Featured Article

-

2.2KExploration

2.2KExplorationThe ‘Cowboy State’ Oil Boom Is Falling Behind

By Tsvetana Paraskova for Oilprice.com – A year ago, the Powder River Basin in northeastern Wyoming was thought to be the next hot...

-

1.9KExploration

1.9KExplorationPermian players Diamondback, Pioneer, Parsley increase production, tighten spending

By Jordan Blum – Houston Chronicle – Some of the top oil producers in the booming Permian Basin reported mixed financial results...

-

2.3KExploration

2.3KExplorationCompanies increase Oklahoma production while cutting rigs

From The Oklahoman – Oil and natural gas production in Oklahoma is likely to continue increasing even as companies further cut the...

-

2.1KExploration

2.1KExplorationU.S. natural gas demand is at a record – and prices keep dropping

By Scott DiSavino – (Reuters) – U.S. natural gas demand is at an all-time high and expected to keep rising – and...

-

2.1KExploration

2.1KExplorationBig Oil taking smaller rivals to school on shale

Jordan Blum – Houston Chronicle – Big Oil companies such as Exxon Mobil and Chevron are surpassing their smaller shale drilling rivals...

-

4.1KExploration

4.1KExplorationHaynesville/Bossier Shale Information

The Haynesville/Bossier Shale, located in East Texas (Railroad Commission of Texas District 6) and Western Louisiana, is a hydrocarbon-producing geological formation capable...

-

4.0KExploration

4.0KExplorationNevada Becoming Wild West for Oil Speculation

Bobby Magill – Bloomberg – Oil drilling in Nevada is a risky bet—the geology is complicated and drillers say the odds are...

-

6.3KRig Count

6.3KRig CountWeekly Rig Count Update: August 2, 2019

Stay updated on oil and gas stories, prices and the weekly rig count. Sign up for our Weekly Newsletter HERE. Led by...

-

2.9KExploration

2.9KExplorationFrac sand truckers can make good money doing a dangerous job

By Noi Mahoney – Freight Waves– Long before sunrise, Molly Sizer starts her day in West Texas as a professional frac sand hauler. She...

-

2.8KExploration

2.8KExplorationWyoming mineral and landowners say changes to drilling permit rule not enough

Camille Erickson – Casper Star Tribune – Wyoming’s oil and gas sector is still digesting fresh changes to the state’s drilling regulations....

Snippets

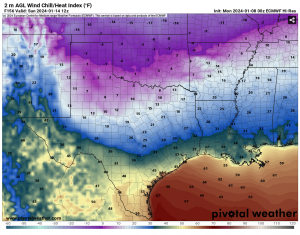

- 🌨️Cold Weather Forecast for OklahomaA real taste of winter is hitting most of the state this week, sending oil and gas crews to wear extra...A real taste of winter is hitting most of the state this week, sending oil and gas crews to wear extra clothing to fight the extreme wind chills. Oklahoma Climatologist Gary McManus says we’ll see wind chills down “into the single digits and teens” Tuesday morning.Read More

“Then, around Friday, we’re going to get a blast of true Arctic air, and then we could see a February 2021-lite version of winter where we stay below freezing for several days. A bit far out to say for sure, but get ready for winter-for-real.”

He said another storm system will likely hit the state on Friday and early next week with a strong chance of snow for many areas of Oklahoma—“just depends on the storm track of those systems. [Source: OK Energy Today} - DOE earmarks $70M to secure energy infrastructureThe Department of Energy is allocating up to $70 million to guard the nation's infrastructure from cyberattacks...The Department of Energy is allocating up to $70 million to guard the nation's infrastructure from cyberattacks and other cyber threats. The DOE is accepting applications for funding for its All-Hazards Energy Resilience project that will center on zero-trust architectures for electrical, gas, or oil settings.Read More

- Closing Oil & Gas PriceBenchmark U.S. crude oil for February delivery...Benchmark U.S. crude oil for February delivery rose $1.47 to $72.24 per barrel Tuesday. Brent crude for March delivery rose $1.47 to $77.59 per barrel.Read More

Wholesale gasoline for February delivery rose 5 cents to $2.08 a gallon. February heating oil rose 7 cents to $2.65 a gallon. February natural gas rose 21 cents to $3.19 per 1,000 cubic feet.

- Energy Sector CommentaryThe energy sector is off to a...Read More

The energy sector is off to a higher start, rebounding from yesterday's steep slide on the backs of strength in the underlying commodities. Major equity futures meanwhile steadied this morning as rates ticked higher and investors await a pair of key inflation readings later this week to gain clarity into the path forward for rate cuts from the Fed. The benchmark 10-year Treasury note yield rose more than 4 basis points this morning and is now trading above 4%.

WTI and Brent crude oil futures are up by over 2.5% in early trading, recovering from yesterday’s 4% drop on rising concerns that tensions in the Middle East will spread and ongoing supply outages in Libya. Weak economic data out of Germany, lingering demand worries, and speculation of rising OPEC supply after Saudi Arabia cut its OSP yesterday, are keeping a cap on gains. The Israeli military has said its fight against Hamas will continue through 2024, worrying markets that the conflict could grow into a regional crisis that could disrupt Middle Eastern oil supplies. German industrial production unexpectedly fell in November according to the Federal Statistics Office, marking a sixth consecutive monthly decline.

Natural gas futures resumed their trend higher, backed by cooler weather forecast in key consuming regions that should stir demand ahead of another winter storm.

- Canada, Mexico projects seen squeezing US Gulf heavy crude supplyThe upcoming startup of the 590,000-barrel-per-day Trans Mountain Expansion oil pipeline in Canada and...The upcoming startup of the 590,000-barrel-per-day Trans Mountain Expansion oil pipeline in Canada and the 340,000-bpd Olmeca refinery in Mexico is expected to reduce the availability of heavy sour crude oil barrels on the US Gulf Coast. Crude imports from Venezuela could help fill a potential gap, but uncertainty surrounding US sanctions clouds that prospect.Read More

MOST POPULAR

-

750Oil & Gas News

750Oil & Gas NewsFermi America Reveals Ambitious Texas Energy Megaproject

Fermi America, a Texas-based company co-founded by former U.S. Energy Secretary and former Texas...

-

465National

465NationalEIA: U.S. Natural Gas Use to Hit Record in 2025

Natural gas remains the leading source of electricity generation in the United States, but...

-

465Mineral Owners

465Mineral OwnersTiny Decimals, Big Consequences: Mineral Rights Fragmentation in the U.S.

Mineral rights fragmentation is not a temporary crisis but an inherent, perpetual friction in...

-

448International

448InternationalTurkey Plans Energy Deals With USA

by Bloomberg, via RigZone.com | F.Kozok, S.Hacaoglu | Turkey plans to sign new energy deals with...

-

426Oil & Gas News

426Oil & Gas NewsTrump Calls Out Europe on Russian Energy Purchases

President Donald Trump used his address at the United Nations General Assembly this week...

-

340Oil & Gas News

340Oil & Gas NewsInfrastructure Gaps Threaten Permian’s AI Energy Future

West Texas holds a treasure trove of natural gas that could become a critical...

-

221Acquisitions

221AcquisitionsContinental and TotalEnergies Ink Major Anadarko Basin Agreement

TotalEnergies has signed an agreement with Continental Resources to acquire a 49% interest in...

-

205Oil & Gas News

205Oil & Gas NewsOil Posts Biggest Weekly Gain Since July

by Bloomberg [via RigZone.com] |Veena Ali-Khan, Mia Gindis| Oil notched its biggest weekly gain...

-

135Oil & Gas News

135Oil & Gas NewsDouble Eagle Founders Still Love Their Work

By Mella McEwen,| Midland Reporter Telegram | John Sellers and Cody Campbell, co-chief executive officers...

-

128International

128InternationalU.S. Energy Giant Exxon Mobil Fires 2,000 as Job Losses Rip Through Economy

By DANIEL JONES, US CONSUMER EDITOR | Daily Mail | and REUTERS | Exxon Mobil...

-

112Downstream

112DownstreamVistra to Build Nearly $1B in Natural Gas Power Plants as Oil and Gas Industry Electrifies

By Claire Hao, Staff Writer| Houston Chronicle| Vistra plans to build two new natural gas...

-

87Oil & Gas News

87Oil & Gas NewsAXP Energy Advances Noble County Mississippi Lime Development

AXP Energy has confirmed the presence of hydrocarbons in multiple pay zones at its...