Featured Article

-

2.3KOCC Filings

2.3KOCC FilingsOklahoma Weekly O&G Report – 12/5/2017

We saw another big transfer hit yesterday, this time 500 wells! Want more information? Give us a shout to hello@oseberg.io, or if you are...

-

4.8KScoop & Stack

4.8KScoop & StackOpportunity Knocks in the Woodford Condensate Play

Continental Resources recently announced a record-setting density project in the SCOOP Woodford Condensate fairway. The Sympson 10-well project reportedly had a combined...

-

2.7KRig Count

2.7KRig CountRig Count Update December 1, 2017

Oklahoma stays flat; U.S. Rigs Climb by 6 The number of active drilling rigs jumped up for the fourth straight week. The...

-

2.6KNational

2.6KNationalSenate Passes Major Tax Reform Package

The U.S. Senate voted just before 2 a.m. ET Saturday to pass a sweeping tax overhaul worth roughly $1.4 trillion, putting the...

-

2.5KInvesting

2.5KInvestingOil Patch Property Valuations Play Key Role in Company’s Financial Health

From mineral rights and royalty interest owners to oil and gas producers and their shareholders to local, state and federal governments, the...

-

3.0KProduction

3.0KProductionIn cutting deal, OPEC optimistic about oil market

The world’s major oil producers, (aka OPEC) on Thursday agreed to keep a lid on production for another year as they attempt...

-

2.4KRig Count

2.4KRig CountRig Count Update November 22, 2017

Due to Thanksgiving, the rig count report by Baker Hughes which normally comes out on Friday, came out last Wednesday, November 22nd,...

-

10.6KScoop & Stack

10.6KScoop & StackArkoma Basin: Sooner or later, everything old becomes new again – or does it simply become LESS old?

And, so it is with the Arkoma Woodford play in southeastern Oklahoma. One of the earliest unconventional dry gas plays in the...

-

2.2KExploration

2.2KExplorationSenate May Approve Drilling In Alaskan Wilderness With Tax Bill

Drilling in Alaska’s Arctic National Wildlife Refuge may soon be a reality, as Republicans are on the cusp of accomplishing two major...

-

1.9KRig Count

1.9KRig CountRig Count Update November 17, 2017

OKLA loses 1 rig while US Rigs climb by 8. The number of oil rigs stayed flat this week, while the number of gas...

Snippets

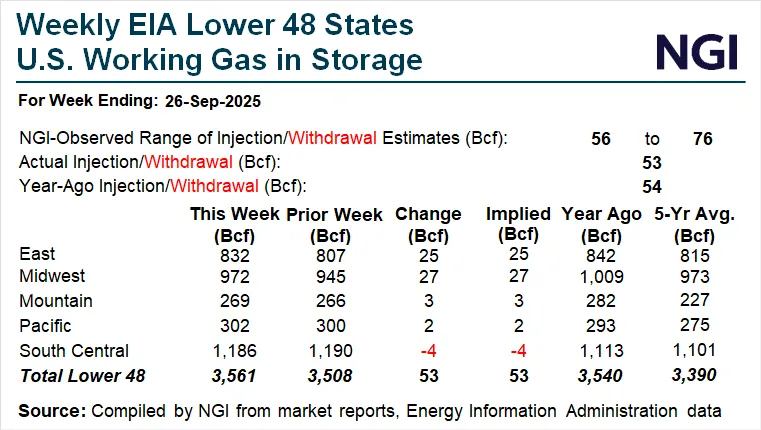

- Natural gas storage falls short of expectations, signaling increased demandThe U.S. Energy Information Administration (EIA) on Thursday reported...The U.S. Energy Information Administration (EIA) on Thursday reported a 53 Bcf injection of natural gas into storage for the week ended Sept. 26. Landing well below expectations, the result lifted natural gas prompt month futures to 11-week highs.Read More

Traders note that this marks the third consecutive week of smaller-than-expected injections, indicating that late-season cooling demand and weaker wind generation are already tightening the balance. The miss amplified buying interest, with heavy volume pushing the November contract above $3.50 intraday before sellers capped the move.

The report’s findings suggest a greater demand for natural gas than initially anticipated, a factor that is bullish for natural gas prices. The forecasted figure was based on the assumption that the increase in natural gas inventories would be more than the actual figure. However, the actual number reported was significantly less than the forecasted number, implying a higher demand for natural gas.

In comparison to the previous week’s data, the current number also shows a decline. The previous week’s natural gas storage was reported at 75B, indicating a drop of 22B week over week. This decrease further underscores the increased demand for natural gas in the market.

- DAILY OIL PRICE: October 2, 2025Crude Oil: 60.48 (-1.30)....Read More

- Crude Oil: 60.48 (-1.30).

- Nymex MTD AVG: 61.1300.

- Natural Gas: 3.442 (-0.034).

- Gasoline: 1.8510 (-0.0349).

- Spreads: November/December (+0.32), December/January (+0.17).

- Plains WTI Posting: 56.96 (-1.30).

Source: Odessa American

- Dow, S&P 500 and Nasdaq all end at record highs after 5th straight day of gainsU.S. stocks rose for a fifth-straight day on Thursday,...Read More

U.S. stocks rose for a fifth-straight day on Thursday, with the Dow, S&P 500 and Nasdaq Composite all tallying a fresh round of record highs.

It was the 30th record finish of 2025 for the S&P 500 and Nasdaq, and 10th for the Dow. The small-cap Russell 2000 also rose for a fifth day. Thursday marked the first time since November 2023 that all four indexes have risen for five straight days.

The Dow tallied its first five-day winning streak since May 2, Dow Jones Market Data showed. The S&P 500 saw its longest winning streak since July 28. For the Russell 2000, it was the longest since July 3, and for the Nasdaq, the longest since Sept. 15.

The S&P 500 rose by 4.15 points, or 0.1%, to finish at 6,715.35, according to Dow Jones Market Data.

The Nasdaq Composite rose by 88.89 points, or 0.4%, to 22,844.05.

The Dow rose by 78.62 points, or 0.2%, to 46,519.72.

- EIA Rattles Oil Markets With Reports of Crude Oil, Product BuildsCrude oil inventories in the...Read More

Crude oil inventories in the United States increased by 1.8 million barrels during the week ending September 26, after shrinking by 600,000 barrels in the week prior, according to new data from the U.S. Energy Information Administration (EIA) released on Wednesday. The increase brings commercial stockpiles to 416.5 million barrels according to government data, which is still 4% below the five-year average for this time of year.

The EIA’s data release follows API’s figures that were released a day earlier, which suggested that crude oil inventories contracted by 3.674 million barrels.

For total motor gasoline, the EIA reported an increase of 4.1 million barrels, after the week prior’s 1.1-million-barrel decrease. The most recent figures showed that average daily gasoline production had decreased to 9.3 million barrels. For middle distillates, inventories increased by 600,000 barrels, while production decreased to 5 million barrels per day. Distillate inventories decreased 1.7 million barrels in the week prior and are now 6% below the five-year average for this time of year.

Total products supplied over the last four weeks slipped to 20.3 million barrels per day, up 1.2% compared to the same period last year. Gasoline demand averaged 8.7 million barrels per day during the previous four weeks, while the distillate four-week average supplied fell to 3.6 million barrels—down 4.4 percent year over year. - Oil majors hedge near-term downturn with long-cycle betsMajor oil companies are reacting to a bleak short-term outlook by trimming...Major oil companies are reacting to a bleak short-term outlook by trimming costs, jobs and share buybacks, even as they double down on long-cycle projects based on the view that slowing supply growth later this decade could lift prices into the 2030s, writes Ron Bousso. BP has committed $5 billion to a Gulf of America development due in 2030, while ExxonMobil is holding firm on $27-29 billion in 2025 spending and scouting for deals.Read More

MOST POPULAR

-

1.0KMineral Owners

1.0KMineral OwnersTiny Decimals, Big Consequences: Mineral Rights Fragmentation in the U.S.

Mineral rights fragmentation is not a temporary crisis but an inherent, perpetual friction in...

-

523National

523NationalEIA: U.S. Natural Gas Use to Hit Record in 2025

Natural gas remains the leading source of electricity generation in the United States, but...

-

491Oil & Gas News

491Oil & Gas NewsTrump Calls Out Europe on Russian Energy Purchases

President Donald Trump used his address at the United Nations General Assembly this week...

-

405Oil & Gas News

405Oil & Gas NewsInfrastructure Gaps Threaten Permian’s AI Energy Future

West Texas holds a treasure trove of natural gas that could become a critical...

-

319Acquisitions

319AcquisitionsContinental and TotalEnergies Ink Major Anadarko Basin Agreement

TotalEnergies has signed an agreement with Continental Resources to acquire a 49% interest in...

-

240Oil & Gas News

240Oil & Gas NewsOil Posts Biggest Weekly Gain Since July

by Bloomberg [via RigZone.com] |Veena Ali-Khan, Mia Gindis| Oil notched its biggest weekly gain...

-

180International

180InternationalU.S. Energy Giant Exxon Mobil Fires 2,000 as Job Losses Rip Through Economy

By DANIEL JONES, US CONSUMER EDITOR | Daily Mail | and REUTERS | Exxon Mobil...

-

164Oil & Gas News

164Oil & Gas NewsTexas Oil Benefits as Ukraine Targets Russian Refineries

Ukraine’s ongoing drone campaign has become a major headache for Moscow, targeting one of...

-

162Downstream

162DownstreamVistra to Build Nearly $1B in Natural Gas Power Plants as Oil and Gas Industry Electrifies

By Claire Hao, Staff Writer| Houston Chronicle| Vistra plans to build two new natural gas...

-

160Oil & Gas News

160Oil & Gas NewsDouble Eagle Founders Still Love Their Work

By Mella McEwen,| Midland Reporter Telegram | John Sellers and Cody Campbell, co-chief executive officers...

-

139Oil & Gas News

139Oil & Gas NewsAXP Energy Advances Noble County Mississippi Lime Development

AXP Energy has confirmed the presence of hydrocarbons in multiple pay zones at its...

-

91Oil & Gas News

91Oil & Gas NewsOPEC+ Agrees to Another Output Hike in November Despite Growing Concerns of Glut

OPEC+’s production hikes have been a tool to both punish countries that were overproducing...