 0.8%, to settle at $71.46 a barrel on the New York Mercantile Exchange on Thursday. With U.S. prices now within that price band, that “‘Biden SPR put’ is definitely playing a part in the market finding some price support in the low $70 range,” said Tyler Richey, co-editor at Sevens Report Research.Read More

- S&P 500 snaps 5-day losing streak, Dow ends up over 180 pointsThe S&P 500 ended a five-session slide on Thursday as major U.S. equity indexes booked a solid round...The S&P 500 ended a five-session slide on Thursday as major U.S. equity indexes booked a solid round of daily gains. The Dow Jones Industrial Average DJIA, rose about 182 points, or 0.5%, closing near 33,780, while the S&P 500 index SPX gained 0.8% and the Nasdaq Composite Index COMP outperformed with a 1.1% advance, according to FactSet data. Investors were migrating back into stocks after weekly labor market data pointed to potential weakness, with businesses not hiring as many workers. A roaring labor market has been one of several factors keeping Wall Street on edge as the Federal Reserve has been trying to cool high inflation by sharply raising interest rates. Rising wages have threatened to throw a wrench in that effort, while also rekindling fears that the U.S. central bank might need to get even more aggressive than earlier anticipated with its rate hiking plans. Higher rates have weighed heavily on stocks and bonds in 2022, but could also threaten to tip the U.S. economy into a deeper recession than expected in the coming months. The 10-year Treasury rate rose 8.5 basis points to 3.492% on Thursday.Read More

- Gas prices are now cheaper than this time last year. Could they fall below $3 a gallon in the months ahead?Drivers paying for gas on Thursday paid slightly less on average than they did one year ago — a 1c...Drivers paying for gas on Thursday paid slightly less on average than they did one year ago — a 1c difference — but there may be even cheaper gas in the weeks and months to come, experts say. Thursday’s national average for a gallon of gas was approximately $3.33, AAA said. Six months after drivers were snapping photos of high prices at the pump, gasoline-industry experts say the downward trend is due to a combination of falling crude-oil prices and a drop in driver demand after traditionally busy summer months.Read More

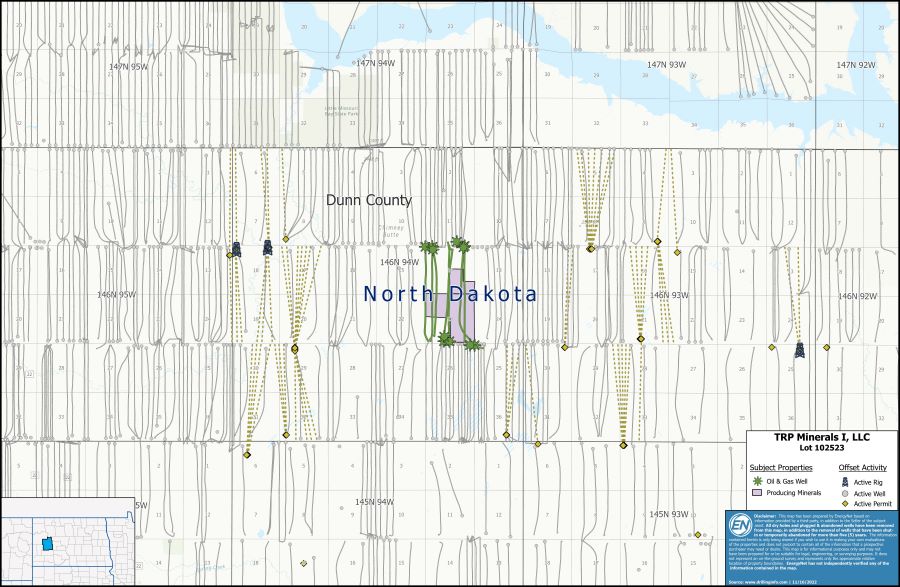

“We expect gas prices likely are going to continue trending lower,” said AAA spokesman Devin Gladden. It’s possible the national average will fall below the $3-per-gallon mark, but when that happens and for how long is unclear, he added. - Marketed: TRP Minerals LLC 11 Well PackageTRP Minerals LLC retained EnergyNet for the sale of an 11-well package in Dunn County, N.D., through...TRP Minerals LLC retained EnergyNet for the sale of an 11-well package in Dunn County, N.D., through an auction closing Dec. 8. The Lot# 102523 package includes mineral assets and three offset rigs.Read More

- Sentencing of Former Theranos Company PresidentEx-Theranos president gets a longer sentence than Elizabeth Holmes. A federal judge...Ex-Theranos president gets a longer sentence than Elizabeth Holmes. A federal judge sentenced Ramesh “Sunny” Balwani, who was Holmes’s No. 2 at the failed blood-testing startup and is also her ex-boyfriend, to nearly 13 years in prison (Holmes got 11). Balwani and Holmes had pointed the finger at each other for the fraud at Theranos, which they built into a $10 billion company before it came out that the tech they were hyping simply didn’t work and was never going to.Read More

MOST POPULAR

-

382Exploration

382ExplorationTotalEnergies Secures New Offshore Exploration Permit in Congo

By Michael Kern for Oilprice.com | TotalEnergies, along with its partners QatarEnergy and the national...

-

378Production

378ProductionTen Counties in the Permian Basin Account for 93% of U.S. Oil Production Growth Since 2020

Source: EIA | Between 2020 and 2024, total crude oil and lease condensate production...

-

275Oil & Gas News

275Oil & Gas NewsEnbridge Backs Northeast Supply and Gulf LNG Demand

Canadian midstream operator Enbridge has approved final investment decisions on two new gas transmission...

-

264Oil & Gas News

264Oil & Gas NewsN.M. Braces for Revenue Losses From Royalty Rate Cuts

Ian M. Stevenson | EENews.net | Falling royalty rates for oil and gas production...

-

260Renewables

260RenewablesThe Battery Storage Market Is Set to Grow Ninefold by 2040

By Felicity Bradstock for Oilprice.com | Following the massive growth in global renewable energy...

-

250Midstream

250MidstreamTarga Advances Forza Pipeline Linking Delaware to Waha

Targa Resources Corp. has launched a non-binding open season for its proposed Forza Pipeline...

-

218Acquisitions

218Acquisitions$550MM Canvas Acquisition Expands Diversified Energy’s Oklahoma Footprint

Diversified Energy Company Plc has announced a $550 million acquisition of Canvas Energy, a...

-

181National

181NationalU.S. Gas Power Capacity Set for Big Jump as Renewables Growth Slows

Reporting by Gavin Maguire | (Reuters) – U.S. power developers are planning to sharply...

-

160Downstream

160DownstreamCalifornia Puts Oil Price-Gouging Rule on Hold to Keep Pumps Supplied

Authored by Jill McLaughlin via The Epoch Times, | California regulators fearing a dramatic...

-

111Oil & Gas News

111Oil & Gas NewsU.S. Oil Producers Slash 2025 Spending as Prices Slide and Consolidation Mounts

The U.S. oil and gas industry is entering a period of retrenchment, marked by...

-

109Energy

109EnergyNatural Gas and Batteries Anchor Data Center Growth

Data centers across the United States are increasingly grappling with one of the most...

-

60Natural Gas

60Natural GasPowering the US Data Center Boom With Wasted Natural Gas

[energyintel.com] A data center boom in the US is straining the grid and pushing...