Featured Article

-

2.8KRig Count

2.8KRig CountRig Count – May 6, 2017

Permian, overall US rig counts each up 7 US oil-directed rigs also rose for a 16th consecutive week, gaining 6 units to 703,...

-

4.6KScoop & Stack

4.6KScoop & StackTrackin’ the STACK – Part THREE

As a geographer and geospatial professional, I am always seeking the answers to questions such as: Where are things? How did things...

-

19.0KExploration

19.0KExplorationTom Ward’s New Venture: Mach Resources

Natural gas icon Tom Ward may be shopping for shale gas assets that were sold in 2011 by Chesapeake Energy Corp., the...

-

4.1KScoop & Stack

4.1KScoop & StackRemnants of the Wild West – Oklahoma Mineral Title under Railroads

When one thinks of the modern oil and gas industry, few images of early railcars or railroads come to mind. With the...

-

2.6KOCC Filings

2.6KOCC FilingsOklahoma Weekly Report – April 24, 2017

Oseberg generated the following weekly report, which covers activity in Oklahoma for the week of April 24, 2017. This is a 30 day...

-

5.4KExploration

5.4KExplorationVine Resources Files $500 Million IPO

Vine Resources Files $500 Million IPO As The Haynesville Comes Back In Favor Being a basin that produces dry gas, the Haynesville...

-

3.6KExploration

3.6KExplorationOklahoma Energy Jobs Act Of 2017

House Bill 1613 and Senate Bill 284, together known as the The Oklahoma Energy Jobs Act of 2017 (“OEJA”), were introduced on...

-

4.1KScoop & Stack

4.1KScoop & StackTitle Opinions for Mineral Buyers

Throughout the STACK and SCOOP, mineral buyers have been actively acquiring mineral interests, and as such, mineral buying is at an all-time...

-

4.3KScoop & Stack

4.3KScoop & StackTrackin The STACK – Part TWO

Oklahoma’s STACK play continued making headlines over the past month as established players in the area double down on their Q1 investments...

-

3.8KScoop & Stack

3.8KScoop & StackChisholm and Apollo Global Launch Partnership With Stack Deal

Chisholm Oil & Gas LLC and Apollo Global Management LLC (NYSE: APO) formed a strategic partnership as the E&P closed on 53,000...

Snippets

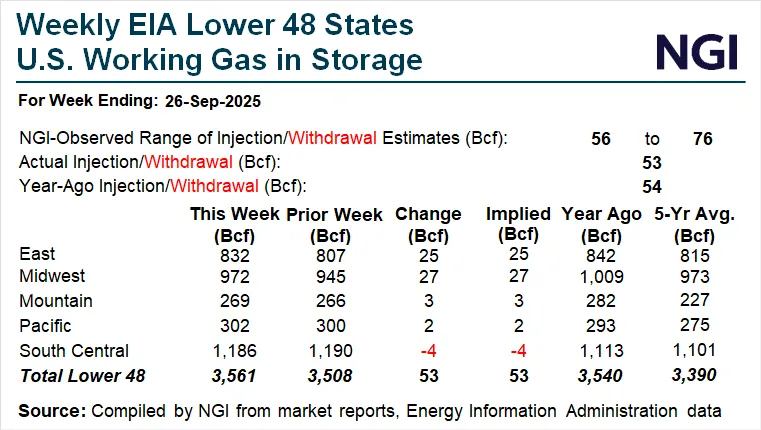

- Natural gas storage falls short of expectations, signaling increased demandThe U.S. Energy Information Administration (EIA) on Thursday reported...The U.S. Energy Information Administration (EIA) on Thursday reported a 53 Bcf injection of natural gas into storage for the week ended Sept. 26. Landing well below expectations, the result lifted natural gas prompt month futures to 11-week highs.Read More

Traders note that this marks the third consecutive week of smaller-than-expected injections, indicating that late-season cooling demand and weaker wind generation are already tightening the balance. The miss amplified buying interest, with heavy volume pushing the November contract above $3.50 intraday before sellers capped the move.

The report’s findings suggest a greater demand for natural gas than initially anticipated, a factor that is bullish for natural gas prices. The forecasted figure was based on the assumption that the increase in natural gas inventories would be more than the actual figure. However, the actual number reported was significantly less than the forecasted number, implying a higher demand for natural gas.

In comparison to the previous week’s data, the current number also shows a decline. The previous week’s natural gas storage was reported at 75B, indicating a drop of 22B week over week. This decrease further underscores the increased demand for natural gas in the market.

- DAILY OIL PRICE: October 2, 2025Crude Oil: 60.48 (-1.30)....Read More

- Crude Oil: 60.48 (-1.30).

- Nymex MTD AVG: 61.1300.

- Natural Gas: 3.442 (-0.034).

- Gasoline: 1.8510 (-0.0349).

- Spreads: November/December (+0.32), December/January (+0.17).

- Plains WTI Posting: 56.96 (-1.30).

Source: Odessa American

- Dow, S&P 500 and Nasdaq all end at record highs after 5th straight day of gainsU.S. stocks rose for a fifth-straight day on Thursday,...Read More

U.S. stocks rose for a fifth-straight day on Thursday, with the Dow, S&P 500 and Nasdaq Composite all tallying a fresh round of record highs.

It was the 30th record finish of 2025 for the S&P 500 and Nasdaq, and 10th for the Dow. The small-cap Russell 2000 also rose for a fifth day. Thursday marked the first time since November 2023 that all four indexes have risen for five straight days.

The Dow tallied its first five-day winning streak since May 2, Dow Jones Market Data showed. The S&P 500 saw its longest winning streak since July 28. For the Russell 2000, it was the longest since July 3, and for the Nasdaq, the longest since Sept. 15.

The S&P 500 rose by 4.15 points, or 0.1%, to finish at 6,715.35, according to Dow Jones Market Data.

The Nasdaq Composite rose by 88.89 points, or 0.4%, to 22,844.05.

The Dow rose by 78.62 points, or 0.2%, to 46,519.72.

- EIA Rattles Oil Markets With Reports of Crude Oil, Product BuildsCrude oil inventories in the...Read More

Crude oil inventories in the United States increased by 1.8 million barrels during the week ending September 26, after shrinking by 600,000 barrels in the week prior, according to new data from the U.S. Energy Information Administration (EIA) released on Wednesday. The increase brings commercial stockpiles to 416.5 million barrels according to government data, which is still 4% below the five-year average for this time of year.

The EIA’s data release follows API’s figures that were released a day earlier, which suggested that crude oil inventories contracted by 3.674 million barrels.

For total motor gasoline, the EIA reported an increase of 4.1 million barrels, after the week prior’s 1.1-million-barrel decrease. The most recent figures showed that average daily gasoline production had decreased to 9.3 million barrels. For middle distillates, inventories increased by 600,000 barrels, while production decreased to 5 million barrels per day. Distillate inventories decreased 1.7 million barrels in the week prior and are now 6% below the five-year average for this time of year.

Total products supplied over the last four weeks slipped to 20.3 million barrels per day, up 1.2% compared to the same period last year. Gasoline demand averaged 8.7 million barrels per day during the previous four weeks, while the distillate four-week average supplied fell to 3.6 million barrels—down 4.4 percent year over year. - Oil majors hedge near-term downturn with long-cycle betsMajor oil companies are reacting to a bleak short-term outlook by trimming...Major oil companies are reacting to a bleak short-term outlook by trimming costs, jobs and share buybacks, even as they double down on long-cycle projects based on the view that slowing supply growth later this decade could lift prices into the 2030s, writes Ron Bousso. BP has committed $5 billion to a Gulf of America development due in 2030, while ExxonMobil is holding firm on $27-29 billion in 2025 spending and scouting for deals.Read More

MOST POPULAR

-

1.6KOil & Gas News

1.6KOil & Gas NewsOil’s Five-Month Slide and the Surplus Story: What Backwardation and Contango Are Signaling Now

Whether the weakness persists will show up first in structure and stocks: if spreads...

-

513Oil & Gas News

513Oil & Gas NewsU.S. Shale Faces Rising Costs as Core Inventory Wanes

Operators across the Lower 48 are entering a pivotal new phase of development, where...

-

424Mineral Owners

424Mineral OwnersTrusts and Title: How Estate Planning Tools Help Shape Oil and Gas Asset Transfers in Texas and Oklahoma

Estate planning for mineral owners: how trusts secure oil & gas assets, speed inheritance,...

-

336International

336InternationalAlgeria and Saudi Arabia Ink $5.4B Energy Deal

Algeria has taken another major step to revitalize its oil and gas sector, signing...

-

293Oil & Gas News

293Oil & Gas NewsPermian Basin Cuts Emissions While Output Soars

In a rare win for both production and environmental performance, a new analysis by...

-

228International

228InternationalCitgo Auction Battle Heats Up Between Venezuela Creditors

A high-stakes courtroom fight in Delaware has pitted bidders for the parent company of...

-

199Oil & Gas News

199Oil & Gas NewsOil’s Billion Barrel Sea Surplus Expands

Vortexa’s figures exclude oil in floating storage, defined as oil stored on stationary vessels...

-

139Oil & Gas News

139Oil & Gas NewsTexas’ Orphaned Well Count Reaches Highest Level in Nearly Two Decades

Story By Charles Kennedy |OilPrice.com| Texas’ inventory of orphaned oil and gas wells has...

-

131Energy

131EnergyNew Lithium Facility Redefines Texas Energy Innovation

Crews have begun construction on what will become Texas’s first end-to-end produced water lithium...