Featured Article

-

1.1KOil & Gas News

1.1KOil & Gas NewsLithium Refinery Planned in Oklahoma

By: News 9 – A Connecticut energy startup company plans to build a lithium refinery just outside Tulsa, on an unspecified 66-acre...

-

754Oil & Gas News

754Oil & Gas NewsGiant batteries drain economics of gas power plants

LONDON, (Reuters) – Giant batteries that ensure stable power supply by offsetting intermittent renewable supplies are becoming cheap enough to make developers...

-

895Oil & Gas News

895Oil & Gas NewsNew Mexico Gas Emissions Are Half of Those of Texas Per Unit

By: Carol A. Clark – Los Alamos Daily Post – The nationally leading oil and gas regulations of the Lujan Grisham administration...

-

828Acquisitions

828AcquisitionsArgus Media: Shale M&A to gather pace in hunt for inventory

Story By Stephen Cunningham |Argus Media| Future merger and acquisition activity may not be able to match the size of the deals...

-

848International

848InternationalWorld Oil Demand Continues to Exceed Expectations

Story by Andreas Exarheas|Rigzone Staff| World oil demand continues to exceed expectations, the International Energy Agency (IEA) stated in its latest oil...

-

732Oil & Gas News

732Oil & Gas NewsEuropean Union Reaches Deal on Methane Reduction

The European Union’s recent agreement to significantly curb methane emissions in the energy sector marks a pivotal step in its ongoing battle...

-

699Oil & Gas News

699Oil & Gas NewsKaroon to Acquire GOM Assets for $720MM

Story By Rocky Teodoro|RigZone.com|Australia’s Karoon Energy Limited is acquiring a 30 percent interest in the Gulf of Mexico’s Who Dat and Dome...

-

978International

978InternationalYemen’s Houthi rebels hijack an Israeli-linked ship in the Red Sea and take 25 crew members hostage

JERUSALEM (AP) — Yemen’s Houthi rebels seized an Israeli-linked cargo ship in a crucial Red Sea shipping route on Sunday, officials said, taking over...

-

690Oil & Gas News

690Oil & Gas NewsTwo Men Convicted in US of Trying to Sell Iranian Petroleum

By: Reuters – A U.S. jury has convicted two Texas men of trying to sell Iranian petroleum in violation of sanctions imposed...

-

1.1KOil & Gas News

1.1KOil & Gas NewsThe Bakken is Back!

By: S&P Global – Rising natural gas-to-oil ratios will continue to support gas production in the US’ Bakken Shale, Oneok executives said....

Snippets

- U.S. stocks end lower, but Nasdaq posts longest weekly win streak since FebruaryU.S. stocks closed lower on Friday as investors focused on debt-ceiling...U.S. stocks closed lower on Friday as investors focused on debt-ceiling talks in Washington D.C., which Republican Rep. Garret Graves of Louisiana, a deputy for House Speaker Kevin McCarthy, said were on pause. The Dow Jones Industrial Average DJIA ended about 109 points lower Friday near 33,426 but booked a 0.4% weekly gain. So did the other major U.S. indexes. The S&P 500 index SPX closed 0.2% lower while booking a 1.6% weekly gain. The Nasdaq Composite Index COMP shed 0.2% Friday but gained 3% for the week to advance for a fourth week in a row, its longest weekly stretch of wins since February 3, according to Dow Jones Market Data. Focus on Friday also was on regional banks after CNN reported that Treasury Secretary Janet Yellen said more mergers in the sector might be needed.Read More

- Energy Commentary for Friday MorningThe energy sector is off to a...Read More

The energy sector is off to a higher start, supported by strength in the underlying commodities and in the major equity futures. U.S. stock index futures edged higher on optimism that a deal to avoid a catastrophic U.S. debt default could be reached over the weekend.

WTI and Brent crude oil futures are trading higher as investors turned cautiously optimistic over the fading risk of a U.S. debt default. Sentiment has remained mixed as investors weigh optimism over the avoidance of a U.S. debt default against inflation data that could portend more interest rate hikes from global central banks. However, Middle East crude prices in Asia fell to their lowest level in months, despite OPEC+ production cuts, as Asian refiners held back spot purchases and China and India binged on cheap Russian oil.

Natural gas futures are extending gains for the second-straight session on a smaller-than-expected U.S. storage build and as wildfires kept gas exports from Canada near a 25-month low.

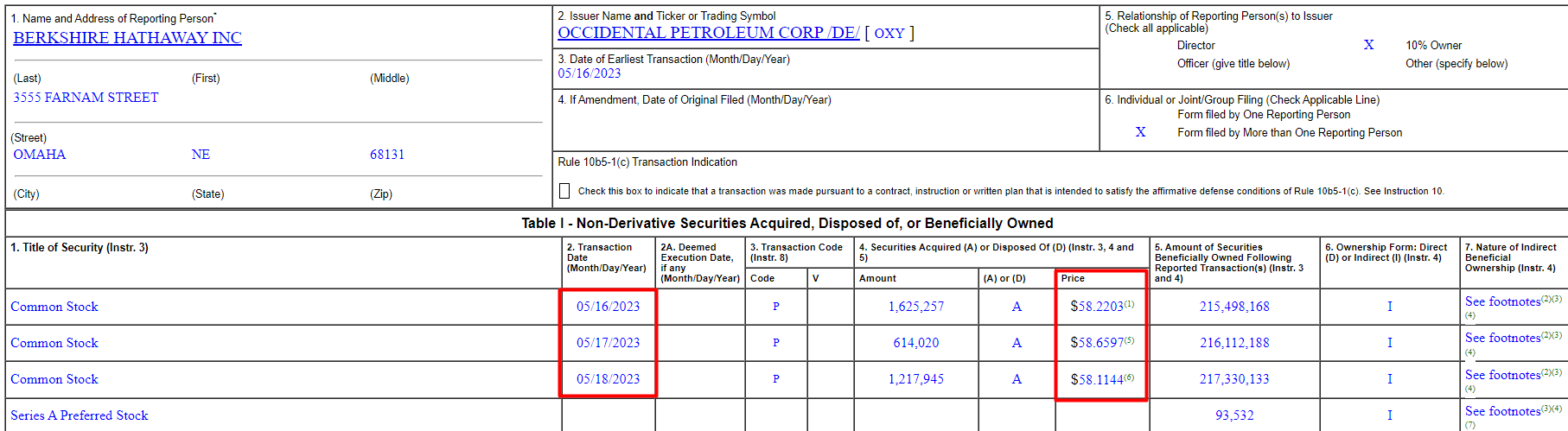

- Occidental Petroleum: Warren Buffett Buys AgainJust a few hours ago, ...Just a few hours ago, it was revealed that Warren Buffett purchased an additional $200 million [or ~ 3.46 million shares] in OXY stock from May 16-18, 2023, according to the recent SEC filing.Read More

In total, Berkshire now owns more than 217.3 million shares of Occidental Petroleum, valued at approximately $12.7 billion. Additionally, Berkshire holds around $9.5 billion worth of Occidental preferred stock, which carries an 8% annual dividend, and has warrants to purchase $5 billion worth of Occidental common shares for $59.62 per share.

- ChatGPT gets its own appOpenAI released an ...OpenAI released an app of its chatbot for the iPhone in the US and said a version for green texters is on the way. The ChatGPT app functions similarly to the existing browser design (free, no ads), but OpenAI hopes that by making ChatGPT easily accessible on your phone, you’ll use it more—and Google Search less. In other AI news, Meta, for the first time, revealed the extensive infrastructure it’s been building to support its artificial intelligence ambitions, including a “family” of chips.Read More

- Friday Sports ClipsKentucky Derby winner Mage...Kentucky Derby winner Mage will look to win the second leg of Triple Crown at tomorrow's 148th Preakness Stakes (More) | Rafael Nadal to miss French Open with injury, expects 2024 to be his final season (More)Read More

MOST POPULAR

-

444Oil & Gas News

444Oil & Gas NewsN.M. Braces for Revenue Losses From Royalty Rate Cuts

Ian M. Stevenson | EENews.net | Falling royalty rates for oil and gas production...

-

410Acquisitions

410Acquisitions$550MM Canvas Acquisition Expands Diversified Energy’s Oklahoma Footprint

Diversified Energy Company Plc has announced a $550 million acquisition of Canvas Energy, a...

-

392National

392NationalU.S. Gas Power Capacity Set for Big Jump as Renewables Growth Slows

Reporting by Gavin Maguire | (Reuters) – U.S. power developers are planning to sharply...

-

298Oil & Gas News

298Oil & Gas NewsU.S. Oil Producers Slash 2025 Spending as Prices Slide and Consolidation Mounts

The U.S. oil and gas industry is entering a period of retrenchment, marked by...

-

296Downstream

296DownstreamCalifornia Puts Oil Price-Gouging Rule on Hold to Keep Pumps Supplied

Authored by Jill McLaughlin via The Epoch Times, | California regulators fearing a dramatic...

-

291Energy

291EnergyNatural Gas and Batteries Anchor Data Center Growth

Data centers across the United States are increasingly grappling with one of the most...

-

248Natural Gas

248Natural GasPowering the US Data Center Boom With Wasted Natural Gas

[energyintel.com] A data center boom in the US is straining the grid and pushing...

-

236Oil & Gas News

236Oil & Gas NewsShale Expected to Weather ‘Lower for Longer’ Oil Prices

By Mella McEwen,Oil Editor | MRT | Crude prices have spent much of the year...

-

217Oil & Gas News

217Oil & Gas NewsViking Minerals Closes $40M Fund VI, Doubling Down on Strategic Growth Amid Industry Headwinds

Oklahoma City, OK – September 16, 2025 — In a market where many mineral...

-

166Oil & Gas News

166Oil & Gas NewsFaster Decline Rates Challenge Energy Security Worldwide

The International Energy Agency (IEA) has issued a stark warning that the world’s oil...

-

151International

151InternationalCanada Bets Big on LNG Export Capacity Growth

Canada’s ambitions to become a global energy powerhouse gained momentum just two months after...

-

115Oklahoma

115OklahomaOklahoma Drive In Pauses Operations During New Energy Project

The temporary closure of the Chief Drive In Theatre in Ninnekah has sparked local...