Featured Article

-

7.7KProduction

7.7KProductionDevon Energy Selling $1 Billion in Assets

Oklahoma City based Devon Energy Corp. (NYSE: DVN) announced this week that it has entered into definitive agreements with undisclosed parties to...

-

2.7KRig Count

2.7KRig CountRig Count – May 6, 2017

Permian, overall US rig counts each up 7 US oil-directed rigs also rose for a 16th consecutive week, gaining 6 units to 703,...

-

4.5KScoop & Stack

4.5KScoop & StackTrackin’ the STACK – Part THREE

As a geographer and geospatial professional, I am always seeking the answers to questions such as: Where are things? How did things...

-

18.8KExploration

18.8KExplorationTom Ward’s New Venture: Mach Resources

Natural gas icon Tom Ward may be shopping for shale gas assets that were sold in 2011 by Chesapeake Energy Corp., the...

-

4.0KScoop & Stack

4.0KScoop & StackRemnants of the Wild West – Oklahoma Mineral Title under Railroads

When one thinks of the modern oil and gas industry, few images of early railcars or railroads come to mind. With the...

-

2.5KOCC Filings

2.5KOCC FilingsOklahoma Weekly Report – April 24, 2017

Oseberg generated the following weekly report, which covers activity in Oklahoma for the week of April 24, 2017. This is a 30 day...

-

5.4KExploration

5.4KExplorationVine Resources Files $500 Million IPO

Vine Resources Files $500 Million IPO As The Haynesville Comes Back In Favor Being a basin that produces dry gas, the Haynesville...

-

3.6KExploration

3.6KExplorationOklahoma Energy Jobs Act Of 2017

House Bill 1613 and Senate Bill 284, together known as the The Oklahoma Energy Jobs Act of 2017 (“OEJA”), were introduced on...

-

4.0KScoop & Stack

4.0KScoop & StackTitle Opinions for Mineral Buyers

Throughout the STACK and SCOOP, mineral buyers have been actively acquiring mineral interests, and as such, mineral buying is at an all-time...

-

4.3KScoop & Stack

4.3KScoop & StackTrackin The STACK – Part TWO

Oklahoma’s STACK play continued making headlines over the past month as established players in the area double down on their Q1 investments...

Snippets

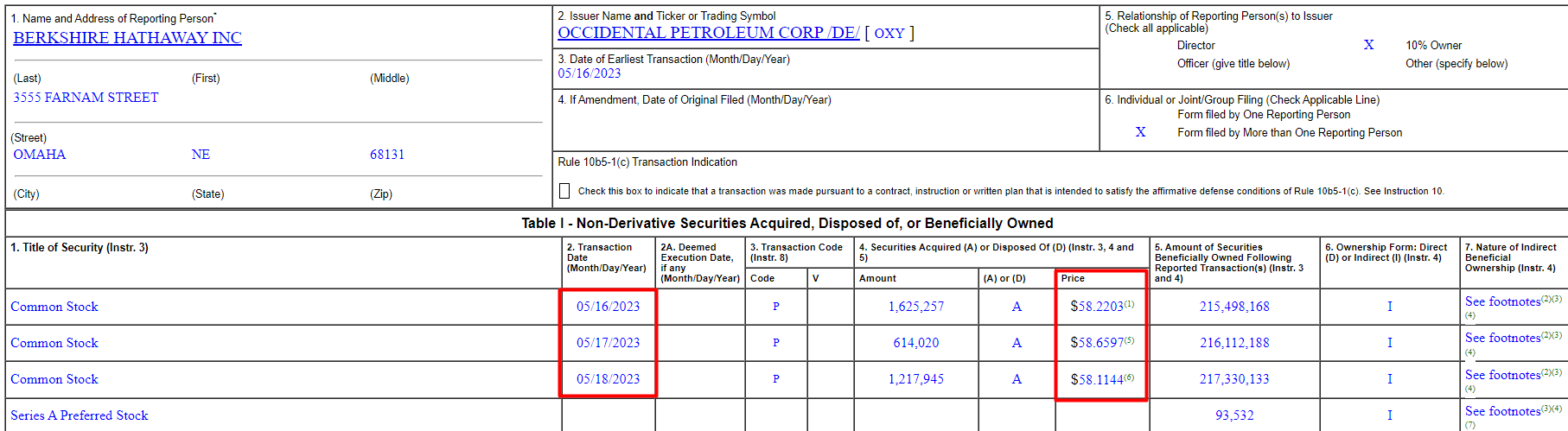

- Occidental Petroleum: Warren Buffett Buys AgainJust a few hours ago, ...Just a few hours ago, it was revealed that Warren Buffett purchased an additional $200 million [or ~ 3.46 million shares] in OXY stock from May 16-18, 2023, according to the recent SEC filing.Read More

In total, Berkshire now owns more than 217.3 million shares of Occidental Petroleum, valued at approximately $12.7 billion. Additionally, Berkshire holds around $9.5 billion worth of Occidental preferred stock, which carries an 8% annual dividend, and has warrants to purchase $5 billion worth of Occidental common shares for $59.62 per share.

- ChatGPT gets its own appOpenAI released an ...OpenAI released an app of its chatbot for the iPhone in the US and said a version for green texters is on the way. The ChatGPT app functions similarly to the existing browser design (free, no ads), but OpenAI hopes that by making ChatGPT easily accessible on your phone, you’ll use it more—and Google Search less. In other AI news, Meta, for the first time, revealed the extensive infrastructure it’s been building to support its artificial intelligence ambitions, including a “family” of chips.Read More

- Friday Sports ClipsKentucky Derby winner Mage...Kentucky Derby winner Mage will look to win the second leg of Triple Crown at tomorrow's 148th Preakness Stakes (More) | Rafael Nadal to miss French Open with injury, expects 2024 to be his final season (More)Read More

- Stock Market Outlook for FridayUS stock futures rise early Friday, as investors still await progress in debt-ceiling...US stock futures rise early Friday, as investors still await progress in debt-ceiling talks. Meanwhile, Federal Reserve Chair Jerome Powell and New York Fed President John Williams are due to make speeches later today. Check out the latest market moves.Read More

Earnings on deck: Morgan Stanley, Honeywell, Amgen, all reporting. - Closing Oil & Gas PricesBenchmark U.S. crude oil for June delivery fell...Benchmark U.S. crude oil for June delivery fell 97 cents to $71.86 a barrel Thursday. Brent crude for July delivery fell $1.10 to $75.86 a barrel.Read More

Wholesale gasoline for June delivery was unchanged at $2.57 a gallon. June heating oil fell 2 cents to $2.40 a gallon. June natural gas rose 22 cents to $2.59 per 1,000 cubic feet.

MOST POPULAR

-

415Oil & Gas News

415Oil & Gas NewsN.M. Braces for Revenue Losses From Royalty Rate Cuts

Ian M. Stevenson | EENews.net | Falling royalty rates for oil and gas production...

-

384Acquisitions

384Acquisitions$550MM Canvas Acquisition Expands Diversified Energy’s Oklahoma Footprint

Diversified Energy Company Plc has announced a $550 million acquisition of Canvas Energy, a...

-

367National

367NationalU.S. Gas Power Capacity Set for Big Jump as Renewables Growth Slows

Reporting by Gavin Maguire | (Reuters) – U.S. power developers are planning to sharply...

-

277Downstream

277DownstreamCalifornia Puts Oil Price-Gouging Rule on Hold to Keep Pumps Supplied

Authored by Jill McLaughlin via The Epoch Times, | California regulators fearing a dramatic...

-

269Energy

269EnergyNatural Gas and Batteries Anchor Data Center Growth

Data centers across the United States are increasingly grappling with one of the most...

-

267Oil & Gas News

267Oil & Gas NewsU.S. Oil Producers Slash 2025 Spending as Prices Slide and Consolidation Mounts

The U.S. oil and gas industry is entering a period of retrenchment, marked by...

-

229Natural Gas

229Natural GasPowering the US Data Center Boom With Wasted Natural Gas

[energyintel.com] A data center boom in the US is straining the grid and pushing...

-

201Oil & Gas News

201Oil & Gas NewsShale Expected to Weather ‘Lower for Longer’ Oil Prices

By Mella McEwen,Oil Editor | MRT | Crude prices have spent much of the year...

-

176Oil & Gas News

176Oil & Gas NewsViking Minerals Closes $40M Fund VI, Doubling Down on Strategic Growth Amid Industry Headwinds

Oklahoma City, OK – September 16, 2025 — In a market where many mineral...

-

137Oil & Gas News

137Oil & Gas NewsFaster Decline Rates Challenge Energy Security Worldwide

The International Energy Agency (IEA) has issued a stark warning that the world’s oil...

-

130International

130InternationalCanada Bets Big on LNG Export Capacity Growth

Canada’s ambitions to become a global energy powerhouse gained momentum just two months after...

-

14Oklahoma

14OklahomaOklahoma Drive In Pauses Operations During New Energy Project

The temporary closure of the Chief Drive In Theatre in Ninnekah has sparked local...